Definition

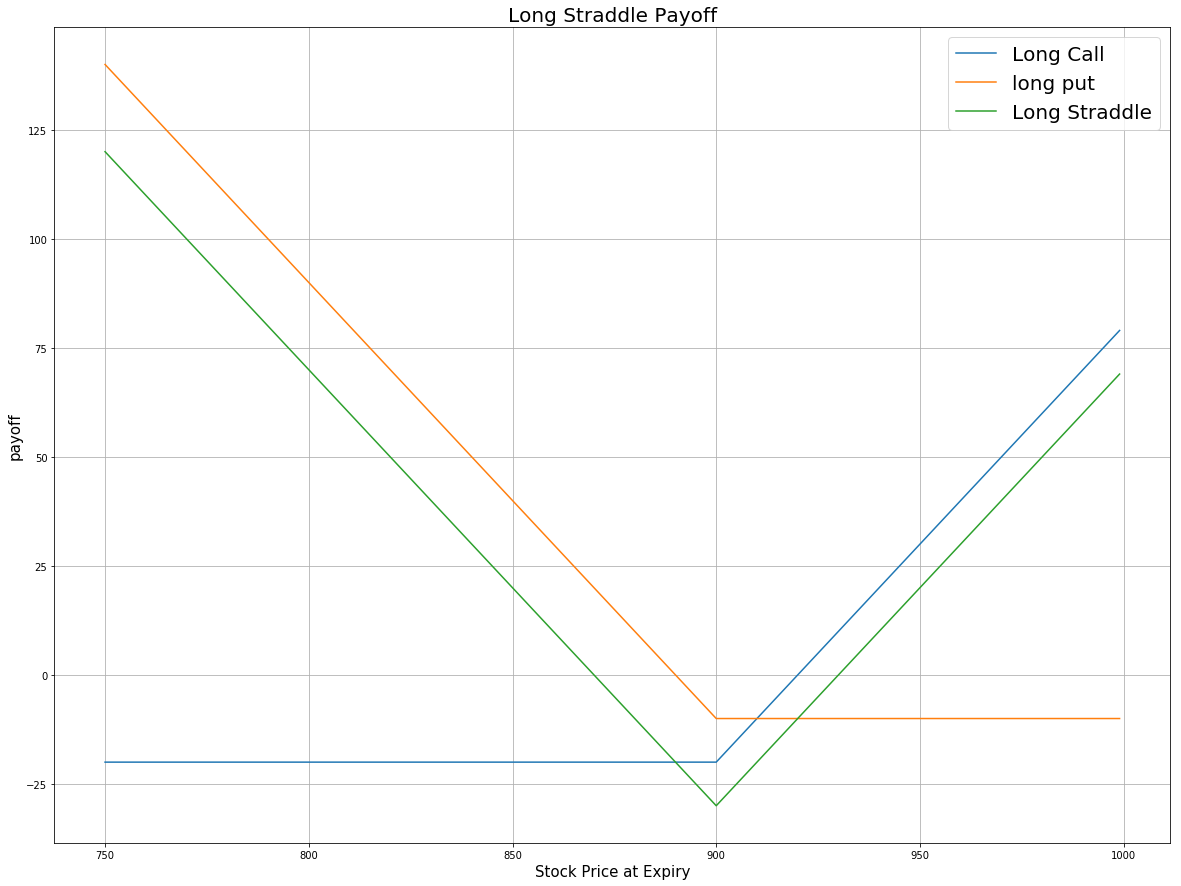

Long Straddle is an options trading strategy involving the going long in both a call and a put option, where both options have the same underlying asset, strike price and expiration date. This strategy aims to profit from volatile movements in the underlying stock, either positive or negative.

price = np.arange(750,1000,1)

strike = 900 # strike price for both call and put

premium_call = 20 # premium of call option

premium_put = 10 # premium of put option

# payoff for the long call

payoff_long_call = [max(-premium_call, i-strike-premium_call) for i in price]

# payoff for the long put

payoff_long_put = [max(-premium_put, strike-i-premium_put) for i in price]

payoff = np.sum([payoff_long_call, payoff_long_put], axis=0)

plt.figure(figsize=(20,15))

plt.plot(price, payoff_long_call, label = 'Long Call')

plt.plot(price, payoff_long_put, label = 'long put')

plt.plot(price, payoff, label = 'Long Straddle')

plt.legend(fontsize = 20)

plt.xlabel('Stock Price at Expiry',fontsize = 15)

plt.ylabel('payoff',fontsize = 15)

plt.title('Long Straddle Payoff',fontsize = 20)

plt.grid(True)

Given this plot, if the stock price moves significantly away from the strike price in either direction, the Long Straddle will profit. The potential profit is unlimited on the upside because the stock price can rise indefinitely. On the downside, the potential profit is substantial but limited since the stock price can't fall below zero. The potential loss is limited to the premium of both call and put options. The maximum loss will be realized if the stock price is exactly equal to the strike price at expiration, and both options will expire worthless.

Implementation

Step 1: Initialize your algorithm and filter the contract. Here we choose the time to expiration to be between 30 to 60 days.

def Initialize(self):

self.SetStartDate(2017, 4, 01)

self.SetEndDate(2017, 6, 30)

self.SetCash(100000)

equity = self.AddEquity("GOOG", Resolution.Minute)

option = self.AddOption("GOOG", Resolution.Minute)

self.symbol = option.Symbol

# set our strike/expiry filter for this option chain

option.SetFilter(-5, 5, timedelta(30), timedelta(60))

# use the underlying equity GOOG as the benchmark

self.SetBenchmark(equity.Symbol)

Step 2: Sort the option chain by expiration and choose the furthest date to filter the call contract. Then sort those call contracts by their strike price and choose the call contracts with the highest strike price to trade.

for i in optionchain:

if i.Key != self.symbol: continue

chain = i.Value

# sort the optionchain by expiration date and choose the furthest date

expiry = sorted(chain,key = lambda x: x.Expiry, reverse=True)[0].Expiry

# filter the call options from the contracts expires on that date

call = [i for i in chain if i.Expiry == expiry and i.Right == 0]

# sort the contracts according to their strike prices

call_contracts = sorted(call,key = lambda x: x.Strike)

if len(call_contracts) == 0: continue

self.call = call_contracts[0]

Step 3: According to the call option contract, choose the put option with the same strike price and the same expiration date. Then buy the call option and the put option at the same time and wait until expiration.

for i in chain:

if i.Expiry == expiry and i.Right == 1 and i.Strike ==call_contracts[0].Strike:

self.put = i

self.Buy(self.call.Symbol, 1)

self.Buy(self.put.Symbol, 1)

Summary

There are three possible outcomes at expiration for the Long Straddle strategy. If the stock price is at the strike price at expiration, then both the call and the put become worthless and no stock position is created. If the stock price is above the strike price at expiration, the put option expires worthless, the long call is exercised, the stock is purchased at the strike price and a long stock position for is created. If the stock price is below the strike price at expiration, the call expires worthless, the long put is exercised, the stock is sold at the strike price and a short stock position is created. In this algorithm, the undelying asset is GOOG stock. We purchase both the $820 put and the $820 call at time 0. At the expiration, the share price of GOOG rises to 930 then the call option is exercised and the put options become worthless. After expiration, we hold long position for 100 shares of GOOG stock.