Open Source Financial Technology, Paving the Future of Trading

Power your quantitative research with a cutting-edge, unified API for research, backtesting, and live trading on the world's leading algorithmic trading platform.

Unified Quant Infrastructure

Finding alpha is a challenging task. As the universe of data expands rapidly and the pace of technological development accelerates, you need every advantage the market has to offer.

You need a complete suite of cloud-based tools to research investment approaches, assess strategies with backtesting, then rapidly deploy to maximize returns. For more bespoke requirements or proprietary datasets, replicate the full QuantConnect experience on-premise with our Local Platform.

QuantConnect offers the powerful financial tools you need for every stage of your quant journey.

Create Account

FROM RESEARCH TO PRODUCTION

Cloud Research

Our cloud-based research terminals attach to terabytes of financial, fundamental, and alternative data, preformatted and ready to use.

Alternative data is linked to the underlying securities, tagged with the FIGI, CUSIP, and ISIN to facilitate building strategies.

Access popular machine learning and feature selection libraries to quantify factor importance. We can install custom packages on request.

FROM RESEARCH TO PRODUCTION

Backtesting

With minimal-to-no code changes, move from research to point-in-time, fee, slippage, and spread-adjusted backtesting on lightning-fast cloud cores. Perform multi-asset backtesting on portfolios comprised of thousands of securities with realistic margin-modeling.

Import custom and alternative data linked to underlying securities for realistically modeling live-trading portfolios and avoiding common pitfalls like look-ahead bias.

Our technology has been battle-tested with thousands of unit and regression tests, and more than 15,000 backtests are performed on QuantConnect daily.

FROM RESEARCH TO PRODUCTION

Parameter Optimization

Our parameter sensitivity testing allows you to run thousands of full backtests on our scalable cloud compute, completing weeks of work in minutes.

Visualize all the iterations of parameters on heatmaps to quickly understand your strategy's sensitivity to parameters for robust out-of-sample trading.

Explore further by opening each result and seeing its trades and backtest logs to understand the source of your alpha.

FROM RESEARCH TO PRODUCTION

Institutional-Grade Live Trading

Since 2012, QuantConnect has deployed more than 375,000 live strategies to a managed, co-located live-trading environment. Our platform processes more than $45B in notional volume per month.

Execute trades directly through our 20 integrations or to EMSX Net's 1,300 liquidity providers.

Our live feeds include US SIP, CME, FX, and major crypto exchanges. Other live feed options are available upon request.

FROM RESEARCH TO PRODUCTION

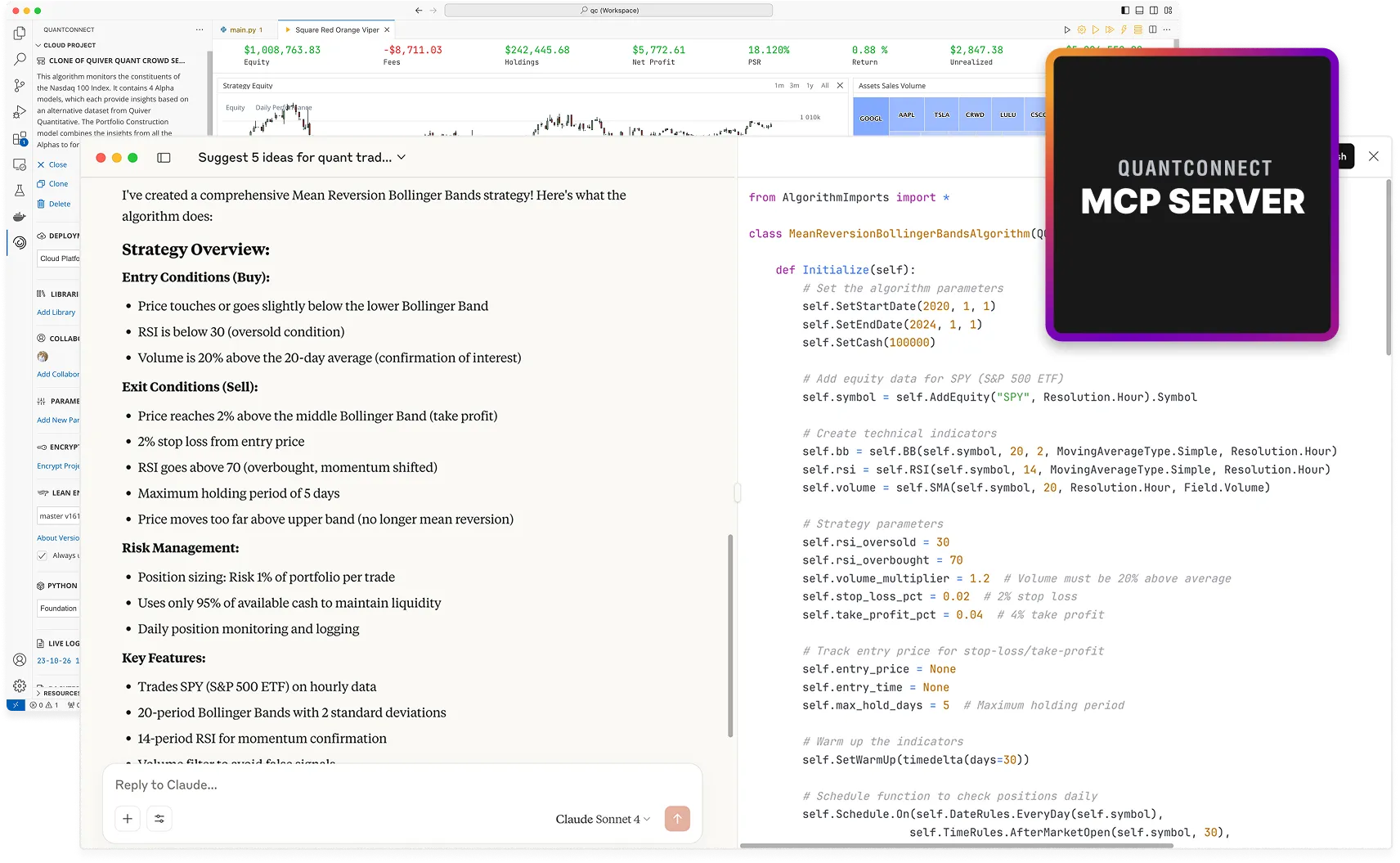

Bridge Your AI Agents to QuantConnect

Enable your AI to design, backtest, optimize, and live trade your quantitative trading strategies on QuantConnect — through a structured, AI-friendly interface. Designed with the needs of professional quant teams in mind, the MCP Server delivers the reliability, flexibility, and security required for real-world trading systems.

Build vs Buy: Your Firm's Dream Quantitative Research Platform

Have you ever thought about creating your own algorithmic trading platform but aren't sure about the expenses? Use our Build vs. Buy cost calculator to accurately assess the costs of developing a professional-grade quantitative trading platform. Compare these costs with using a ready-made solution like QuantConnect to make an informed decision.

Multi-Asset Portfolio Modeling

We accurately model multi-asset portfolio strategies, tracking real-time strategy equity across complex portfolios in backtesting and live trading. You can easily access the margin remaining for your strategy and size positions to reduce cash.

Equity

US Stock and ETFs since 1998, managing corporate actions, from tick to daily resolutions.

Equity Options

US Equity Options at minute resolution since 2010, with realistic portfolio modeling.

Indexes

US Cash Indexes since 1998 from tick to daily resolution bars on NDX, SPX, and VIX.

Index Options

US Index Options since 2012 from minute to daily resolutions, with portfolio modeling.

Futures

US Future markets at tick to daily resolutions since 2009, for the most liquid 70 contracts.

Future Options

Future Option markets at minute to daily resolutions since 2012, for the most liquid 70 contracts.

Forex

Interbank and market maker brokerage spreads, with realistic cashbook and margin lending.

CFD

Derivative CFD assets for leading brokerages for international traders with realistic spreads.

Crypto

Thousands of cryptocurrency pairs from six exchanges with cash and margin account modeling.

Rich Library of Alternative Data

Orthogonal signals are critical to building a robust strategy. We serve a rich library of alternative data with more than 40 distinct vendors covering millions of potential strategies.

Each dataset is processed with a uniform timestamp and delivered to your strategy point-in-time to avoid selection bias. With one simple line of code, your alternative data automatically links to underlying assets and tracks corporate actions through time.

Data is ready to be used in live trading, delivered in real-time in our co-located live-trading environment. Prefer to do your research on-premise? Export and download the data through our Datasets Marketplace.

Explore alternative data with a single line of code

Open-Source Algorithmic Trading Engine

LEAN is the algorithmic trading engine at the heart of QuantConnect. More than 180+ engineers contributed to the development of this lightning-fast, open-source platform. It provides modeling that surpasses the best financial institutions in the world. LEAN can be run on-premise or in the cloud.

Open-source provides you the freedom to modify it to suit your needs.

Local Development, Cloud Backtesting

Code locally in your favorite development environment, then synchronize your projects to the cloud to work on the go with QuantConnect's IDE.

lean backtest "My Project" —debug

lean cloud backtest "My Project"

lean cloud live "My Project"

Installation: pip install lean

An Inspired and Connected Global Community

QuantConnect has a global community of 447,300 quants, researchers, data scientists, and engineers. Collectively we are the biggest quant research community in the world with more than 1,200 strategies shared through the forums, a vast library of public quant research.

Every month, the brightest quantitative minds use our platform to generate research. On an average month 50,000 QuantConnect users create 2,500 new algorithms and write 1M lines of code.

LIVE TRADING

LIVE TRADING