In this lesson we will select a universe of assets where the 50-EMA is greater than the 200 EMA, create a custom class to hold symbol specific data, and use the history API to prepare our indicators.

What You'll Learn- Laying down our universe foundation

- Grouping data with classes

- Creating properties and methods to tidy code

- Using a history call to prepare indicators

We recommend you complete all previous beginner lessons before starting this lesson.

Laying Our Universe Foundation- 200-50 EMA Momentum Universe

- Laying Our Universe Foundation

In this lesson we will using two indicators to perform selection on a universe of securities.

Creating Our UniverseRecall that we use coarse universe selection to create a set of stocks based on dollar-volume, and price. To create our universe of assets we need to pass a coarse selection filter function to the self.AddUniverse() method in our initializer.

Our CoarseSelectionFilter must return a list of symbols, which LEAN automatically subscribes to and adds to our algorithm.

To filter and sort our stocks we can use lambda functions and list comprehension.

# Use the sorted method and lambda to get keys in ascending order (greatest to least in DollarVolume) sortedByDollarVolume = sorted(coarse, key=lambda c: c.DollarVolume, reverse=True) # Use list comprehension to get symbols from your sorted list # with a price more than $5 per share and get the top 10 symbols [c.Symbol for c in sortedByDollarVolume if c.Price > 5][:10]Adding and Removing SecuritiesThe OnSecuritiesChanged event fires whenever we have changes to our universe. It receives a SecurityChanges object containing references to the added and removed securities. The AddedSecurities and RemovedSecurities properties are lists of security objects.

Task Objectives CompletedContinue

- Reverse sort coarse by dollar volume to get the highest volume stocks.

- Filter out the stocks less than $10, save the result to

self.selected. - Liquidate securities leaving the universe in the

OnSecuritiesChangedevent. - Allocate 10% holdings to each asset added to the universe.

changes.AddedSecurities and changes.RemovedSecurities, collections with the security.Symbol? If you need to review these topics you can go back to the lesson Liquid Universe Selection. Code: class EMAMomentumUniverse(QCAlgorithm):def Initialize(self):

self.SetStartDate(2019, 1, 7)

self.SetEndDate(2019, 4, 1)

self.SetCash(100000)

self.UniverseSettings.Resolution = Resolution.Daily

self.AddUniverse(self.CoarseSelectionFunction)

self.selected = None

def CoarseSelectionFunction(self, coarse):

#1. Sort coarse by dollar volume

sortedByDollarVolume = sorted(coarse, key=lambda c: c.DollarVolume, reverse=True)

#2. Filter out the stocks less than $10 and return selected

self.selected = [c.Symbol for c in sortedByDollarVolume if c.Price > 10][:10]

return self.selected

def OnSecuritiesChanged(self, changes):

#3. Liquidate securities leaving the universe

for security in changes.RemovedSecurities:

self.Liquidate(security.Symbol)

#4. Allocate 10% holdings to each asset added to the universe

for security in changes.AddedSecurities:

self.SetHoldings(security.Symbol, 0.10) ------------------------continued below....

Greg Kendall

- 200-50 EMA Momentum Universe

- Grouping Data with Classes

The 200-50 EMA Momentum StrategyAn exponential moving average (EMA) is a technical analysis tool. We can calculate averages of asset price for any time period.

The momentum strategy hypothesis is that stocks that have performed well in the past will continue to perform well. The EMA Momentum Universe selects stocks based on their fast and slow moving average values. An

Creating ClassesExponentialMovingAverage()class is initialized with a number of bars. Its period is that bar count, multiplied by the period of the bars used.So far our algorithms have all been part of one class. We can create additional classes as a way to group together variables for our universe selection and update any indicators all in a few lines of code. We create another class so each class focuses on one problem, this is known as "Separation of Concerns".

Initializing Class ObjectsClasses can set a constructor to initialize members of the class.

# Create a class to group our indicators class SelectionData: # Set the constructer __init__ that takes the parameter self def __init__(self): # Save the indicator to self.ema self.slow = ExponentialMovingAverage(200)Methods can group code and provide a clean way to check our indicators are ready. For universes it is convenient to check if our indicators are ready with the

# Create a class method called is_ready class SelectionData: def is_ready(self): # Return the IsReady property return self.slow.IsReadyIsReadyproperty:We could also use a method to group updating indicators as demonstrated below. The benefits of this abstraction are more obvious with more complex examples.

# Create a class method called update that takes the parameters self, time, price class SelectionData: def update(self, time, price): #Use the Update property to get the time and price for our indicators self.fast.Update(time, price) self.slow.Update(time, price)Task Objectives CompletedContinue

We will create a new class to hold the 200 ("slow") and 50 ("fast") day moving average indicator objects. The new class is initialized and updated via methods.

- Create a class named

- Create a constructor which takes the

- Create a method in

- Create a method in

Hint: Remember to include theclass SelectionData().selfobject. In the constructor, create theself.fastandself.slowclass variables and initialize them with anExponentialMovingAverageobject.SelectionDatanamedis_readywith a self parameter which returns true if our slow and fast indicators are ready.SelectionDatanamedupdatewithself,time, andpriceparameters which updates the indicators with the latest price.selfparamter first in your methods. Remember the indicator classes take an uppercase U for theirUpdatemethods, and uppercase, or pascal caseIsReadyfor checking their state. Code:class EMAMomentumUniverse(QCAlgorithm):

def Initialize(self):

self.SetStartDate(2019, 1, 7)

self.SetEndDate(2019, 4, 1)

self.SetCash(100000)

self.UniverseSettings.Resolution = Resolution.Daily

self.AddUniverse(self.CoarseSelectionFunction)

def CoarseSelectionFunction(self, coarse):

sortedByDollarVolume = sorted(coarse, key=lambda c: c.DollarVolume, reverse=True)

selected = [c.Symbol for c in sortedByDollarVolume if c.Price > 10][:10]

return selected

def OnSecuritiesChanged(self, changes):

for security in changes.RemovedSecurities:

self.Liquidate(security.Symbol)

for security in changes.AddedSecurities:

self.SetHoldings(security.Symbol, 0.10)

#1. Create a class SelectionData

class SelectionData():

#2. Create a constructor that takes self

def __init__(self):

#2. Save the fast and slow ExponentialMovingAverage

self.slow = ExponentialMovingAverage(200)

self.fast = ExponentialMovingAverage(50)

#3. Check if our indicators are ready

def is_ready(self):

return self.slow.IsReady and self.fast.IsReady

#4. Use the "indicator.Update" method to update the time and price of both indicators

def update(self, time, price):

self.fast.Update(time, price)

self.slow.Update(time, price)

Greg Kendall

- 200-50 EMA Momentum Universe

- Applying Class In Universe

Universes and DictionariesLet's create a

Initializing a Dictionary# Initialize a dictionary called averages self.averages = {}Adding to a Dictionary, Checking if an Item is in DictionarySelectionDatafor every security in our universe, and store it in a dictionary to quickly access their methods.Dictionaries are a way of storing data which you can look up later with a "key". To perform EMA-universe selection on every security we'll need a

SelectionDatafor every Symbol in our universe.We can check if an item exists in a dictionary with

# check if the object is already in the dictionary. if symbol not in self.averages: # Add the new SelectionData to the key self.averages[symbol] = SelectionData()Accessing Dictionary Itemsin. We should check if it exists before creating a new copy:You can access and use dictionary items with braces/brackets. Using braces you can look up the specific Symbol and find the right SelectionData value.

# e.g. Accessing a method and pass in parameters self.averages[symbol].update(self.Time, coarse.AdjustedPrice) # e.g. Accessing property of class, as a dictionary item if self.averages[symbol].fast > self.averages[symbol].slow: # Access dictionary methods with braces using "dot notation" if self.averages[symbol].is_ready(): selected.append(symbol)Task Objectives CompletedContinue

- Create a dictionary class variable named

- In your universe selection, check if the dictionary contains symbol.

- If Symbol is not in the

- Access the

- Using the

Hint: Dictionaries can be a little tricky until you get used to them. Think of it like a book, where you're sorting data on different pages. You can look up the right page with the Symbol object Code: class EMAMomentumUniverse(QCAlgorithm):self.averages.averagesdictionary, create a new instance ofSelectionData; and add it to averages.self.averages[symbol]and update it with the time and adjusted price data.SelectionDataobject in averages, check if the indicators are ready, and the fast-EMA is greater than the slow-EMA. Then useappendto add symbol to the selected list.def Initialize(self):

self.SetStartDate(2019, 1, 7)

self.SetEndDate(2019, 4, 1)

self.SetCash(100000)

self.UniverseSettings.Resolution = Resolution.Daily

self.AddUniverse(self.CoarseSelectionFunction)

#1. Create our dictionary and save it to self.averages

self.averages = { }

def CoarseSelectionFunction(self, universe):

selected = []

universe = sorted(universe, key=lambda c: c.DollarVolume, reverse=True)

universe = [c for c in universe if c.Price > 10][:100]

# Create loop to use all the coarse data

for coarse in universe:

symbol = coarse.Symbol

#2. Check if we've created an instance of SelectionData for this symbol

if symbol not in self.averages:

#3. Create a new instance of SelectionData and save to averages[symbol]

self.averages[symbol] = SelectionData()

#4. Update the symbol with the latest coarse.AdjustedPrice data

self.averages[symbol].update(self.Time, coarse.AdjustedPrice)

#5. Check if 50-EMA > 200-EMA and if so append the symbol to selected list.

if self.averages[symbol].fast > self.averages[symbol].slow:

if self.averages[symbol].is_ready():

selected.append(symbol)

return selected[:10]

def OnSecuritiesChanged(self, changes):

for security in changes.RemovedSecurities:

self.Liquidate(security.Symbol)

for security in changes.AddedSecurities:

self.SetHoldings(security.Symbol, 0.10)

class SelectionData(object):

def __init__(self):

self.slow = ExponentialMovingAverage(200)

self.fast = ExponentialMovingAverage(50)

def is_ready(self):

return self.slow.IsReady and self.fast.IsReady

def update(self, time, price):

self.fast.Update(time, price)

self.slow.Update(time, price)

Greg Kendall

- 200-50 EMA Momentum Universe

- Preparing Indicators with History

Applying a History FunctionWe need to prepare our indicators with data. With the QuantConnect History API, we request data for symbols as a pandas dataframe.

The History API has many different helpers, the simplest of these gets data for a single symbol.

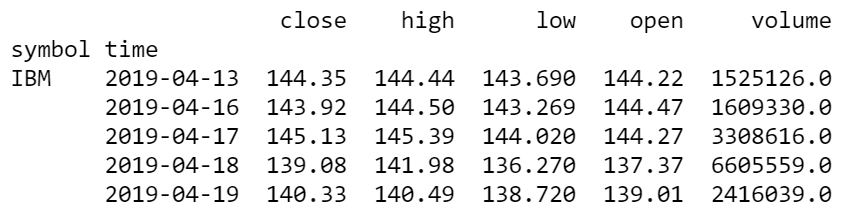

history = self.History(symbol, 200, Resolution.Daily)Using History DataFrameEach row of the history result represents the prices at a point of time. Each column of the DataFrame is a property of the price data (e.g. open, high, low, close).

History data is returned in ascending order from oldest to newest. If no resolution is chosen the default is Resolution.Minute. We can iterate over the results of a history call using

for bar in history.itertuples(): self.fast.Update(bar.Index[1], bar.close) self.slow.Update(bar.Index[1], bar.close)itertuples(). The history DataFrame has two indexes; Symbol(0) and Time(1). You can access the time of a row by usingrow.Index[1]. The column names of the history result are lowercase.Task Objectives CompletedContinue

In our previous backtest we didn't see trades because our indicators were waiting for 200 days to pass before they were ready to use. Here we will use the History API to speed up getting ready for trading.

- Call

- Adjust the creation of the

- Update the

- Iterate over the history data, passing rows into the

Hint: You can pass in the history result like thisHistoryto get 200 days of history data for each symbol in our universeSelectionDataobject to pass in the history result__init__constructor to accept a history array.updatemethod to prepare the indicators.SelectionData(history). CODE:class EMAMomentumUniverse(QCAlgorithm):

def Initialize(self):

self.SetStartDate(2019, 1, 7)

self.SetEndDate(2019, 4, 1)

self.SetCash(100000)

self.UniverseSettings.Resolution = Resolution.Daily

self.AddUniverse(self.CoarseSelectionFunction)

self.averages = { }

def CoarseSelectionFunction(self, universe):

selected = []

universe = sorted(universe, key=lambda c: c.DollarVolume, reverse=True)

universe = [c for c in universe if c.Price > 10][:100]

for coarse in universe:

symbol = coarse.Symbol

if symbol not in self.averages:

# 1. Call history to get an array of 200 days of history data

history = self.History(symbol, 200, Resolution.Daily)

#2. Adjust SelectionData to pass in the history result

self.averages[symbol] = SelectionData(history)

self.averages[symbol].update(self.Time, coarse.AdjustedPrice)

if self.averages[symbol].is_ready() and self.averages[symbol].fast > self.averages[symbol].slow:

selected.append(symbol)

return selected[:10]

def OnSecuritiesChanged(self, changes):

for security in changes.RemovedSecurities:

self.Liquidate(security.Symbol)

for security in changes.AddedSecurities:

self.SetHoldings(security.Symbol, 0.10)

class SelectionData():

#3. Update the constructor to accept a history array

def __init__(self, history):

self.slow = ExponentialMovingAverage(200)

self.fast = ExponentialMovingAverage(50)

#4. Loop over the history data and update the indicators

for bar in history.itertuples():

self.fast.Update(bar.Index[1], bar.close)

self.slow.Update(bar.Index[1], bar.close)

def is_ready(self):

return self.slow.IsReady and self.fast.IsReady

def update(self, time, price):

self.fast.Update(time, price)

self.slow.Update(time, price)

Greg Kendall

Here is the backtest and code:

Angelo Galanti

I cannot complete Lesson 7 Task 03 Grouping Data with Classes in the boot camp.

I copied the solution.py in my main.py but I do receive the error 'QCAlgorithm' is not defined.

This is the first task when I need to create a Class and somehow I think this is related to the problem

Could someone help me?

Thanks

Error Message:

Algorithm.Initialize() Error: During the algorithm initialization, the following exception has occurred: Loader.TryCreatePythonAlgorithm(): Unable to import python module ./cache/algorithm/project/main.pyc. AlgorithmPythonWrapper(): name 'QCAlgorithm' is not defined

at <module>

class EMAMomentumUniverse(QCAlgorithm):

at Python.Runtime.PythonException.ThrowLastAsClrException()

at Python.Runtime.NewReferenceExtensions.BorrowOrThrow(NewReference& reference)

at Python.Runtime.PyModule.Import(String name)

at Python.Runtime.Py.Import(String name)

at QuantConnect.AlgorithmFactory.Python.Wrappers.AlgorithmPythonWrapper..ctor(String moduleName) at AlgorithmFactory/Python/Wrappers/AlgorithmPythonWrapper.cs:line 74 in main.py: line 0

name 'QCAlgorithm' is not defined Stack Trace: During the algorithm initialization, the following exception has occurred: Loader.TryCreatePythonAlgorithm(): Unable to import python module ./cache/algorithm/project/main.pyc. AlgorithmPythonWrapper(): name 'QCAlgorithm' is not defined

at <module>

class EMAMomentumUniverse(QCAlgorithm):

at Python.Runtime.PythonException.ThrowLastAsClrException()

at Python.Runtime.NewReferenceExtensions.BorrowOrThrow(NewReference& reference)

at Python.Runtime.PyModule.Import(String name)

at Python.Runtime.Py.Import(String name)

at QuantConnect.AlgorithmFactory.Python.Wrappers.AlgorithmPythonWrapper..ctor(String moduleName) at AlgorithmFactory/Python/Wrappers/AlgorithmPythonWrapper.cs:line 74 in main.py: line 0

name 'QCAlgorithm' is not defined

Stacktrace:

During the algorithm initialization, the following exception has occurred: Loader.TryCreatePythonAlgorithm(): Unable to import python module ./cache/algorithm/project/main.pyc. AlgorithmPythonWrapper(): name 'QCAlgorithm' is not defined at class EMAMomentumUniverse(QCAlgorithm): at Python.Runtime.PythonException.ThrowLastAsClrException() at Python.Runtime.NewReferenceExtensions.BorrowOrThrow(NewReference& reference) at Python.Runtime.PyModule.Import(String name) at Python.Runtime.Py.Import(String name) at QuantConnect.AlgorithmFactory.Python.Wrappers.AlgorithmPythonWrapper..ctor(String moduleName) at AlgorithmFactory/Python/Wrappers/AlgorithmPythonWrapper.cs:line 74 in main.py: line 0 name 'QCAlgorithm' is not defined

Alexandre Catarino

Hi Angelo Galanti ,

Thank you for the report.

We have fixed the lesson by adding

at the beginning of the script. The AlgorithmImports contains the QCAlgorithm definition.

Best regards,

Alex

Greg Kendall

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

To unlock posting to the community forums please complete at least 30% of Boot Camp.

You can continue your Boot Camp training progress from the terminal. We hope to see you in the community soon!