Intro

Alpha authors may wonder which aspects to optimize for when creating an alpha-generating algorithm in order to maximize ‘commercial success’ in the Alpha Market. Alpha subscribers may wonder which factors others typically base their subscription decisions on.

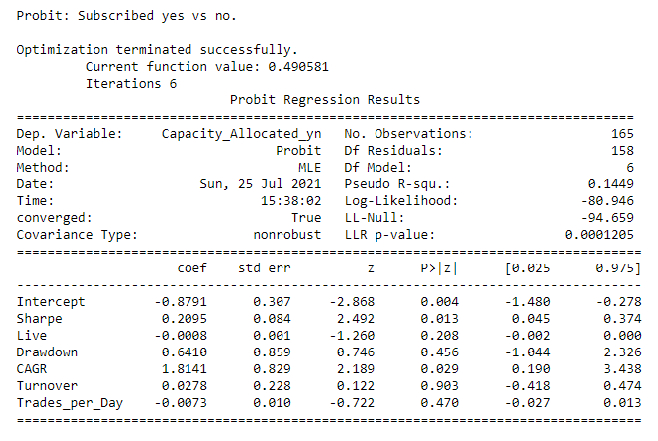

To identify success factors or key decision drivers in the Alpha Market, we can estimate a model that tries to explain whether or not a strategy is subscribed, considering multiple possible drivers. Below is the estimation output of a Probit model that predicts subscription based on the factors listed in the Alpha Market overview table, specifically: Sharpe, Drawdown, Live (i.e., number of days with live track record), CAGR, Turnover, Trades per Day, and Information Ratio. PSR is excluded since it is highly correlated (> 80%) with Sharpe, so that the included variable captures the excluded variable almost completely.

Speculation regarding drivers

- Sharpe, CAGR, and Information Ratio: These are key portfolio success metrics, i.e. a positive effect is anticipated (= the more the better).

- Drawdown: An indicator of portfolio risk, i.e. a negative effect is anticipated (= the less the better).

- Turnover and Trades per Day: Could be seen as negative by some, since greater turnover means higher transaction costs. However, others may see greater turnover as positive since it can indicate a strategy that is more responsive to market conditions.

- Live: A positive thing in general, since a longer live trading track record reduces information asymmetry regarding the extent to which a strategy replicates out of sample. However, possible subscribers may like or not like what they see, so the effect could go either way.

Insights

The key subscription drivers seem to be a higher Sharpe and CAGR (statistically significant at p < 0.05). The results indicate that Live (extent of a live track record), Drawdown, Turnover, and Trades per Day do not systematically affect the subscription decision.

Limitations and possible improvements

The results are descriptive (‘how things currently are’) and neither normative (‘how things should be’) nor predictive (‘how things might be in the future’). Insights are from the cross-section (i.e., one snapshot) of the currently listed strategies in the Alpha Market, i.e. the 165 strategies with available data on all of the considered factors.

Brainstorming regarding possible improvements of the approach:

- track the Alpha Market over time (e.g., using monthly data snapshots to estimate the model)

- consider additional factors (e.g., aspects regarding the alpha description or author background)

- model the subscription amount

Estimation results.

Jared Broad

Thank you for the analysis Peter!

I think the biggest factor is universal fear with investors: (a) “is this doing / will this do – as it claims to do?” This is measured by live track record + reconciliation with backtests + reconciliation with paper trading vs live trading (real volume-spreads-slippage). Drawdown is also reflected in this by “how much could I lose to know this is not doing what it should be doing”.

The best alphas are pretty simple in their execution which makes them reconcile perfectly with backtests. They also trade semi-regularly so investors can know the algorithm is pro-actively monitoring their positions.

After that, the next consideration is (b) "will this deliver exceptional returns"; which is for the average investor not “risk-adjusted returns” but simple returns. We're starting work to more proactively educate on risk-adjusted returns, and flagging/delisting algorithms that fail out-of-sample so some of them will not be an option going forward.

That said; we currently have a mix of professional fund managers and retail investors in the market. I think the only thing that unites them both is (a). (b) understands risk-adjusted returns and is seeking to beat the S&P500 (e.g. 10-25% CAGR) but not 100% CAGR. Professionals are happy to apply leverage to high Sharpe strategies to get the balance they need.

Your other notes:

We created the current market ranking score is calculated like this:

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Peter Guenther

Excellent comment, Jared Broad! Food for thought on multiple fronts:

Normative. Multiple inputs regarding normative aspects (‘how things should be’) which an empirical analysis fails to capture.

Interventions. One could use the model to track the impact of an intervention, such as the increased education around risk-adjusted returns that you mentioned. Specifically, one could use a pretest-posttest design and assess the decision drivers before the intervention (e.g., using monthly snapshots in the three months before) and compare with the assessment after the intervention (e.g., allowing for some time to settle and then using monthly snapshots in the following three months). For example, one would expect that Sharpe increases in importance while CAGR decreases. In addition, drawdown might become a significant (negative) decision driver. And so on.

Model expansions. In addition, multiple inspirations regarding variables to expand the model with. I just quickly list them here, including some notes, for further reference:

Peter Guenther

A follow up regarding the model expansion ideas listed above

Updates. The updated model includes the following additional/changed elements:

Findings. Consistent with the results of the slimmer model, Sharpe Ratio and CAGR remain the dominant drivers of people’s decision to subscribe to a particular alpha market algo (p < 0.05), while the results indicate that the other drivers do not systematically affect people’s signing up decision. The squared term of Turnover has a negative effect and, although non-significant, may show up as a more systematic effect, favoring medium turnover, in a larger sample (e.g., via tracking the alpha market over time).

To dos. The above-listed ideas regarding reconciliation (i.e., match between backtest vs live and live-paper vs live-actual) and segments (retail vs professional investors) have not yet been considered and could add to the explanation regarding why people decide to subscribe to certain alpha market algos and not others. Moreover, tracking the dynamics over time is likely to generate additional and more robust insights.

Probit model estimation results

(see column P > |z| i.e. the p-value for the effects' statistical significance).

Peter Guenther

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

To unlock posting to the community forums please complete at least 30% of Boot Camp.

You can continue your Boot Camp training progress from the terminal. We hope to see you in the community soon!