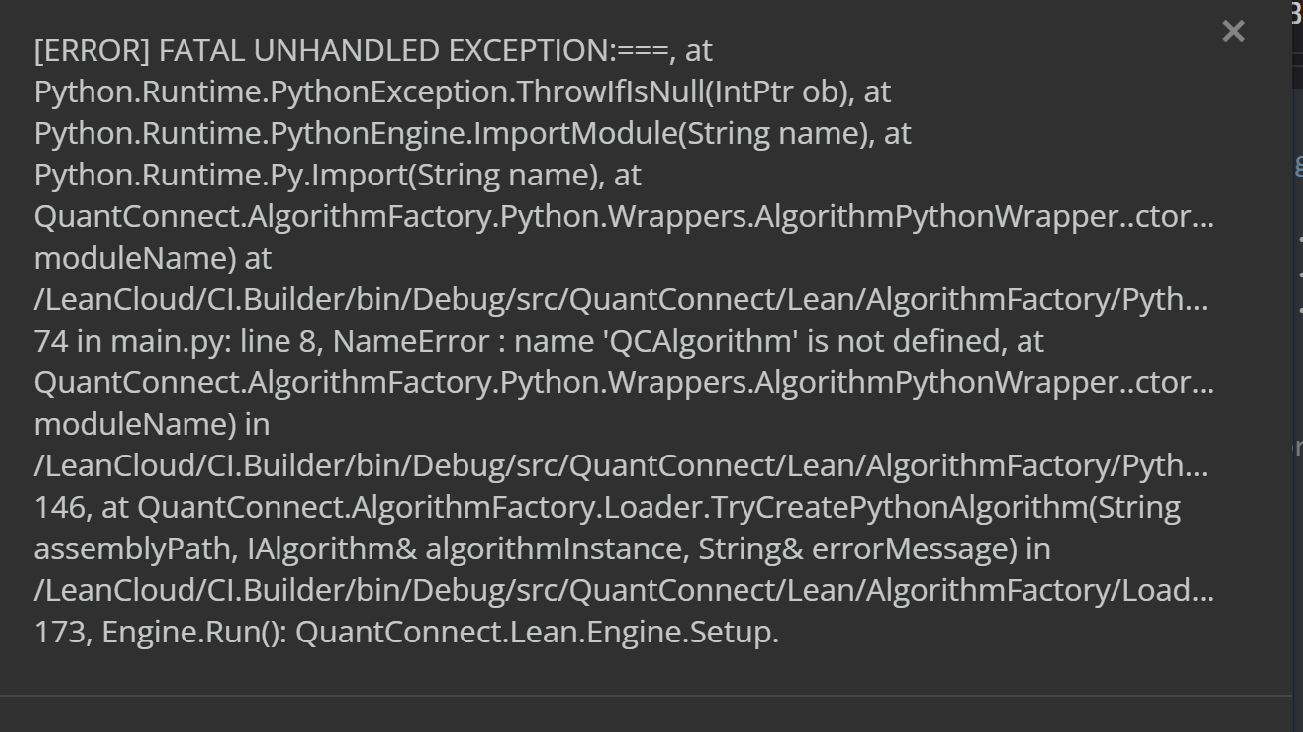

Receiving the following non descript error. Unforutantely, doesnt even let the backtest finish so I can further troubleshoot. Any idea how I might go about troubleshotting this? Theres a few things going on here, but high level:

KEI econmic indiciators dictates where in the cycle and what sectors should be getting bought. Algo goes forward and buys minimal shares of that sector ticker. Then depending on which sector ticker has active holdings, the algo looks at the universe pool of stocks, applies some TA to dictate buy and sells. Heres the error I am getting:

Heres the algo…

#from QuantConnect.Python import PythonQuandl

import numpy as np

import pandas as pd

import scipy as sc

from datetime import timedelta

from QuantConnect.Data.UniverseSelection import *

from Selection.FundamentalUniverseSelectionModel import FundamentalUniverseSelectionModel

class SmoothRedWhale(QCAlgorithm):

def Initialize(self):

self.SetStartDate(2022, 1, 1) # Set Start Date

#self.SetEndDate(2019, 1, 1)

self.SetCash(100000) # Set Strategy Cash

quandl_symbol = "OECD/KEI_LOLITOAA_OECDE_ST_M"

## Optional argument - personal token necessary for restricted dataset

#Quandl.SetAuthCode("PrzwuZR28Wqegvv1sdJ7")

self.SetBrokerageModel(BrokerageName.AlphaStreams)

self.SetWarmup(200)

self.init = True

self.kei = self.AddData(NasdaqDataLink, quandl_symbol, Resolution.Daily).Symbol

self.sma = self.SMA(self.kei, 1)

self.mom = self.MOMP(self.kei, 2)

self.XLFsector_symbolDataBySymbol = {}

self.XLEsector_symbolDataBySymbol = {}

self.XLBsector_symbolDataBySymbol = {}

self.XLIsector_symbolDataBySymbol = {}

self.XLYsector_symbolDataBySymbol = {}

self.XLPsector_symbolDataBySymbol = {}

self.XLUsector_symbolDataBySymbol = {}

self.XLKsector_symbolDataBySymbol = {}

self.XLVsector_symbolDataBySymbol = {}

self.XLCsector_symbolDataBySymbol = {}

self.XLEstocks = []

self.XLFstocks = []

self.XLBstocks = []

self.XLIstocks = []

self.XLYstocks = []

self.XLPstocks = []

self.XLUstocks = []

self.XLKstocks = []

self.XLVstocks = []

self.XLCstocks = []

self.trade = True

self.stateData = { }

self.SPY = self.AddEquity('SPY', Resolution.Daily).Symbol

self.stock = self.AddEquity('QQQ', Resolution.Hour).Symbol

self.bond = self.AddEquity('TMF', Resolution.Hour).Symbol

self.vix = self.AddEquity('VIX', Resolution.Minute).Symbol

self.XLF = self.AddEquity('XLF', Resolution.Hour).Symbol

self.XLE = self.AddEquity('XLE', Resolution.Hour).Symbol

self.XLB = self.AddEquity('XLB', Resolution.Hour).Symbol

self.XLI = self.AddEquity('XLI', Resolution.Hour).Symbol

self.XLY = self.AddEquity('XLY', Resolution.Hour).Symbol

self.XLP = self.AddEquity('XLP', Resolution.Hour).Symbol

self.XLU = self.AddEquity('XLU', Resolution.Hour).Symbol

self.XLK = self.AddEquity('XLK', Resolution.Hour).Symbol

self.XLV = self.AddEquity('XLV', Resolution.Hour).Symbol

self.XLC = self.AddEquity('XLC', Resolution.Hour).Symbol

#self.manually_selected = [self.SPY, self.stock, self.bond, self.vix, self.XLF, self.XLE, self.XLB, self.XLI, self.XLY, self.XLP, self.XLU, self.XLK, self.XLV, self.XLC]

self.manually_selected = []

# Stock Selector

self.UniverseSettings.Resolution = Resolution.Minute

self.universeXLF = self.AddUniverse(self.coarse, self.XLFfine)

self.universeXLE = self.AddUniverse(self.coarse, self.XLEfine)

self.universeXLB = self.AddUniverse(self.coarse, self.XLBfine)

self.universeXLI = self.AddUniverse(self.coarse, self.XLIfine)

self.universeXLY = self.AddUniverse(self.coarse, self.XLYfine)

self.universeXLP = self.AddUniverse(self.coarse, self.XLPfine)

self.universeXLU = self.AddUniverse(self.coarse, self.XLUfine)

self.universeXLK = self.AddUniverse(self.coarse, self.XLKfine)

self.universeXLV = self.AddUniverse(self.coarse, self.XLVfine)

self.universeXLC = self.AddUniverse(self.coarse, self.XLCfine)

self.SetWarmup(500)

self.symbolBySectorCode = dict()

self.__numberOfSymbols = 1000

self.__numberOfSymbolsFine = 3

self.addedsymbols = [self.SPY, self.stock, self.bond, self.vix, self.XLF, self.XLE, self.XLB, self.XLI, self.XLY, self.XLP, self.XLU, self.XLK, self.XLV, self.XLC]

self.Schedule.On(self.DateRules.EveryDay(self.stock), self.TimeRules.AfterMarketOpen(self.stock, 1),

self.Rebalance)

self.Schedule.On(self.DateRules.EveryDay(self.stock), self.TimeRules.AfterMarketOpen(self.stock, 5),

self.Collectsymboldata)

#set the following between 1 - 4 hours depending on buy frequency

self.Schedule.On(self.DateRules.EveryDay(self.stock),

self.TimeRules.Every(timedelta(hours=1)),

self.buySignals)

# self.Schedule.On(self.DateRules.EveryDay(self.stock),

# self.TimeRules.Every(timedelta(hours=3.25)),

# self.sellSignals)

self.Schedule.On(self.DateRules.EveryDay("SPY"),

self.TimeRules.AfterMarketOpen("SPY"),

self.tradeStart)

self.Schedule.On(self.DateRules.EveryDay("SPY"),

self.TimeRules.BeforeMarketClose("SPY"),

self.tradeEnd)

def OnData(self, data):

#for symbol in self.activelyTrading:

# if not self.Portfolio[symbol].Invested:

# self.SetHoldings(symbol, self.weight)

# Note: in the below, x is Symbol and x.Value is string

self.Debug(f"XLU universe includes: {[x.Value for x in self.XLUstocks]}")

self.Debug(f"XLU has data on: {[x.Value for x in self.XLUsector_symbolDataBySymbol]}")

#self.Debug(f"Actively Trading: {[x.Value for x in self.activelyTrading]}")

# self.Debug(f"XLB universe includes: {[x.Value for x in self.XLBstocks]}")

# self.Debug(f"XLI universe includes: {[x.Value for x in self.XLIstocks]}")

# self.Debug(f"XLY universe includes: {[x.Value for x in self.XLYstocks]}")

# self.Debug(f"XLP universe includes: {[x.Value for x in self.XLPstocks]}")

# self.Debug(f"XLU universe includes: {[x.Value for x in self.XLUstocks]}")

# self.Debug(f"XLK universe includes: {[x.Value for x in self.XLKstocks]}")

# self.Debug(f"XLV universe includes: {[x.Value for x in self.XLVstocks]}")

# self.Debug(f"XLC universe includes: {[x.Value for x in self.XLCstocks]}")

def tradeStart(self):

self.trade = True

def tradeEnd(self):

self.trade = False

def Collectsymboldata(self):

for symbol in self.XLFstocks:

self.AddEquity(symbol, Resolution.Hour)

ema10 = self.EMA(symbol, 10, Resolution.Hour, Field.Close)

sma200 = self.SMA(symbol, 200, Resolution.Daily, Field.Close)

sma7 = self.SMA(symbol, 7, Resolution.Hour, Field.Close)

sma20 = self.SMA(symbol, 20, Resolution.Daily, Field.Close)

sma50 = self.SMA(symbol, 50, Resolution.Daily, Field.Close)

ema20 = self.EMA(symbol, 20, Resolution.Hour, Field.Close)

ema50 = self.EMA(symbol, 50, Resolution.Hour, Field.Close)

rsi = self.RSI(symbol, 14, Resolution.Daily)

wilr = self.WILR(symbol, 14, Resolution.Daily)

wilr_fast = self.WILR(symbol, 10, Resolution.Daily)

high = self.MAX(symbol, int(self.GetParameter("highHist")), Resolution.Daily, Field.High)

midhigh = self.MAX(symbol, 3, Resolution.Daily, Field.High)

low = self.MIN(symbol, int(self.GetParameter("lowHist")), Resolution.Daily, Field.Low)

stoplow = self.MIN(symbol, 20, Resolution.Daily, Field.Low)

symbolData = SymbolData(symbol, sma7, ema10, sma20, sma200, sma50, ema20, rsi, wilr, wilr_fast, high, midhigh, low, stoplow)

self.XLFsector_symbolDataBySymbol[symbol] = symbolData

for symbol in self.XLEstocks:

self.AddEquity(symbol, Resolution.Hour)

ema10 = self.EMA(symbol, 10, Resolution.Hour, Field.Close)

sma200 = self.SMA(symbol, 200, Resolution.Daily, Field.Close)

sma7 = self.SMA(symbol, 7, Resolution.Hour, Field.Close)

sma20 = self.SMA(symbol, 20, Resolution.Daily, Field.Close)

sma50 = self.SMA(symbol, 50, Resolution.Daily, Field.Close)

ema20 = self.EMA(symbol, 20, Resolution.Hour, Field.Close)

ema50 = self.EMA(symbol, 50, Resolution.Hour, Field.Close)

rsi = self.RSI(symbol, 14, Resolution.Daily)

wilr = self.WILR(symbol, 14, Resolution.Daily)

wilr_fast = self.WILR(symbol, 10, Resolution.Daily)

high = self.MAX(symbol, int(self.GetParameter("highHist")), Resolution.Daily, Field.High)

midhigh = self.MAX(symbol, 3, Resolution.Daily, Field.High)

low = self.MIN(symbol, int(self.GetParameter("lowHist")), Resolution.Daily, Field.Low)

stoplow = self.MIN(symbol, 20, Resolution.Daily, Field.Low)

symbolData = SymbolData(symbol, sma7, ema10, sma20, sma200, sma50, ema20, rsi, wilr, wilr_fast, high, midhigh, low, stoplow)

self.XLEsector_symbolDataBySymbol[symbol] = symbolData

for symbol in self.XLBstocks:

self.AddEquity(symbol, Resolution.Hour)

ema10 = self.EMA(symbol, 10, Resolution.Hour, Field.Close)

sma200 = self.SMA(symbol, 200, Resolution.Daily, Field.Close)

sma7 = self.SMA(symbol, 7, Resolution.Hour, Field.Close)

sma20 = self.SMA(symbol, 20, Resolution.Daily, Field.Close)

sma50 = self.SMA(symbol, 50, Resolution.Daily, Field.Close)

ema20 = self.EMA(symbol, 20, Resolution.Hour, Field.Close)

ema50 = self.EMA(symbol, 50, Resolution.Hour, Field.Close)

rsi = self.RSI(symbol, 14, Resolution.Daily)

wilr = self.WILR(symbol, 14, Resolution.Daily)

wilr_fast = self.WILR(symbol, 10, Resolution.Daily)

high = self.MAX(symbol, int(self.GetParameter("highHist")), Resolution.Daily, Field.High)

midhigh = self.MAX(symbol, 3, Resolution.Daily, Field.High)

low = self.MIN(symbol, int(self.GetParameter("lowHist")), Resolution.Daily, Field.Low)

stoplow = self.MIN(symbol, 20, Resolution.Daily, Field.Low)

symbolData = SymbolData(symbol, sma7, ema10, sma20, sma200, sma50, ema20, rsi, wilr, wilr_fast, high, midhigh, low, stoplow)

self.XLBsector_symbolDataBySymbol[symbol] = symbolData

for symbol in self.XLIstocks:

self.AddEquity(symbol, Resolution.Hour)

ema10 = self.EMA(symbol, 10, Resolution.Hour, Field.Close)

sma200 = self.SMA(symbol, 200, Resolution.Daily, Field.Close)

sma7 = self.SMA(symbol, 7, Resolution.Hour, Field.Close)

sma20 = self.SMA(symbol, 20, Resolution.Daily, Field.Close)

sma50 = self.SMA(symbol, 50, Resolution.Daily, Field.Close)

ema20 = self.EMA(symbol, 20, Resolution.Hour, Field.Close)

ema50 = self.EMA(symbol, 50, Resolution.Hour, Field.Close)

rsi = self.RSI(symbol, 14, Resolution.Daily)

wilr = self.WILR(symbol, 14, Resolution.Daily)

wilr_fast = self.WILR(symbol, 10, Resolution.Daily)

high = self.MAX(symbol, int(self.GetParameter("highHist")), Resolution.Daily, Field.High)

midhigh = self.MAX(symbol, 3, Resolution.Daily, Field.High)

low = self.MIN(symbol, int(self.GetParameter("lowHist")), Resolution.Daily, Field.Low)

stoplow = self.MIN(symbol, 20, Resolution.Daily, Field.Low)

symbolData = SymbolData(symbol, sma7, ema10, sma20, sma200, sma50, ema20, rsi, wilr, wilr_fast, high, midhigh, low, stoplow)

self.XLIsector_symbolDataBySymbol[symbol] = symbolData

for symbol in self.XLYstocks:

self.AddEquity(symbol, Resolution.Hour)

ema10 = self.EMA(symbol, 10, Resolution.Hour, Field.Close)

sma200 = self.SMA(symbol, 200, Resolution.Daily, Field.Close)

sma7 = self.SMA(symbol, 7, Resolution.Hour, Field.Close)

sma20 = self.SMA(symbol, 20, Resolution.Daily, Field.Close)

sma50 = self.SMA(symbol, 50, Resolution.Daily, Field.Close)

ema20 = self.EMA(symbol, 20, Resolution.Hour, Field.Close)

ema50 = self.EMA(symbol, 50, Resolution.Hour, Field.Close)

rsi = self.RSI(symbol, 14, Resolution.Daily)

wilr = self.WILR(symbol, 14, Resolution.Daily)

wilr_fast = self.WILR(symbol, 10, Resolution.Daily)

high = self.MAX(symbol, int(self.GetParameter("highHist")), Resolution.Daily, Field.High)

midhigh = self.MAX(symbol, 3, Resolution.Daily, Field.High)

low = self.MIN(symbol, int(self.GetParameter("lowHist")), Resolution.Daily, Field.Low)

stoplow = self.MIN(symbol, 20, Resolution.Daily, Field.Low)

symbolData = SymbolData(symbol, sma7, ema10, sma20, sma200, sma50, ema20, rsi, wilr, wilr_fast, high, midhigh, low, stoplow)

self.XLYsector_symbolDataBySymbol[symbol] = symbolData

for symbol in self.XLPstocks:

self.AddEquity(symbol, Resolution.Hour)

ema10 = self.EMA(symbol, 10, Resolution.Hour, Field.Close)

sma200 = self.SMA(symbol, 200, Resolution.Daily, Field.Close)

sma7 = self.SMA(symbol, 7, Resolution.Hour, Field.Close)

sma20 = self.SMA(symbol, 20, Resolution.Daily, Field.Close)

sma50 = self.SMA(symbol, 50, Resolution.Daily, Field.Close)

ema20 = self.EMA(symbol, 20, Resolution.Hour, Field.Close)

ema50 = self.EMA(symbol, 50, Resolution.Hour, Field.Close)

rsi = self.RSI(symbol, 14, Resolution.Daily)

wilr = self.WILR(symbol, 14, Resolution.Daily)

wilr_fast = self.WILR(symbol, 10, Resolution.Daily)

high = self.MAX(symbol, int(self.GetParameter("highHist")), Resolution.Daily, Field.High)

midhigh = self.MAX(symbol, 3, Resolution.Daily, Field.High)

low = self.MIN(symbol, int(self.GetParameter("lowHist")), Resolution.Daily, Field.Low)

stoplow = self.MIN(symbol, 20, Resolution.Daily, Field.Low)

symbolData = SymbolData(symbol, sma7, ema10, sma20, sma200, sma50, ema20, rsi, wilr, wilr_fast, high, midhigh, low, stoplow)

self.XLPsector_symbolDataBySymbol[symbol] = symbolData

for symbol in self.XLUstocks:

self.AddEquity(symbol, Resolution.Hour)

ema10 = self.EMA(symbol, 10, Resolution.Hour, Field.Close)

sma200 = self.SMA(symbol, 200, Resolution.Daily, Field.Close)

sma7 = self.SMA(symbol, 7, Resolution.Hour, Field.Close)

sma20 = self.SMA(symbol, 20, Resolution.Daily, Field.Close)

sma50 = self.SMA(symbol, 50, Resolution.Daily, Field.Close)

ema20 = self.EMA(symbol, 20, Resolution.Hour, Field.Close)

ema50 = self.EMA(symbol, 50, Resolution.Hour, Field.Close)

rsi = self.RSI(symbol, 14, Resolution.Daily)

wilr = self.WILR(symbol, 14, Resolution.Daily)

wilr_fast = self.WILR(symbol, 10, Resolution.Daily)

high = self.MAX(symbol, int(self.GetParameter("highHist")), Resolution.Daily, Field.High)

midhigh = self.MAX(symbol, 3, Resolution.Daily, Field.High)

low = self.MIN(symbol, int(self.GetParameter("lowHist")), Resolution.Daily, Field.Low)

stoplow = self.MIN(symbol, 20, Resolution.Daily, Field.Low)

symbolData = SymbolData(symbol, sma7, ema10, sma20, sma200, sma50, ema20, rsi, wilr, wilr_fast, high, midhigh, low, stoplow)

self.XLUsector_symbolDataBySymbol[symbol] = symbolData

for symbol in self.XLKstocks:

self.AddEquity(symbol, Resolution.Hour)

ema10 = self.EMA(symbol, 10, Resolution.Hour, Field.Close)

sma200 = self.SMA(symbol, 200, Resolution.Daily, Field.Close)

sma7 = self.SMA(symbol, 7, Resolution.Hour, Field.Close)

sma20 = self.SMA(symbol, 20, Resolution.Daily, Field.Close)

sma50 = self.SMA(symbol, 50, Resolution.Daily, Field.Close)

ema20 = self.EMA(symbol, 20, Resolution.Hour, Field.Close)

ema50 = self.EMA(symbol, 50, Resolution.Hour, Field.Close)

rsi = self.RSI(symbol, 14, Resolution.Daily)

wilr = self.WILR(symbol, 14, Resolution.Daily)

wilr_fast = self.WILR(symbol, 10, Resolution.Daily)

high = self.MAX(symbol, int(self.GetParameter("highHist")), Resolution.Daily, Field.High)

midhigh = self.MAX(symbol, 3, Resolution.Daily, Field.High)

low = self.MIN(symbol, int(self.GetParameter("lowHist")), Resolution.Daily, Field.Low)

stoplow = self.MIN(symbol, 20, Resolution.Daily, Field.Low)

symbolData = SymbolData(symbol, sma7, ema10, sma20, sma200, sma50, ema20, rsi, wilr, wilr_fast, high, midhigh, low, stoplow)

self.XLKsector_symbolDataBySymbol[symbol] = symbolData

def coarse(self, coarse):

for i in coarse:

if i.Symbol not in self.stateData:

self.stateData[i.Symbol] = SelectionData(i.Symbol, 200)

# Updates the SymbolData object with current EOD price

avg = self.stateData[i.Symbol]

avg.update(i.EndTime, i.AdjustedPrice, i.DollarVolume)

# Filter the values of the dict to those above EMA and more than $1B vol.

# CoarseWithFundamental = [x for x in self.stateData.values() if x.is_above_ema and x.volume > 1000000000]

# sort by the largest in volume.

# values.sort(key=lambda x: x.volume, reverse=True)

# we need to return only the symbol objects

# self.coarselist = [ x.symbol for x in values[:self.__numberOfSymbols] ]

#CoarseWithFundamental = [x for x in coarse if (x.HasFundamentalData) and (float(x.Price) > 10)]

#sortedByDollarVolume = sorted(CoarseWithFundamental, key=lambda x: x.DollarVolume, reverse=True)

#top = sortedByDollarVolume[:self.__numberOfSymbols]

#

# self.coarselist = [i.Symbol for i in top]

# for symbol in self.manually_selected:

# self.coarselist.append(symbol)

##################

# We are going to use a dictionary to refer the object that will keep the moving averages

for cf in coarse:

if cf.Symbol not in self.averages:

self.averages[cf.Symbol] = SymbolData(cf.Symbol)

# Updates the SymbolData object with current EOD price

avg = self.averages[cf.Symbol]

avg.update(cf.EndTime, cf.AdjustedPrice)

# Filter the values of the dict: we only want up-trending securities

values = list(filter(lambda x: x.is_uptrend, self.averages.values()))

# Sorts the values of the dict: we want those with greater difference between the moving averages

values.sort(key=lambda x: x.scale, reverse=True)

for x in values[:self.__numberOfSymbols]:

self.Log('symbol: ' + str(x.symbol.Value) + ' scale: ' + str(x.scale))

# we need to return only the symbol objects

return [ x.symbol for x in values[:self.__numberOfSymbols] ]

#

# CoarseWithFundamental = [x for x in coarse if (x.HasFundamentalData) and x.is_above_ema and (float(x.Price) > 5)]

# sortedByDollarVolume = sorted(CoarseWithFundamental, key=lambda x: x.DollarVolume, reverse=True) 1

# top = sortedByDollarVolume[:self.__numberOfSymbols]

# self.coarselist = [i.Symbol for i in top]

return self.coarselist

def XLFfine(self, fine):

filtered_fine = [x for x in fine if x.AssetClassification.MorningstarSectorCode == MorningstarSectorCode.FinancialServices

and (x.ValuationRatios.EVToEBITDA > 0)

and (x.EarningReports.BasicAverageShares.ThreeMonths > 0)

and x.EarningReports.BasicAverageShares.ThreeMonths * (x.EarningReports.BasicEPS.TwelveMonths*x.ValuationRatios.PERatio) > 2e9]

sortedByfactor1 = sorted(filtered_fine, key=lambda x: x.OperationRatios.ROIC.Value, reverse=True)

sortedByfactor2 = sorted(filtered_fine, key=lambda x: x.OperationRatios.LongTermDebtEquityRatio.Value, reverse=True)

sortedByfactor3 = sorted(filtered_fine, key=lambda x: x.ValuationRatios.FCFYield, reverse=True)

stock_dict = {}

# assign a score to each stock, you can also change the rule of scoring here.

for i,ele in enumerate(sortedByfactor1):

rank1 = i

rank2 = sortedByfactor2.index(ele)

rank3 = sortedByfactor3.index(ele)

score = sum([rank1*0.4,rank2*0.2,rank3*0.4])

stock_dict[ele] = score

# sort the stocks by their scores

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=False)

sorted_symbol = [x[0] for x in self.sorted_stock]

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=True)

#

self.sorted_symbol = [self.sorted_stock[i][0] for i in range(len(self.sorted_stock))]

topFine = self.sorted_symbol[:self.__numberOfSymbolsFine]

#topFine = sortedByNormalizedPE[:self.__numberOfSymbolsFine]

self.XLFstocks = [i.Symbol for i in topFine]

#for symbol in self.manually_selected:

# self.XLFstocks.append(symbol)

return self.XLFstocks

def XLEfine(self, fine):

filtered_fine = [x for x in fine if x.AssetClassification.MorningstarSectorCode == MorningstarSectorCode.Energy

and (x.ValuationRatios.EVToEBITDA > 0)

and (x.EarningReports.BasicAverageShares.ThreeMonths > 0)

and x.EarningReports.BasicAverageShares.ThreeMonths * (x.EarningReports.BasicEPS.TwelveMonths*x.ValuationRatios.PERatio) > 2e9]

sortedByfactor1 = sorted(filtered_fine, key=lambda x: x.OperationRatios.ROIC.Value, reverse=True)

sortedByfactor2 = sorted(filtered_fine, key=lambda x: x.OperationRatios.LongTermDebtEquityRatio.Value, reverse=True)

sortedByfactor3 = sorted(filtered_fine, key=lambda x: x.ValuationRatios.FCFYield, reverse=True)

stock_dict = {}

# assign a score to each stock, you can also change the rule of scoring here.

for i,ele in enumerate(sortedByfactor1):

rank1 = i

rank2 = sortedByfactor2.index(ele)

rank3 = sortedByfactor3.index(ele)

score = sum([rank1*0.4,rank2*0.2,rank3*0.4])

stock_dict[ele] = score

# sort the stocks by their scores

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=False)

sorted_symbol = [x[0] for x in self.sorted_stock]

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=True)

#

self.sorted_symbol = [self.sorted_stock[i][0] for i in range(len(self.sorted_stock))]

topFine = self.sorted_symbol[:self.__numberOfSymbolsFine]

self.XLEstocks = [i.Symbol for i in topFine]

# for symbol in self.manually_selected:

# self.XLEstocks.append(symbol)

return self.XLEstocks

def XLBfine(self, fine):

filtered_fine = [x for x in fine if x.AssetClassification.MorningstarSectorCode == MorningstarSectorCode.BasicMaterials

and (x.ValuationRatios.EVToEBITDA > 0)

and (x.EarningReports.BasicAverageShares.ThreeMonths > 0)

and x.EarningReports.BasicAverageShares.ThreeMonths * (x.EarningReports.BasicEPS.TwelveMonths*x.ValuationRatios.PERatio) > 2e9]

sortedByfactor1 = sorted(filtered_fine, key=lambda x: x.OperationRatios.ROIC.Value, reverse=True)

sortedByfactor2 = sorted(filtered_fine, key=lambda x: x.OperationRatios.LongTermDebtEquityRatio.Value, reverse=True)

sortedByfactor3 = sorted(filtered_fine, key=lambda x: x.ValuationRatios.FCFYield, reverse=True)

stock_dict = {}

# assign a score to each stock, you can also change the rule of scoring here.

for i,ele in enumerate(sortedByfactor1):

rank1 = i

rank2 = sortedByfactor2.index(ele)

rank3 = sortedByfactor3.index(ele)

score = sum([rank1*0.4,rank2*0.2,rank3*0.4])

stock_dict[ele] = score

# sort the stocks by their scores

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=False)

sorted_symbol = [x[0] for x in self.sorted_stock]

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=True)

#

self.sorted_symbol = [self.sorted_stock[i][0] for i in range(len(self.sorted_stock))]

topFine = self.sorted_symbol[:self.__numberOfSymbolsFine]

self.XLBstocks = [i.Symbol for i in topFine]

# for symbol in self.manually_selected:

# self.XLBstocks.append(symbol)

return self.XLBstocks

def XLIfine(self, fine):

filtered_fine = [x for x in fine if x.AssetClassification.MorningstarSectorCode == MorningstarSectorCode.Industrials

and (x.ValuationRatios.EVToEBITDA > 0)

and (x.EarningReports.BasicAverageShares.ThreeMonths > 0)

and x.EarningReports.BasicAverageShares.ThreeMonths * (x.EarningReports.BasicEPS.TwelveMonths*x.ValuationRatios.PERatio) > 2e9]

sortedByfactor1 = sorted(filtered_fine, key=lambda x: x.OperationRatios.ROIC.Value, reverse=True)

sortedByfactor2 = sorted(filtered_fine, key=lambda x: x.OperationRatios.LongTermDebtEquityRatio.Value, reverse=True)

sortedByfactor3 = sorted(filtered_fine, key=lambda x: x.ValuationRatios.FCFYield, reverse=True)

stock_dict = {}

# assign a score to each stock, you can also change the rule of scoring here.

for i,ele in enumerate(sortedByfactor1):

rank1 = i

rank2 = sortedByfactor2.index(ele)

rank3 = sortedByfactor3.index(ele)

score = sum([rank1*0.4,rank2*0.2,rank3*0.4])

stock_dict[ele] = score

# sort the stocks by their scores

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=False)

sorted_symbol = [x[0] for x in self.sorted_stock]

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=True)

#

self.sorted_symbol = [self.sorted_stock[i][0] for i in range(len(self.sorted_stock))]

topFine = self.sorted_symbol[:self.__numberOfSymbolsFine]

self.XLIstocks = [i.Symbol for i in topFine]

# for symbol in self.manually_selected:

# self.XLIstocks.append(symbol)

return self.XLIstocks

def XLYfine(self, fine):

filtered_fine = [x for x in fine if x.AssetClassification.MorningstarSectorCode == MorningstarSectorCode.ConsumerCyclical

and (x.ValuationRatios.EVToEBITDA > 0)

and (x.EarningReports.BasicAverageShares.ThreeMonths > 0)

and x.EarningReports.BasicAverageShares.ThreeMonths * (x.EarningReports.BasicEPS.TwelveMonths*x.ValuationRatios.PERatio) > 2e9]

sortedByfactor1 = sorted(filtered_fine, key=lambda x: x.OperationRatios.ROIC.Value, reverse=True)

sortedByfactor2 = sorted(filtered_fine, key=lambda x: x.OperationRatios.LongTermDebtEquityRatio.Value, reverse=True)

sortedByfactor3 = sorted(filtered_fine, key=lambda x: x.ValuationRatios.FCFYield, reverse=True)

stock_dict = {}

# assign a score to each stock, you can also change the rule of scoring here.

for i,ele in enumerate(sortedByfactor1):

rank1 = i

rank2 = sortedByfactor2.index(ele)

rank3 = sortedByfactor3.index(ele)

score = sum([rank1*0.4,rank2*0.2,rank3*0.4])

stock_dict[ele] = score

# sort the stocks by their scores

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=False)

sorted_symbol = [x[0] for x in self.sorted_stock]

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=True)

#

self.sorted_symbol = [self.sorted_stock[i][0] for i in range(len(self.sorted_stock))]

topFine = self.sorted_symbol[:self.__numberOfSymbolsFine]

self.XLYstocks = [i.Symbol for i in topFine]

# for symbol in self.manually_selected:

# self.XLYstocks.append(symbol)

return self.XLYstocks

def XLPfine(self, fine):

filtered_fine = [x for x in fine if x.AssetClassification.MorningstarSectorCode == MorningstarSectorCode.ConsumerDefensive

and (x.ValuationRatios.EVToEBITDA > 0)

and (x.EarningReports.BasicAverageShares.ThreeMonths > 0)

and x.EarningReports.BasicAverageShares.ThreeMonths * (x.EarningReports.BasicEPS.TwelveMonths*x.ValuationRatios.PERatio) > 2e9]

sortedByfactor1 = sorted(filtered_fine, key=lambda x: x.OperationRatios.ROIC.Value, reverse=True)

sortedByfactor2 = sorted(filtered_fine, key=lambda x: x.OperationRatios.LongTermDebtEquityRatio.Value, reverse=True)

sortedByfactor3 = sorted(filtered_fine, key=lambda x: x.ValuationRatios.FCFYield, reverse=True)

stock_dict = {}

# assign a score to each stock, you can also change the rule of scoring here.

for i,ele in enumerate(sortedByfactor1):

rank1 = i

rank2 = sortedByfactor2.index(ele)

rank3 = sortedByfactor3.index(ele)

score = sum([rank1*0.4,rank2*0.2,rank3*0.4])

stock_dict[ele] = score

# sort the stocks by their scores

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=False)

sorted_symbol = [x[0] for x in self.sorted_stock]

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=True)

#

self.sorted_symbol = [self.sorted_stock[i][0] for i in range(len(self.sorted_stock))]

topFine = self.sorted_symbol[:self.__numberOfSymbolsFine]

self.XLPstocks = [i.Symbol for i in topFine]

# for symbol in self.manually_selected:

# self.XLPstocks.append(symbol)

return self.XLPstocks

def XLUfine(self, fine):

filtered_fine = [x for x in fine if x.AssetClassification.MorningstarSectorCode == MorningstarSectorCode.Utilities

]

sortedByfactor1 = sorted(filtered_fine, key=lambda x: x.OperationRatios.ROIC.Value, reverse=True)

sortedByfactor2 = sorted(filtered_fine, key=lambda x: x.OperationRatios.LongTermDebtEquityRatio.Value, reverse=True)

sortedByfactor3 = sorted(filtered_fine, key=lambda x: x.ValuationRatios.FCFYield, reverse=True)

stock_dict = {}

# assign a score to each stock, you can also change the rule of scoring here.

for i,ele in enumerate(sortedByfactor1):

rank1 = i

rank2 = sortedByfactor2.index(ele)

rank3 = sortedByfactor3.index(ele)

score = sum([rank1*0.4,rank2*0.2,rank3*0.4])

stock_dict[ele] = score

# sort the stocks by their scores

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=False)

sorted_symbol = [x[0] for x in self.sorted_stock]

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=True)

#

self.sorted_symbol = [self.sorted_stock[i][0] for i in range(len(self.sorted_stock))]

topFine = self.sorted_symbol[:self.__numberOfSymbolsFine]

self.XLUstocks = [i.Symbol for i in topFine]

# for symbol in self.manually_selected:

# self.XLUstocks.append(symbol)

return self.XLUstocks

def XLKfine(self, fine):

filtered_fine = [x for x in fine if x.AssetClassification.MorningstarSectorCode == MorningstarSectorCode.Technology

and (x.ValuationRatios.EVToEBITDA > 0)

and (x.EarningReports.BasicAverageShares.ThreeMonths > 0)

and x.EarningReports.BasicAverageShares.ThreeMonths * (x.EarningReports.BasicEPS.TwelveMonths*x.ValuationRatios.PERatio) > 2e9]

sortedByfactor1 = sorted(filtered_fine, key=lambda x: x.OperationRatios.ROIC.Value, reverse=True)

sortedByfactor2 = sorted(filtered_fine, key=lambda x: x.OperationRatios.LongTermDebtEquityRatio.Value, reverse=True)

sortedByfactor3 = sorted(filtered_fine, key=lambda x: x.ValuationRatios.FCFYield, reverse=True)

stock_dict = {}

# assign a score to each stock, you can also change the rule of scoring here.

for i,ele in enumerate(sortedByfactor1):

rank1 = i

rank2 = sortedByfactor2.index(ele)

rank3 = sortedByfactor3.index(ele)

score = sum([rank1*0.4,rank2*0.2,rank3*0.4])

stock_dict[ele] = score

# sort the stocks by their scores

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=False)

sorted_symbol = [x[0] for x in self.sorted_stock]

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=True)

#

self.sorted_symbol = [self.sorted_stock[i][0] for i in range(len(self.sorted_stock))]

topFine = self.sorted_symbol[:self.__numberOfSymbolsFine]

self.XLKstocks = [i.Symbol for i in topFine]

# for symbol in self.manually_selected:

# self.XLKstocks.append(symbol)

return self.XLKstocks

def XLVfine(self, fine):

filtered_fine = [x for x in fine if x.AssetClassification.MorningstarSectorCode == MorningstarSectorCode.Healthcare

and (x.ValuationRatios.EVToEBITDA > 0)

and (x.EarningReports.BasicAverageShares.ThreeMonths > 0)

and x.EarningReports.BasicAverageShares.ThreeMonths * (x.EarningReports.BasicEPS.TwelveMonths*x.ValuationRatios.PERatio) > 2e9]

sortedByfactor1 = sorted(filtered_fine, key=lambda x: x.OperationRatios.ROIC.Value, reverse=True)

sortedByfactor2 = sorted(filtered_fine, key=lambda x: x.OperationRatios.LongTermDebtEquityRatio.Value, reverse=True)

sortedByfactor3 = sorted(filtered_fine, key=lambda x: x.ValuationRatios.FCFYield, reverse=True)

stock_dict = {}

# assign a score to each stock, you can also change the rule of scoring here.

for i,ele in enumerate(sortedByfactor1):

rank1 = i

rank2 = sortedByfactor2.index(ele)

rank3 = sortedByfactor3.index(ele)

score = sum([rank1*0.4,rank2*0.2,rank3*0.4])

stock_dict[ele] = score

# sort the stocks by their scores

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=False)

sorted_symbol = [x[0] for x in self.sorted_stock]

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=True)

#

self.sorted_symbol = [self.sorted_stock[i][0] for i in range(len(self.sorted_stock))]

topFine = self.sorted_symbol[:self.__numberOfSymbolsFine]

self.XLVstocks = [i.Symbol for i in topFine]

# for symbol in self.manually_selected:

# self.XLVstocks.append(symbol)

return self.XLVstocks

def XLCfine(self, fine):

filtered_fine = [x for x in fine if x.AssetClassification.MorningstarSectorCode == MorningstarSectorCode.CommunicationServices

and (x.ValuationRatios.EVToEBITDA > 0)

and (x.EarningReports.BasicAverageShares.ThreeMonths > 0)

and x.EarningReports.BasicAverageShares.ThreeMonths * (x.EarningReports.BasicEPS.TwelveMonths*x.ValuationRatios.PERatio) > 2e9]

sortedByfactor1 = sorted(filtered_fine, key=lambda x: x.OperationRatios.ROIC.Value, reverse=True)

sortedByfactor2 = sorted(filtered_fine, key=lambda x: x.OperationRatios.LongTermDebtEquityRatio.Value, reverse=True)

sortedByfactor3 = sorted(filtered_fine, key=lambda x: x.ValuationRatios.FCFYield, reverse=True)

stock_dict = {}

# assign a score to each stock, you can also change the rule of scoring here.

for i,ele in enumerate(sortedByfactor1):

rank1 = i

rank2 = sortedByfactor2.index(ele)

rank3 = sortedByfactor3.index(ele)

score = sum([rank1*0.4,rank2*0.2,rank3*0.4])

stock_dict[ele] = score

# sort the stocks by their scores

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=False)

sorted_symbol = [x[0] for x in self.sorted_stock]

self.sorted_stock = sorted(stock_dict.items(), key=lambda d:d[1],reverse=True)

#

self.sorted_symbol = [self.sorted_stock[i][0] for i in range(len(self.sorted_stock))]

topFine = self.sorted_symbol[:self.__numberOfSymbolsFine]

self.XLCstocks = [i.Symbol for i in topFine]

# for symbol in self.manually_selected:

# self.XLCstocks.append(symbol)

return self.XLCstocks

def Rebalance(self):

if not self.mom.IsReady or not self.sma.IsReady: return

initial_asset = self.stock if self.mom.Current.Value > 0 else self.bond

if self.init:

self.SetHoldings(initial_asset, .01)

self.init = False

keihist = self.History([self.kei], (int(self.GetParameter("keihist"))))

#keihist = keihist['Value'].unstack(level=0).dropna()

keihistlowt = np.nanpercentile(keihist, 15)

keihistmidt = np.nanpercentile(keihist, 50)

keihisthight = np.nanpercentile(keihist, 90)

kei = self.sma.Current.Value

keimom = self.mom.Current.Value

if (keimom < 0 and kei < keihistmidt and kei > keihistlowt) and not (self.Securities[self.bond].Invested) :

# DECLINE

self.Liquidate()

self.SetHoldings(self.XLP, .01)

for symbol, symbolData in self.XLPsector_symbolDataBySymbol.items():

if not self.Portfolio[symbol].Invested : #and (self.Securities[symbol].Close > symbolData.sma50.Current.Value):

self.SetHoldings(symbol, .1, False, "Buy Signal")

#Stop Loss

# for symbol, symbolData in self.XLPsector_symbolDataBySymbol.items():

# if not (self.Securities[symbol].Close < symbolData.low.Current.Value) and (self.Securities[self.XLB].Invested):

# self.Liquidate()

# self.SetHoldings(self.XLP, .01)

self.SetHoldings(self.bond, .4)

self.Debug("STAPLES {0} >> {1}".format(self.XLP, self.Time))

elif (keimom > 0 and kei < keihistlowt) and not (self.Securities[self.XLB].Invested) :

# RECOVERY

self.Liquidate()

self.SetHoldings(self.XLB, .01)

for symbol, symbolData in self.XLEsector_symbolDataBySymbol.items():

if not self.Portfolio[symbol].Invested : #and (self.Securities[symbol].Close > symbolData.sma50.Current.Value):

self.SetHoldings(symbol, .1, False, "Buy Signal")

#XLB

for symbol, symbolData in self.XLBsector_symbolDataBySymbol.items():

if not self.Portfolio[symbol].Invested : #and (self.Securities[symbol].Close > symbolData.sma50.Current.Value):

self.SetHoldings(symbol, .1, False, "Buy Signal")

#XLY

for symbol, symbolData in self.XLYsector_symbolDataBySymbol.items():

if not self.Portfolio[symbol].Invested : #and (self.Securities[symbol].Close > symbolData.sma50.Current.Value):

self.SetHoldings(symbol, .1, False, "Buy Signal")

#Stop Loss

# for symbol, symbolData in self.XLBsector_symbolDataBySymbol.items():

# if not (self.Securities[symbol].Close < symbolData.low.Current.Value) and (self.Securities[self.XLB].Invested):

# self.Liquidate()

# self.SetHoldings(self.XLB, .01)

self.Debug("MATERIALS {0} >> {1}".format(self.XLB, self.Time))

elif (keimom > 0 and kei > keihistlowt and kei < keihistmidt) and not (self.Securities[self.XLE].Invested) :

# EARLY

self.Liquidate()

self.SetHoldings(self.XLE, .01)

#XLF

for symbol, symbolData in self.XLFsector_symbolDataBySymbol.items():

if not self.Portfolio[symbol].Invested : #and (self.Securities[symbol].Close > symbolData.sma50.Current.Value):

self.SetHoldings(symbol, .1, False, "Buy Signal")

#XLI

for symbol, symbolData in self.XLIsector_symbolDataBySymbol.items():

if not self.Portfolio[symbol].Invested : #and (self.Securities[symbol].Close > symbolData.sma50.Current.Value):

self.SetHoldings(symbol, .1, False, "Buy Signal")

#XLE

for symbol, symbolData in self.XLEsector_symbolDataBySymbol.items():

if not self.Portfolio[symbol].Invested : #and (self.Securities[symbol].Close > symbolData.sma50.Current.Value):

self.SetHoldings(symbol, .1, False, "Buy Signal")

#Stop Loss

# for symbol, symbolData in self.XLEstocks.items():

# if not (self.Securities[symbol].Close < symbolData.low.Current.Value) and (self.Securities[self.XLE].Invested):

# self.Liquidate()

# self.SetHoldings(self.XLE, .01)

self.Debug("ENERGY {0} >> {1}".format(self.XLE, self.Time))

elif (keimom > 0 and kei > keihistmidt and kei < keihisthight) and not (self.Securities[self.XLU].Invested) :

# REBOUND

self.Liquidate()

#self.SetHoldings(self.XLK, .5)

self.SetHoldings(self.XLU, .01)

#XLU

for symbol, symbolData in self.XLUsector_symbolDataBySymbol.items():

if not self.Portfolio[symbol].Invested : #and (self.Securities[symbol].Close > symbolData.sma50.Current.Value):

self.SetHoldings(symbol, .2, False, "Buy Signal")

#Stop Loss

# for symbol, symbolData in self.XLUsector_symbolDataBySymbol.items():

# if not (self.Securities[symbol].Close < symbolData.low.Current.Value) and (self.Securities[self.XLU].Invested):

# self.Liquidate()

# self.SetHoldings(self.XLU, .01)

self.Debug("UTILITIES {0} >> {1}".format(self.XLU, self.Time))

elif (keimom < 0 and kei < keihisthight and kei > keihistmidt) and not (self.Securities[self.XLK].Invested) :

# LATE

self.Liquidate()

self.SetHoldings(self.XLK, .01)

for symbol, symbolData in self.XLKsector_symbolDataBySymbol.items():

if not self.Portfolio[symbol].Invested and (self.Securities[symbol].Close > symbolData.sma50.Current.Value) :

self.SetHoldings(symbol, .1, False, "Buy Signal")

#self.SetHoldings(self.XLV, .5)

for symbol, symbolData in self.XLVsector_symbolDataBySymbol.items():

if not self.Portfolio[symbol].Invested and (self.Securities[symbol].Close > symbolData.sma50.Current.Value) :

self.SetHoldings(symbol, .1, False, "Buy Signal")

self.Debug("INFO TECH {0} >> {1}".format(self.XLK, self.Time))

#Stop Loss

# for symbol, symbolData in self.XLKsector_symbolDataBySymbol.items():

# if not (self.Securities[symbol].Close < symbolData.low.Current.Value) and (self.Securities[self.XLK].Invested):

# self.Liquidate()

# self.SetHoldings(self.XLK, .01)

elif (keimom < 0 and kei < 100 and not self.Securities[self.bond].Invested):

self.Liquidate()

self.SetHoldings(self.bond, .5)

self.Plot("LeadInd", "SMA(LeadInd)", self.sma.Current.Value)

self.Plot("LeadInd", "THRESHOLD", 100)

self.Plot("MOMP", "MOMP(LeadInd)", self.mom.Current.Value)

self.Plot("MOMP", "THRESHOLD", 0)

def buySignals(self):

if self.trade == False:

return

## EARLY - XLE

for symbol, symbolData in self.XLEsector_symbolDataBySymbol.items():

if self.Portfolio[self.XLE].Invested:

self.SetHoldings(symbol, .15, False, "Buy Signal")

for symbol, symbolData in self.XLFsector_symbolDataBySymbol.items():

if self.Portfolio[self.XLE].Invested:

self.SetHoldings(symbol, .15, False, "Buy Signal")

for symbol, symbolData in self.XLIsector_symbolDataBySymbol.items():

if self.Portfolio[self.XLE].Invested:

self.SetHoldings(symbol, .15, False, "Buy Signal")

## Recovery - XLB

for symbol, symbolData in self.XLEsector_symbolDataBySymbol.items():

if self.Portfolio[self.XLB].Invested:

self.SetHoldings(symbol, .2, False, "Buy Signal")

for symbol, symbolData in self.XLBsector_symbolDataBySymbol.items():

if self.Portfolio[self.XLB].Invested:

self.SetHoldings(symbol, .2, False, "Buy Signal")

for symbol, symbolData in self.XLYsector_symbolDataBySymbol.items():

if self.Portfolio[self.XLB].Invested:

self.SetHoldings(symbol, .2, False, "Buy Signal")

## Rebound - XLU

for symbol, symbolData in self.XLUsector_symbolDataBySymbol.items():

if self.Portfolio[self.XLU].Invested:

self.SetHoldings(symbol, .2, False, "Buy Signal")

## Decline - XLP

for symbol, symbolData in self.XLPsector_symbolDataBySymbol.items():

if self.Portfolio[self.XLP].Invested:

self.SetHoldings(symbol, .2, False, "Buy Signal")

## Late - XLK

for symbol, symbolData in self.XLKsector_symbolDataBySymbol.items():

if self.Portfolio[self.XLK].Invested:

self.SetHoldings(symbol, .2, False, "Buy Signal")

for symbol, symbolData in self.XLVsector_symbolDataBySymbol.items():

if self.Portfolio[self.XLK].Invested:

self.SetHoldings(symbol, .2, False, "Buy Signal")

class SelectionData(object):

def __init__(self, symbol, period):

self.symbol = symbol

self.ema = ExponentialMovingAverage(period)

self.is_above_ema = False

self.volume = 0

def update(self, time, price, volume):

self.volume = volume

if self.ema.Update(time, price):

self.is_above_ema = price > ema

class FScore(object):

def __init__(self, netincome, operating_cashflow, roa_current,

roa_past, issued_current, issued_past, grossm_current, grossm_past,

longterm_current, longterm_past, curratio_current, curratio_past,

assetturn_current, assetturn_past):

self.netincome = netincome

self.operating_cashflow = operating_cashflow

self.roa_current = roa_current

self.roa_past = roa_past

self.issued_current = issued_current

self.issued_past = issued_past

self.grossm_current = grossm_current

self.grossm_past = grossm_past

self.longterm_current = longterm_current

self.longterm_past = longterm_past

self.curratio_current = curratio_current

self.curratio_past = curratio_past

self.assetturn_current = assetturn_current

self.assetturn_past = assetturn_past

def ObjectiveScore(self):

fscore = 0

fscore += np.where(self.netincome > 0, 1, 0)

fscore += np.where(self.operating_cashflow > 0, 1, 0)

fscore += np.where(self.roa_current > self.roa_past, 1, 0)

fscore += np.where(self.operating_cashflow > self.roa_current, 1, 0)

fscore += np.where(self.longterm_current <= self.longterm_past, 1, 0)

fscore += np.where(self.curratio_current >= self.curratio_past, 1, 0)

fscore += np.where(self.issued_current <= self.issued_past, 1, 0)

fscore += np.where(self.grossm_current >= self.grossm_past, 1, 0)

fscore += np.where(self.assetturn_current >= self.assetturn_past, 1, 0)

return fscore

class SymbolData:

def __init__(self, symbol, sma7, ema10, sma20, sma50, sma200, ema20, rsi, wilr, wilr_fast, high, midhigh, low, stoplow):

self.Symbol = symbol

self.sma7 = sma7

self.ema10 = ema10

self.sma20 = sma20

self.sma50 = sma50

self.sma200 = sma200

self.ema20 = ema20

self.rsi = rsi

self.wilr = wilr

self.wilr_fast = wilr_fast

self.high = high

self.midhigh = midhigh

self.low = low

self.stoplow = stoplow

# Quandl often doesn't use close columns so need to tell LEAN which is the "value" column.

class QuandlCustomColumns(PythonQuandl):

def __init__(self):

# Define ValueColumnName: cannot be None, Empty or non-existant column name

self.ValueColumnName = "Value"

Louis Szeto

Hi Axist

Please include the below line, since importing QC dependencies will not be autocomplete in IDE 3.0.

Best

Louis

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Axist

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

To unlock posting to the community forums please complete at least 30% of Boot Camp.

You can continue your Boot Camp training progress from the terminal. We hope to see you in the community soon!