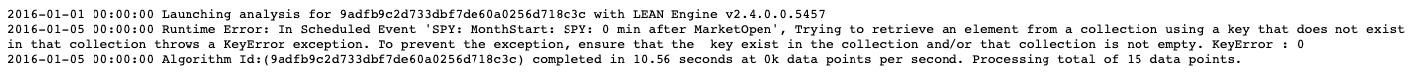

Hi people, I need your help because I can't identify where is the problem of my code. I use an example code and modify the class PortfolioOptimization using cvxpy but always give an error. When I run the class PortfolioOptimization in my pc I don't have any kind of problem, but when I run the class in quantconnect always give me an error.

QUANTCONNECT COMMUNITY

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

Douglas Stridsberg

Hey, would you be able to provide your code so we can see what you're trying to achieve? Seeing what's inside your scheduled event function (MonthStart?) at least would be helpful.

Looks like you're trying to access a non-existing element from a list or something. This usually happens when you try to access something from the incoming data slice - you should always check first if the element you're looking for exists before using it.

Dcajasn

Here is the code :

from math import ceil,floor,isnan

from datetime import datetime

import pandas as pd

import numpy as np

import cvxpy as cv

class AssetAllocationAlgorithm(QCAlgorithm):

def Initialize(self):

self.SetStartDate(2016, 1, 1) #Set Start Date

self.SetEndDate(2018, 1, 1) #Set End Date

self.SetCash(100000) #Set Strategy Cash

tickers = ["IEF", "TLT", "SPY", "EFA", "EEM", "JPXN", "XLK"]

self.symbols = []

for i in tickers:

self.symbols.append(self.AddEquity(i, Resolution.Daily).Symbol)

for syl in self.symbols:

syl.window = RollingWindow[TradeBar](252)

self.Schedule.On(self.DateRules.MonthStart("SPY"), self.TimeRules.AfterMarketOpen("SPY"), Action(self.Rebalancing))

def OnData(self, data):

if data.ContainsKey("SPY"):

for syl in self.symbols:

syl.window.Add(data[syl])

def Rebalancing(self):

data = {}

for syl in self.symbols:

data[syl] = [float(i.Close) for i in syl.window]

df_price = pd.DataFrame(data,columns=data.keys())

# To order prices from oldest to latest

df_price = df_price.sort_values(by = 0, ascending = False)

# Calculating returns

daily_return = df_price.pct_change().dropna().values

if daily_return.empty == False:

a = PortfolioOptimization(daily_return, 0, len(data))

opt_weight = a.opt_portfolio()

if isnan(sum(opt_weight)): return

self.Log(str(opt_weight))

for i in range(len(data)):

self.SetHoldings(df_price.columns[i], opt_weight[i])

# equally weighted

# self.SetHoldings(self.symbols[i], 1.0/len(data))

class PortfolioOptimization(object):

import numpy as np

import pandas as pd

import cvxpy as cv

def __init__(self, df_return, risk_free_rate, num_assets):

self.daily_return = df_return

self.risk_free_rate = risk_free_rate

self.n = num_assets # numbers of risk assets in portfolio

self.mu = np.matrix(df_return.mean(axis = 0).values)

self.sigma = df_return.cov().values

def opt_portfolio(self):

w = cv.Variable((self.mu.shape[1],1))

"""

MV model Variables

"""

risk = cv.quad_form(w, self.sigma)

constraints = [cv.sum(w) == 1]

constraints.append(w >= 0)

constraints.append(w <= 0.25)

prob = cv.Problem(cv.Minimize(risk), constraints)

prob.solve()

weights = np.matrix(w.value).T

weights = weights/np.sum(weights)

weights = np.squeeze(np.array(weights))

return weights

Douglas Stridsberg

Without a line number it's hard to tell where the problem is happening. Given the key that errors is 0, I suspect it may be the following line:

self.SetHoldings(df_price.columns[i], opt_weight[i])

Are you sure df_price.columns[0] and opt_weight[0] exist?

You're going to have to do some troubleshooting in each of the places where this error could occur - i.e. where you're accessing a collection by an ID beginning with 0.

Link Liang

Hi Dany,

I believe your PortfolioOptimization class works fine, and there are two problems with your Rebalancing method:

1. By line df_price = df_price.sort_values(by = 0, ascending = False) , I believe you want to basically reverse all rows. However, the label or index are not values and I don’t think using sort_values() is a good idea here. .iloc[::-1] works just fine here. You can find more information here and here.

2. daily_return = df_price.pct_change().dropna().values gives error: “‘numpy.ndarray’ object has no attribute ‘values’“. I believe you want the 2-D table, and .values should not be necessary here.

Here is an attempt with those modifications. Hope if helps.

Dcajasn

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. QuantConnect makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. All investments involve risk, including loss of principal. You should consult with an investment professional before making any investment decisions.

To unlock posting to the community forums please complete at least 30% of Boot Camp.

You can continue your Boot Camp training progress from the terminal. We hope to see you in the community soon!