Applying Research

Random Forest Regression

Create Hypothesis

We've assumed the price data is a time series with some auto regressive property (i.e. its expectation is related to past price information). Therefore, by using past information, we could predict the next price level. One way to do so is by Random Forest Regression, which is a supervised machine learning algorithm where its weight and bias is decided in non-linear hyperdimension.

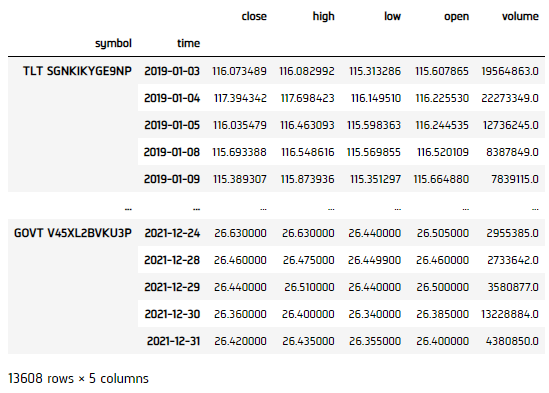

Get Historical Data

To begin, we retrieve historical data for researching.

- Instantiate a

QuantBook. - Select the desired tickers for research.

- Call the

AddEquityadd_equitymethod with the tickers, and their corresponding resolution. Then store theirSymbols. - Call the

historymethod withqb.securities.keysfor all tickers, time argument(s), and resolution to request historical data for the symbol.

qb = QuantBook()

symbols = {}

assets = ["SHY", "TLT", "SHV", "TLH", "EDV", "BIL",

"SPTL", "TBT", "TMF", "TMV", "TBF", "VGSH", "VGIT",

"VGLT", "SCHO", "SCHR", "SPTS", "GOVT"]

for i in range(len(assets)):

symbols[assets[i]] = qb.add_equity(assets[i],Resolution.MINUTE).symbol

If you do not pass a resolution argument, Resolution.MinuteResolution.MINUTE is used by default.

history = qb.history(qb.securities.keys(), datetime(2019, 1, 1), datetime(2021, 12, 31), Resolution.DAILY)

Prepare Data

We'll have to process our data as well as to build the ML model before testing the hypothesis. Our methodology is to use fractional differencing close price as the input data in order to (1) provide stationarity, and (2) retain sufficient extent of variance of the previous price information. We assume d=0.5 is the right balance to do so.

- Select the close column and then call the

unstackmethod. - Feature engineer the data as fractional differencing for input.

- Shift the data for 1-step backward as training output result.

- Split the data into training and testing sets.

- Initialize a Random Forest Regressor.

- Fit the regressor.

df = history['close'].unstack(level=0)

input_ = df.diff() * 0.5 + df * 0.5 input_ = input_.iloc[1:]

output = df.shift(-1).iloc[:-1]

splitter = int(input_.shape[0] * 0.8) X_train = input_.iloc[:splitter] X_test = input_.iloc[splitter:] y_train = output.iloc[:splitter] y_test = output.iloc[splitter:]

regressor = RandomForestRegressor(n_estimators=100, min_samples_split=5, random_state = 1990)

regressor.fit(X_train, y_train)

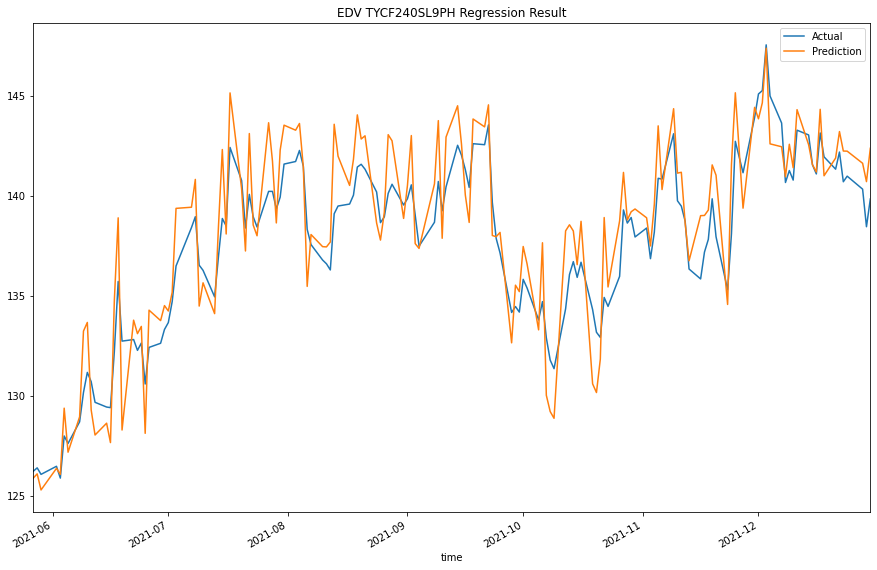

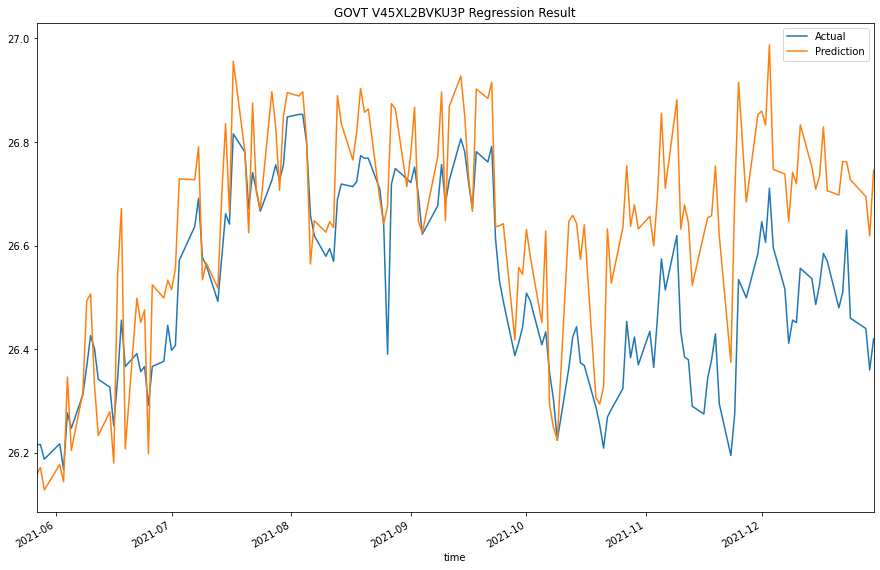

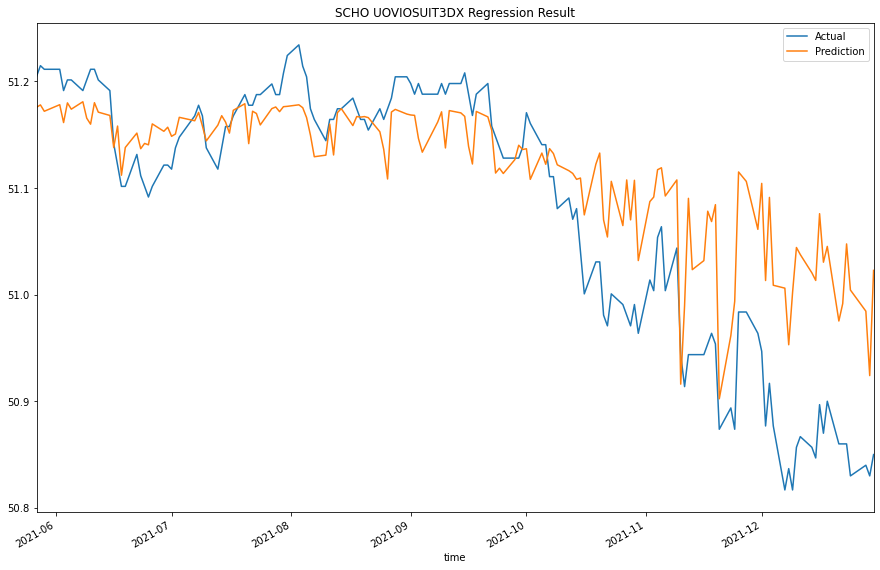

Test Hypothesis

We would test the performance of this ML model to see if it could predict 1-step forward price precisely. To do so, we would compare the predicted and actual prices.

- Predict the testing set.

- Convert result into

DataFrame. - Plot the result for comparison.

predictions = regressor.predict(X_test)

predictions = pd.DataFrame(predictions, index=y_test.index, columns=y_test.columns)

for col in y_test.columns:

plt.figure(figsize=(15, 10))

y_test[col].plot(label="Actual")

predictions[col].plot(label="Prediction")

plt.title(f"{col} Regression Result")

plt.legend()

plt.show()

plt.clf()

For more plots, please clone the project and run the notebook.

Set Up Algorithm

Once we are confident in our hypothesis, we can export this code into backtesting. One way to accomodate this model into backtest is to create a scheduled event which uses our model to predict the expected return. Since we could calculate the expected return, we'd use Mean-Variance Optimization for portfolio construction.

def initialize(self) -> None:

#1. Required: Five years of backtest history

self.set_start_date(2014, 1, 1)

#2. Required: Alpha Streams Models:

self.set_brokerage_model(BrokerageName.ALPHA_STREAMS)

#3. Required: Significant AUM Capacity

self.set_cash(1000000)

#4. Required: Benchmark to SPY

self.set_benchmark("SPY")

self.set_portfolio_construction(MeanVarianceOptimizationPortfolioConstructionModel(portfolio_bias = PortfolioBias.LONG,

period=252))

self.set_execution(ImmediateExecutionModel())

self.assets = ["SHY", "TLT", "IEI", "SHV", "TLH", "EDV", "BIL",

"SPTL", "TBT", "TMF", "TMV", "TBF", "VGSH", "VGIT",

"VGLT", "SCHO", "SCHR", "SPTS", "GOVT"]

# Add Equity ------------------------------------------------

for i in range(len(self.assets)):

self.add_equity(self.assets[i], Resolution.MINUTE)

# Initialize the timer to train the Machine Learning model

self._time = datetime.min

# Set Scheduled Event Method For Our Model

self.schedule.on(self.date_rules.every_day(), self.time_rules.before_market_close("SHY", 5), self.every_day_before_market_close)

We'll also need to create a function to train and update our model from time to time.

def build_model(self) -> None:

# Initialize the Random Forest Regressor

self.regressor = RandomForestRegressor(n_estimators=100, min_samples_split=5, random_state = 1990)

# Get historical data

history = self.history(self.securities.keys(), 360, Resolution.DAILY)

# Select the close column and then call the unstack method.

df = history['close'].unstack(level=0)

# Feature engineer the data for input.

input_ = df.diff() * 0.5 + df * 0.5

input_ = input_.iloc[1:].ffill().fillna(0)

# Shift the data for 1-step backward as training output result.

output = df.shift(-1).iloc[:-1].ffill().fillna(0)

# Fit the regressor

self.regressor.fit(input_, output)

Now we export our model into the scheduled event method. We will switch qb with self and replace methods with their QCAlgorithm counterparts as needed. In this example, this is not an issue because all the methods we used in research also exist in QCAlgorithm.

def every_day_before_market_close(self) -> None:

# Retrain the regressor every month

if self._time < self.time:

self.BuildModel()

self._time = Expiry.end_of_month(self.time)

qb = self

# Fetch history on our universe

df = qb.history(qb.securities.keys(), 2, Resolution.DAILY)

if df.empty: return

# Make all of them into a single time index.

df = df.close.unstack(level=0)

# Feature engineer the data for input

input_ = df.diff() * 0.5 + df * 0.5

input_ = input_.iloc[-1].fillna(0).values.reshape(1, -1)

# Predict the expected price

predictions = self.regressor.predict(input_)

# Get the expected return

predictions = (predictions - df.iloc[-1].values) / df.iloc[-1].values

predictions = predictions.flatten()

# ==============================

insights = []

for i in range(len(predictions)):

insights.append( Insight.price(self.assets[i], timedelta(days=1), InsightDirection.UP, predictions[i]) )

self.emit_insights(insights)

Examples

The below code snippets concludes the above jupyter research notebook content.

from sklearn.ensemble import RandomForestRegressor

# Instantiate a QuantBook.

qb = QuantBook()

# Select the desired tickers for research.

assets = ["SHY", "TLT", "SHV", "TLH", "EDV", "BIL",

"SPTL", "TBT", "TMF", "TMV", "TBF", "VGSH", "VGIT",

"VGLT", "SCHO", "SCHR", "SPTS", "GOVT"]

# Call the AddEquity method with the tickers, and its corresponding resolution. Resolution.MINUTE is used by default.

for i in range(len(assets)):

qb.add_equity(assets[i],Resolution.MINUTE).symbol

# Call the History method with qb.securities.keys for all tickers, time argument(s), and resolution to request historical data for the symbol.

history = qb.history(qb.securities.Keys, datetime(2019, 1, 1), datetime(2021, 12, 31), Resolution.DAILY)

# Select the close column and then call the unstack method.

df = history['close'].unstack(level=0)

# Feature engineer the data for input.

input_ = df.diff() * 0.5 + df * 0.5

input_ = input_.iloc[1:]

# Shift the data for 1-step backward as training output result.

output = df.shift(-1).iloc[:-1]

# Split the data into training and testing sets.

splitter = int(input_.shape[0] * 0.8)

X_train = input_.iloc[:splitter]

X_test = input_.iloc[splitter:]

y_train = output.iloc[:splitter]

y_test = output.iloc[splitter:]

# Initialize a Random Forest Regressor

regressor = RandomForestRegressor(n_estimators=100, min_samples_split=5, random_state = 1990)

# Fit the regressor

regressor.fit(X_train, y_train)

# Predict the testing set

predictions = regressor.predict(X_test)

# Convert result into DataFrame

predictions = pd.DataFrame(predictions, index=y_test.index, columns=y_test.columns)

# Plot the result for comparison

for col in y_test.columns:

plt.figure(figsize=(15, 10))

y_test[col].plot(label="Actual")

predictions[col].plot(label="Prediction")

plt.title(f"{col} Regression Result")

plt.legend()

plt.show()

plt.clf()

The below code snippets concludes the algorithm set up.

from sklearn.ensemble import RandomForestRegressor

class RandomForestRegressionDemo(QCAlgorithm):

def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

self.set_cash(1000000)

self.set_benchmark("SPY")

self.set_portfolio_construction(MeanVarianceOptimizationPortfolioConstructionModel(Resolution.DAILY, PortfolioBias.LONG,

period=5))

self.set_execution(ImmediateExecutionModel())

self.assets = ["SHY", "TLT", "IEI", "SHV", "TLH", "EDV", "BIL",

"SPTL", "TBT", "TMF", "TMV", "TBF", "VGSH", "VGIT",

"VGLT", "SCHO", "SCHR", "SPTS", "GOVT"]

# Add Equity ------------------------------------------------

for i in range(len(self.assets)):

self.add_equity(self.assets[i], Resolution.MINUTE).symbol

# Initialize the timer to train the Machine Learning model

self.last_time = datetime.min

# Set Scheduled Event Method For Our Model

self.schedule.on(self.date_rules.every_day(), self.time_rules.before_market_close("SHY", 5), self.every_day_before_market_close)

def build_model(self) -> None:

# Initialize the Random Forest Regressor

self.regressor = RandomForestRegressor(n_estimators=100, min_samples_split=5, random_state = 1990)

# Get historical data

history = self.history(self.securities.Keys, 360, Resolution.DAILY)

# Select the close column and then call the unstack method.

df = history['close'].unstack(level=0)

# Feature engineer the data for input.

input_ = df.diff() * 0.5 + df * 0.5

input_ = input_.iloc[1:].ffill().fillna(0)

# Shift the data for 1-step backward as training output result.

output = df.shift(-1).iloc[:-1].ffill().fillna(0)

# Fit the regressor

self.regressor.fit(input_, output)

def every_day_before_market_close(self) -> None:

# Retrain the regressor every week

if self.last_time < self.time:

self.build_model()

self.last_time = Expiry.end_of_week(self.last_time)

qb = self

# Fetch history on our universe

df = qb.history(qb.securities.Keys, 2, Resolution.DAILY)

if df.empty: return

# Make all of them into a single time index.

df = df.close.unstack(level=0)

# Feature engineer the data for input

input_ = df.diff() * 0.5 + df * 0.5

input_ = input_.iloc[-1].fillna(0).values.reshape(1, -1)

# Predict the expected price

predictions = self.regressor.predict(input_)

# Get the expected return

predictions = (predictions - df.iloc[-1].values) / df.iloc[-1].values

predictions = predictions.flatten()

# ==============================

insights = []

for i in range(len(predictions)):

insights.append( Insight.price(self.assets[i], timedelta(days=1), InsightDirection.UP, predictions[i]) )

self.emit_insights(insights)