Indicators

Custom Resolutions

Create Subscriptions

You need to subscribe to some market data in order to calculate indicator values.

var qb = new QuantBook();

var symbol = qb.AddEquity("SPY").Symbol; qb = QuantBook()

symbol = qb.add_equity("SPY").symbol

Create Indicator Timeseries

You need to subscribe to some market data and create an indicator in order to calculate a timeseries of indicator values.

Follow these steps to create an indicator timeseries:

- Get some historical data.

- Create a data-point indicator.

- Create a

RollingWindowfor each attribute of the indicator to hold their values. - Attach a handler method to the indicator that updates the

RollingWindowobjects. - Create a

TradeBarConsolidatorto consolidate data into the custom resolution. - Attach a handler method to feed data into the consolidator and updates the indicator with the consolidated bars.

- Iterate through the historical market data and update the indicator.

- Display the data.

- Populate a

DataFramewith the data in theRollingWindowobjects.

// Request historical trading data with the daily resolution. var history = qb.History(symbol, 70, Resolution.Daily);

# Request historical trading data with the daily resolution. history = qb.history[TradeBar](symbol, 70, Resolution.DAILY)

In this example, use a 20-period 2-standard-deviation BollingerBands indicator.

var bb = new BollingerBands(20, 2);

bb = BollingerBands(20, 2)

// Create a window dictionary to store RollingWindow objects. var window = new Dictionary<string, RollingWindow<decimal>>(); // Store the RollingWindow objects, index by key is the property of the indicator. var time = new RollingWindow<DateTime>(50); window["bollingerbands"] = new RollingWindow<decimal>(50); window["lowerband"] = new RollingWindow<decimal>(50); window["middleband"] = new RollingWindow<decimal>(50); window["upperband"] = new RollingWindow<decimal>(50); window["bandwidth"] = new RollingWindow<decimal>(50); window["percentb"] = new RollingWindow<decimal>(50); window["standarddeviation"] = new RollingWindow<decimal>(50); window["price"] = new RollingWindow<decimal>(50);

# Create a window dictionary to store RollingWindow objects.

window = {}

# Store the RollingWindow objects, index by key is the property of the indicator.

window['time'] = RollingWindow(50)

window["bollingerbands"] = RollingWindow(50)

window["lowerband"] = RollingWindow(50)

window["middleband"] = RollingWindow(50)

window["upperband"] = RollingWindow(50)

window["bandwidth"] = RollingWindow(50)

window["percentb"] = RollingWindow(50)

window["standarddeviation"] = RollingWindow(50)

window["price"] = RollingWindow(50)

// Define an update function to add the indicator values to the RollingWindow object.

bb.Updated += (sender, updated) =>

{

var indicator = (BollingerBands)sender;

time.Add(updated.EndTime);

window["bollingerbands"].Add(updated);

window["lowerband"].Add(indicator.LowerBand);

window["middleband"].Add(indicator.MiddleBand);

window["upperband"].Add(indicator.UpperBand);

window["bandwidth"].Add(indicator.BandWidth);

window["percentb"].Add(indicator.PercentB);

window["standarddeviation"].Add(indicator.StandardDeviation);

window["price"].Add(indicator.Price);

}; # Define an update function to add the indicator values to the RollingWindow object.

def update_bollinger_band_window(sender: object, updated: IndicatorDataPoint) -> None:

indicator = sender

window['time'].add(updated.end_time)

window["bollingerbands"].add(updated.value)

window["lowerband"].add(indicator.lower_band.current.value)

window["middleband"].add(indicator.middle_band.current.value)

window["upperband"].add(indicator.upper_band.current.value)

window["bandwidth"].add(indicator.band_width.current.value)

window["percentb"].add(indicator.percent_b.current.value)

window["standarddeviation"].add(indicator.standard_deviation.current.value)

window["price"].add(indicator.price.current.value)

bb.updated += update_bollinger_band_window

When the indicator receives new data, the preceding handler method adds the new IndicatorDataPoint values into the respective RollingWindow.

var consolidator = new TradeBarConsolidator(TimeSpan.FromDays(7));

consolidator = TradeBarConsolidator(timedelta(days=7))

consolidator.DataConsolidated += (sender, consolidated) =>

{

bb.Update(consolidated.EndTime, consolidated.Close);

};

def on_data_consolidated(sender, consolidated):

bb.update(consolidated.end_time, consolidated.close)

consolidator.data_consolidated += on_data_consolidated

When the consolidator receives 7 days of data, the handler generates a 7-day TradeBar and update the indicator.

foreach(var bar in history)

{

consolidator.Update(bar);

} for bar in history:

consolidator.update(bar)

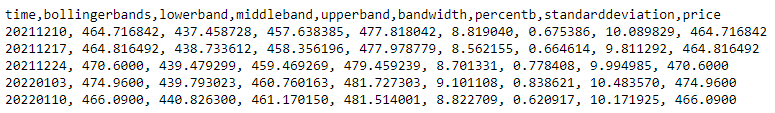

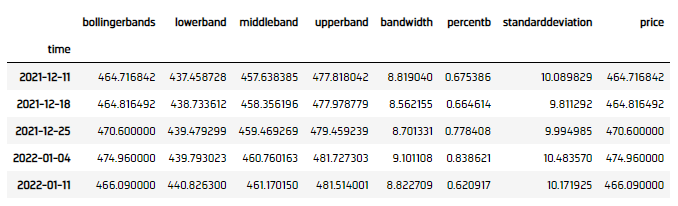

Console.WriteLine($"time,{string.Join(',', window.Select(kvp => kvp.Key))}");

foreach (var i in Enumerable.Range(0, 5).Reverse())

{

var data = string.Join(", ", window.Select(kvp => Math.Round(kvp.Value[i],6)));

Console.WriteLine($"{time[i]:yyyyMMdd}, {data}");

}

bb_dataframe = pd.DataFrame(window).set_index('time')

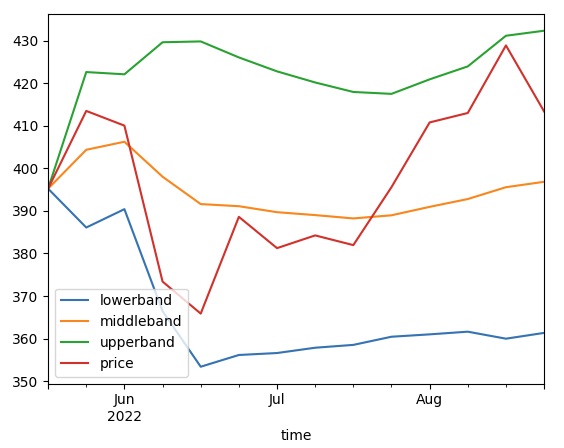

Plot Indicators

Jupyter Notebooks don't currently support libraries to plot historical data, but we are working on adding the functionality. Until the functionality is added, use Python to plot indicators.

Follow these steps to plot the indicator values:

- Select the columsn to plot.

- Call the

plotmethod. - Show the plot.

df = bb_dataframe[['lowerband', 'middleband', 'upperband', 'price']]

df.plot()

plt.show()

Examples

The following examples demonstrate some common practices for researching with data point indicators.

Example 1: Quick Backtest On Bollinger Band

The following example demonstrates a quick backtest to testify the effectiveness of a Bollinger Band mean-reversal, using 5-miunte bar under the research enviornment.

// Load the assembly files and data types in their own cell.

#load "../Initialize.csx"

// Load the necessary assembly files.

#load "../QuantConnect.csx"

#r "../Plotly.NET.dll"

#r "../Plotly.NET.Interactive.dll"

// Import the QuantConnect, Plotly.NET, and Accord packages for calculation and plotting.

using QuantConnect;

using QuantConnect.Indicators;

using QuantConnect.Research;

using Plotly.NET;

using Plotly.NET.Interactive;

using Plotly.NET.LayoutObjects;

// Instantiate the QuantBook instance for researching.

var qb = new QuantBook();

// Request SPY data to work with the indicator.

var symbol = qb.AddEquity("SPY").Symbol;

// Request historical trading data with the daily resolution.

var history = qb.History(symbol, 1000, Resolution.Minute).ToList();

// Create a window dictionary to store RollingWindow objects.

var window = new Dictionary<string, RollingWindow<decimal>>();

// Store the RollingWindow objects, index by key is the property of the indicator.

var time = new RollingWindow<DateTime>(50);

window["bollingerbands"] = new RollingWindow<decimal>(50);

window["lowerband"] = new RollingWindow<decimal>(50);

window["middleband"] = new RollingWindow<decimal>(50);

window["upperband"] = new RollingWindow<decimal>(50);

window["price"] = new RollingWindow<decimal>(50);

// Create the Bollinger Band indicator with parameters to be studied.

var bb = new BollingerBands(20, 2);

// Define an update function to add the indicator values to the RollingWindow object.

bb.Updated += (sender, updated) =>

{

var indicator = (BollingerBands)sender;

time.Add(updated.EndTime);

window["bollingerbands"].Add(updated);

window["lowerband"].Add(indicator.LowerBand);

window["middleband"].Add(indicator.MiddleBand);

window["upperband"].Add(indicator.UpperBand);

window["price"].Add(indicator.Price);

};

// Create a TradeBarConsolidator to consolidate data into the custom resolution.

var consolidator = new TradeBarConsolidator(TimeSpan.FromMinutes(5));

// Attach a handler method to feed data into the consolidator and updates the indicator with the consolidated bars.

consolidator.DataConsolidated += (sender, consolidated) =>

{

bb.Update(consolidated.EndTime, consolidated.Close);

};

// Iterate through the historical market data and update the indicator.

foreach(var bar in history)

{

consolidator.Update(bar);

}

// Obtain the cumulative return curve as a mini-backtest.

var equity = new List<decimal>() { 1m };

var time_ = new List<DateTime>() { history[0].EndTime };

var lowerBand = window["lowerband"].ToList();

var upperBand = window["upperband"].ToList();

for (int i = history.Count - 50; i < history.Count - 1; i++)

{

var bar = history[i];

var nextBar = history[i+1];

// Get 1-day forward return.

var pctChg = (nextBar.Close - bar.Close) / bar.Close;

// Buy if the asset is underprice (below the lower band), sell if overpriced (above the upper band)

var order = bar.Close < lowerBand[i - (history.Count - 50)] ? 1 : (bar.Close > upperBand[i - (history.Count - 50)] ? -1 : 0);

var equityChg = order * pctChg;

equity.Add((1m + equityChg) * equity[^1]);

time_.Add(nextBar.EndTime);

}

// Create line chart of the equity curve.

var chart = Chart2D.Chart.Line<DateTime, decimal, string>(

time_,

equity

);

// Create a Layout as the plot settings.

LinearAxis xAxis = new LinearAxis();

xAxis.SetValue("title", "Time");

LinearAxis yAxis = new LinearAxis();

yAxis.SetValue("title", "Equity");

Title title = Title.init($"Equity by Time of {symbol}");

Layout layout = new Layout();

layout.SetValue("xaxis", xAxis);

layout.SetValue("yaxis", yAxis);

layout.SetValue("title", title);

// Assign the Layout to the chart.

chart.WithLayout(layout);

// Display the plot.

HTML(GenericChart.toChartHTML(chart)) # Instantiate the QuantBook instance for researching.

qb = QuantBook()

# Request SPY data to work with the indicator.

symbol = qb.add_equity("SPY").symbol

# Request historical trading data with the minute resolution.

history = qb.history[TradeBar](symbol, 1000, Resolution.MINUTE)

# Create a window dictionary to store RollingWindow objects.

window = {}

# Store the RollingWindow objects, index by key is the property of the indicator.

window['time'] = RollingWindow(50)

window["bollingerbands"] = RollingWindow(50)

window["lowerband"] = RollingWindow(50)

window["middleband"] = RollingWindow(50)

window["upperband"] = RollingWindow(50)

window["price"] = RollingWindow(50)

# Define an update function to add the indicator values to the RollingWindow object.

def update_bollinger_band_window(sender: object, updated: IndicatorDataPoint) -> None:

indicator = sender

window['time'].add(updated.end_time)

window["bollingerbands"].add(updated.value)

window["lowerband"].add(indicator.lower_band.current.value)

window["middleband"].add(indicator.middle_band.current.value)

window["upperband"].add(indicator.upper_band.current.value)

window["price"].add(indicator.price.current.value)

# Create the Bollinger Band indicator with parameters to be studied.

bb = BollingerBands(20, 2)

bb.updated += update_bollinger_band_window

# Create a TradeBarConsolidator to consolidate data into the custom resolution.

consolidator = TradeBarConsolidator(timedelta(minutes=5))

# Attach a handler method to feed data into the consolidator and updates the indicator with the consolidated bars.

def on_data_consolidated(sender, consolidated):

bb.update(consolidated.end_time, consolidated.close)

consolidator.data_consolidated += on_data_consolidated

# Iterate through the historical market data and update the indicator.

for bar in history:

consolidator.update(bar)

# Populate a DataFrame with the data in the RollingWindow objects.

bb_dataframe = pd.DataFrame(window).set_index('time')

# Create a order record and return column.

# Buy if the asset is underprice (below the lower band), sell if overpriced (above the upper band)

bb_dataframe["position"] = bb_dataframe.apply(lambda x: 1 if x.price < x.lowerband else -1 if x.price > x.upperband else 0, axis=1)

# Get the 1-day forward return.

bb_dataframe["return"] = bb_dataframe["price"].pct_change().shift(-1).fillna(0)

bb_dataframe["return"] = bb_dataframe["position"] * bb_dataframe["return"]

# Obtain the cumulative return curve as a mini-backtest.

equity_curve = (bb_dataframe["return"] + 1).cumprod()

equity_curve.plot(title="Equity Curve on BBand Mean Reversal", ylabel="Equity", xlabel="time")