Applying Research

Uncorrelated Assets

Create Hypothesis

According to Modern Portfolio Thoery, asset combinations with negative or very low correlation could have lower total portfolio variance given the same level of return. Thus, uncorrelated assets allows you to find a portfolio that will, theoretically, be more diversified and resilient to extreme market events. We're testing this statement in real life scenario, while hypothesizing a portfolio with uncorrelated assets could be a consistent portfolio. In this example, we'll compare the performance of 5-least-correlated-asset portfolio (proposed) and 5-most-correlated-asset portfolio (benchmark), both equal weighting.

Import Libraries

Load the required assembly files and data types.

We'll need to import libraries to help with data processing and visualization. Import numpy and matplotlib libraries by the following:

#load "../Initialize.csx" #load "../QuantConnect.csx" using QuantConnect; using QuantConnect.Data; using QuantConnect.Data.Market; using QuantConnect.Algorithm; using QuantConnect.Research; using System; using System.Linq; using Accord.Statistics;

import numpy as np from matplotlib import pyplot as plt

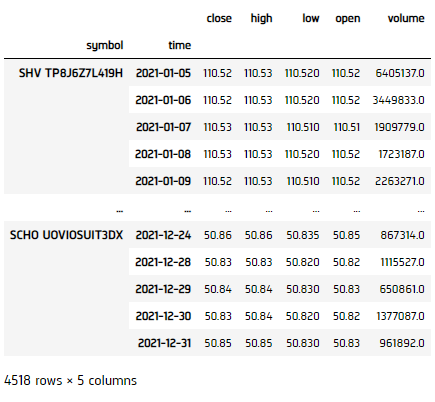

Get Historical Data

To begin, we retrieve historical data for researching.

- Instantiate a

QuantBook. - Select the desired tickers for research.

- Call the

AddEquityadd_equitymethod with the tickers, and their corresponding resolution. - Call the

Historyhistorymethod withqb.Securities.Keysqb.securities.keysfor all tickers, time argument(s), and resolution to request historical data for the symbol.

var qb = new QuantBook();

qb = QuantBook()

var assets = new List<string>() {"SHY", "TLT", "SHV", "TLH", "EDV", "BIL",

"SPTL", "TBT", "TMF", "TMV", "TBF", "VGSH", "VGIT",

"VGLT", "SCHO", "SCHR", "SPTS", "GOVT"}; assets = ["SHY", "TLT", "SHV", "TLH", "EDV", "BIL",

"SPTL", "TBT", "TMF", "TMV", "TBF", "VGSH", "VGIT",

"VGLT", "SCHO", "SCHR", "SPTS", "GOVT"]

foreach(var ticker in assets){

qb.AddEquity(ticker, Resolution.Minute);

} for i in range(len(assets)):

qb.add_equity(assets[i],Resolution.MINUTE)

If you do not pass a resolution argument, Resolution.MinuteResolution.MINUTE is used by default.

var history = qb.History(qb.Securities.Keys, new DateTime(2021, 1, 1), new DateTime(2021, 12, 31), Resolution.Daily);

history = qb.history(qb.securities.keys(), datetime(2021, 1, 1), datetime(2021, 12, 31), Resolution.DAILY)

Prepare Data

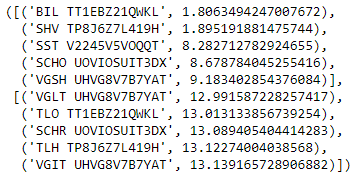

We'll have to process our data to get their correlation and select the least and most related ones.

- Extract daily return for each

SymbolfromSlicedata. - Select the close column and then call the

unstackmethod, then callpct_changeto compute the daily return. - Extract daily return for each

SymbolfromSlicedata. - Write a function to obtain the least and most correlated 5 assets.

var returns = new Dictionary<string, List<Double>>();

var last = new Dictionary<string, Double>();

foreach(var slice in history){

foreach(var symbol in slice.Bars.Keys){

if(!returns.ContainsKey(symbol)){

returns.Add(symbol, new List<Double>());

last.Add(symbol, (Double)slice.Bars[symbol].Close);

}

var change = (Double) ((Double)slice.Bars[symbol].Close - last[symbol])/last[symbol];

last[symbol] = (Double)slice.Bars[symbol].Close;

returns[symbol].Add(change);

}

} returns = history['close'].unstack(level=0).pct_change().iloc[1:]

double[,] ret = new double[returns.Values.ElementAt(0).Count - 1, assets.Count];

int k = 0;

foreach(var kvp in returns)

{

var symbol = kvp.Key;

for(int i=0; i < returns[symbol].Count - 1; i++)

{

ret[i, k] = returns[symbol][i + 1];

}

k++;

}

public Dictionary<string, Double> GetCorrelations(double[,] returns){

// Get correlation matrix

var corrMatrix = Measures.Correlation(ret);

// Find the absolute sum correlation of the assets

var correlations = new Dictionary<string, Double>();

for(int i=0; i < corrMatrix.GetLength(0); i++)

{

var symbol = assets[i];

if(!correlations.ContainsKey(symbol)){

correlations.Add(symbol, 0);

}

for (int j=0; j < corrMatrix.GetLength(1); j++)

{

var value_ = corrMatrix[i, j];

correlations[symbol] += value_ >= 0 ? value_ : -value_;

}

}

return correlations;

}

var corr = GetCorrelations(ret);

var selected = corr.OrderBy(x => x.Value).Take(5);

var benchmark = corr.OrderBy(x => x.Value).TakeLast(5); def get_uncorrelated_assets(returns, num_assets):

# Get correlation

correlation = returns.corr()

# Find assets with lowest and highest absolute sum correlation

selected = []

for index, row in correlation.iteritems():

corr_rank = row.abs().sum()

selected.append((index, corr_rank))

# Sort and take the top num_assets

sort_ = sorted(selected, key = lambda x: x[1])

uncorrelated = sort_[:num_assets]

correlated = sort_[-num_assets:]

return uncorrelated, correlated

selected, benchmark = get_uncorrelated_assets(returns, 5)

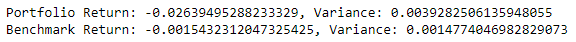

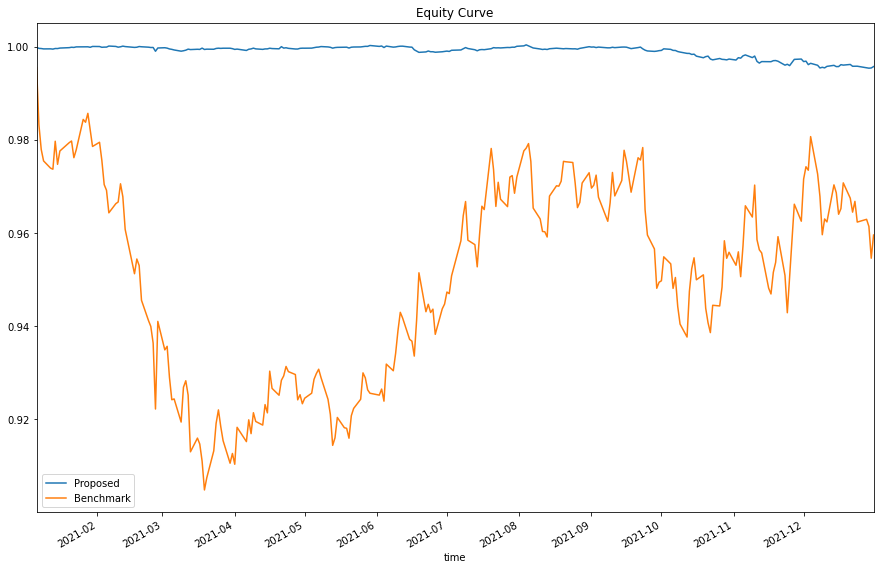

Test Hypothesis

To test the hypothesis: Our desired outcome would be a consistent and low fluctuation equity curve should be seen, as compared with benchmark.

- Construct a equal weighting portfolio for the 5-uncorrelated-asset-portfolio and the 5-correlated-asset-portfolio (benchmark).

- Get the Equity Return for both portfolios.

- Call

cumprodto get the cumulative return. - Calculate the variance of the 2 portfolios.

- Print the result.

- Plot the result.

double[,] portRet = new double[returns.Values.ElementAt(0).Count, 5];

int j = 0;

foreach(var kvp in selected){

var symbol = kvp.Key;

for(int i=0; i < returns[symbol].Count; i++)

{

portRet[i, j] = returns[symbol][i] / 5;

}

j++;

}

double[,] benchRet = new double[returns.Values.ElementAt(0).Count, 5];

j = 0;

foreach(var kvp in benchmark){

var symbol = kvp.Key;

for(int i=0; i < returns[symbol].Count; i++)

{

benchRet[i, j] = returns[symbol][i] / 5;

}

j++;

} port_ret = returns[[x[0] for x in selected]] / 5 bench_ret = returns[[x[0] for x in benchmark]] / 5

var totalValue = new List<double>{1.0};

var dailySum = 0.0;

for(int i=0; i < portRet.GetLength(0); i++)

{

totalValue.Add(totalValue.Last() * (1 + dailySum));

dailySum = 0.0;

for (int j=0; j < portRet.GetLength(1); j++)

{

if (double.IsFinite(portRet[i, j]))

{

dailySum += portRet[i, j];

}

}

}

var totalValueBench = new List<double>{1.0};

var dailySumBench = 0.0;

for(int i=0; i < benchRet.GetLength(0); i++)

{

totalValueBench.Add(totalValueBench.Last() * (1 + dailySumBench));

dailySumBench = 0.0;

for (int j=0; j < benchRet.GetLength(1); j++)

{

if (double.IsFinite(benchRet[i, j]))

{

dailySumBench += benchRet[i, j];

}

}

} total_ret = (np.sum(port_ret, axis=1) + 1).cumprod() total_ret_bench = (np.sum(bench_ret, axis=1) + 1).cumprod()

var returnPort = new List<double>();

previous = 0.0;

for(int i=0; i < totalValue.Count; i++)

{

var current = totalValue[i];

returnPort.Add((current - previous) / previous);

previous = current;

}

var varPort = Math.Sqrt(returnPort.Skip(1).Average(v=>Math.Pow(v-returnPort.Skip(1).Average(),2)));

var returnBench = new List<double>();

previous = 0.0;

for(int i=0; i < totalValueBench.Count; i++)

{

var current = totalValueBench[i];

returnBench.Add((current - previous) / previous);

previous = current;

}

var varBench = Math.Sqrt(returnBench.Skip(1).Average(v=>Math.Pow(v-returnBench.Skip(1).Average(),2)));

Console.WriteLine("Portfolio Return: {0}, Variance: {1}", (totalValue.Last() - totalValue.First())/totalValue.First(), varPort);

Console.WriteLine("Benchmark Return: {0}, Variance: {1}", (totalValueBench.Last() - totalValueBench.First())/totalValueBench.First(), varBench); plt.figure(figsize=(15, 10))

total_ret.plot(label='Proposed')

total_ret_bench.plot(label='Benchmark')

plt.title('Equity Curve')

plt.legend()

plt.show()

We can clearly see from the results, the proposed uncorrelated-asset-portfolio has a lower variance/fluctuation, thus more consistent than the benchmark. This proven our hypothesis.

Set Up Algorithm

Once we are confident in our hypothesis, we can export this code into backtesting. One way to accomodate this model into research is to create a scheduled event which uses our model to pick stocks and goes long.

private List<string> _asset = new List<string>{"SHY", "TLT", "IEI", "SHV", "TLH", "EDV", "BIL",

"SPTL", "TBT", "TMF", "TMV", "TBF", "VGSH", "VGIT",

"VGLT", "SCHO", "SCHR", "SPTS", "GOVT"};

public override void Initialize()

{

// 1. Required: Five years of backtest history

SetStartDate(2014, 1, 1);

// 2. Required: Alpha Streams Models:

SetBrokerageModel(BrokerageName.AlphaStreams);

// 3. Required: Significant AUM Capacity

SetCash(1000000);

// 4. Required: Benchmark to SPY

SetBenchmark("SPY");

SetPortfolioConstruction(new EqualWeightingPortfolioConstructionModel());

SetExecution(new ImmediateExecutionModel());

// Add Equity ------------------------------------------------

foreach(var ticker in _asset)

{

AddEquity(ticker, Resolution.Minute);

}

// Set Scheduled Event Method For Our Model. In this example, we'll rebalance every month.

Schedule.On(DateRules.MonthStart(),

TimeRules.BeforeMarketClose("SHY", 5),

EveryDayBeforeMarketClose);

} def initialize(self) -> None:

#1. Required: Five years of backtest history

self.set_start_date(2014, 1, 1)

#2. Required: Alpha Streams Models:

self.set_brokerage_model(BrokerageName.ALPHA_STREAMS)

#3. Required: Significant AUM Capacity

self.set_cash(1000000)

#4. Required: Benchmark to SPY

self.set_benchmark("SPY")

self.set_portfolio_construction(EqualWeightingPortfolioConstructionModel())

self.set_execution(ImmediateExecutionModel())

self.assets = ["SHY", "TLT", "IEI", "SHV", "TLH", "EDV", "BIL",

"SPTL", "TBT", "TMF", "TMV", "TBF", "VGSH", "VGIT",

"VGLT", "SCHO", "SCHR", "SPTS", "GOVT"]

# Add Equity ------------------------------------------------

for i in range(len(self.assets)):

self.add_equity(self.assets[i], Resolution.MINUTE)

# Set Scheduled Event Method For Our Model. In this example, we'll rebalance every month.

self.schedule.on(self.date_rules.month_start(),

self.time_rules.before_market_close("SHY", 5),

self.every_day_before_market_close)

Now we export our model into the scheduled event method. We will remove qb and replace methods with their QCAlgorithm counterparts as needed. In this example, this is not an issue because all the methods we used in research also exist in QCAlgorithm.

Now we export our model into the scheduled event method. We will switch qb with self and replace methods with their QCAlgorithm counterparts as needed. In this example, this is not an issue because all the methods we used in research also exist in QCAlgorithm.

private void EveryDayBeforeMarketClose()

{

// Fetch history on our universe

var history = History(Securities.Keys, 252*2, Resolution.Daily);

if (history.Count() < 0) return;

// Extract daily return of close prices for each Symbol from Slice data

var returns = new Dictionary<string, List<Double>>();

var last = new Dictionary<string, Double>();

foreach(var slice in history){

foreach(var symbol in slice.Bars.Keys){

if(!returns.ContainsKey(symbol)){

returns.Add(symbol, new List<Double>());

last.Add(symbol, (Double)slice.Bars[symbol].Close);

}

var change = (Double) ((Double)slice.Bars[symbol].Close - last[symbol])/last[symbol];

last[symbol] = (Double)slice.Bars[symbol].Close;

returns[symbol].Add(change);

}

}

// Convert returns into 2-d array

double[,] ret = new double[returns.Values.ElementAt(0).Count - 1, _asset.Count];

int k = 0;

foreach(var kvp in returns)

{

var symbol = kvp.Key;

for(int i=0; i < returns[symbol].Count - 1; i++)

{

ret[i, k] = returns[symbol][i + 1];

}

k++;

}

// Get correlation matrix

var corrMatrix = Measures.Correlation(ret);

// Find 5 assets with the least absolute sum correlation

var correlations = new Dictionary<string, Double>();

for(int i=0; i < corrMatrix.GetLength(0); i++)

{

var symbol = _asset[i];

if(!correlations.ContainsKey(symbol)){

correlations.Add(symbol, 0);

}

for (int j=0; j < corrMatrix.GetLength(1); j++)

{

var value_ = corrMatrix[i, j];

correlations[symbol] += value_ >= 0 ? value_ : -value_;

}

}

var selected = correlations.OrderBy(x => x.Value).Take(5).Select(x => x.Key).ToList();

// Emit insights

foreach(var symbol in selected)

{

var insight = new Insight(symbol, Expiry.EndOfMonth, InsightType.Price, InsightDirection.Up);

EmitInsights(insight);

}

} def every_day_before_market_close(self) -> None:

qb = self

# Fetch history on our universe

history = qb.history(qb.securities.keys(), 252*2, Resolution.DAILY)

if history.empty:

return

# Select the close column and then call the unstack method, then call pct_change to compute the daily return.

returns = history['close'].unstack(level=0).pct_change().iloc[1:]

# Get correlation

correlation = returns.corr()

# Find 5 assets with lowest absolute sum correlation

selected = []

for index, row in correlation.iteritems():

corr_rank = row.abs().sum()

selected.append((index, corr_rank))

sort_ = sorted(selected, key = lambda x: x[1])

selected = [x[0] for x in sort_[:5]]

# ==============================

insights = []

for symbol in selected:

insights.append( Insight.price(symbol, Expiry.END_OF_MONTH, InsightDirection.UP) )

self.emit_insights(insights)

Examples

The below code snippets concludes the above jupyter research notebook content.

// Load the required assembly files and data types.

#load "../Initialize.csx"

#load "../QuantConnect.csx"

using QuantConnect;

using QuantConnect.Data;

using QuantConnect.Data.Market;

using QuantConnect.Algorithm;

using QuantConnect.Research;

using System;

using System.Linq;

using Accord.Statistics;

// Instantiate a QuantBook

var qb = new QuantBook();

// Select the desired tickers for research.

var assets = new List<string>() {"SHY", "TLT", "SHV", "TLH", "EDV", "BIL",

"SPTL", "TBT", "TMF", "TMV", "TBF", "VGSH", "VGIT",

"VGLT", "SCHO", "SCHR", "SPTS", "GOVT"};

// Call the AddEquity method with the tickers, and their corresponding resolution.

foreach(var ticker in assets){

qb.AddEquity(ticker, Resolution.Minute);

}

// Call the History method with qb.Securities.Keys for all tickers, time argument(s), and resolution to request historical data for the symbol.

var history = qb.History(qb.Securities.Keys, new DateTime(2021, 1, 1), new DateTime(2021, 12, 31), Resolution.Daily);

// Extract daily return for each Symbol from Slice data

var returns = new Dictionary<string, List<Double>>();

var last = new Dictionary<string, Double>();

foreach(var slice in history){

foreach(var symbol in slice.Bars.Keys){

if(!returns.ContainsKey(symbol)){

returns.Add(symbol, new List<Double>());

last.Add(symbol, (Double)slice.Bars[symbol].Close);

}

var change = (Double) ((Double)slice.Bars[symbol].Close - last[symbol])/last[symbol];

last[symbol] = (Double)slice.Bars[symbol].Close;

returns[symbol].Add(change);

}

}

// Convert returns into 2-d array

double[,] ret = new double[returns.Values.ElementAt(0).Count - 1, assets.Count];

int k = 0;

foreach(var kvp in returns)

{

var symbol = kvp.Key;

for(int i=0; i < returns[symbol].Count - 1; i++)

{

ret[i, k] = returns[symbol][i + 1];

}

k++;

}

// Write a function to obtain the least and most correlated 5 assets.

public Dictionary<string, Double> GetCorrelations(double[,] returns){

// Get correlation matrix

var corrMatrix = Measures.Correlation(ret);

// Find the absolute sum correlation of the assets

var correlations = new Dictionary<string, Double>();

for(int i=0; i < corrMatrix.GetLength(0); i++)

{

var symbol = assets[i];

if(!correlations.ContainsKey(symbol)){

correlations.Add(symbol, 0);

}

for (int j=0; j < corrMatrix.GetLength(1); j++)

{

var value_ = corrMatrix[i, j];

correlations[symbol] += value_ >= 0 ? value_ : -value_;

}

}

return correlations;

}

var corr = GetCorrelations(ret);

var selected = corr.OrderBy(x => x.Value).Take(5);

var benchmark = corr.OrderBy(x => x.Value).TakeLast(5);

// Construct an equal weighting portfolio for the 5-uncorrelated-asset-portfolio and the 5-correlated-asset-portfolio (benchmark).

double[,] portRet = new double[returns.Values.ElementAt(0).Count, 5];

int j = 0;

foreach(var kvp in selected){

var symbol = kvp.Key;

for(int i=0; i < returns[symbol].Count; i++)

{

portRet[i, j] = returns[symbol][i] / 5;

}

j++;

}

double[,] benchRet = new double[returns.Values.ElementAt(0).Count, 5];

j = 0;

foreach(var kvp in benchmark){

var symbol = kvp.Key;

for(int i=0; i < returns[symbol].Count; i++)

{

benchRet[i, j] = returns[symbol][i] / 5;

}

j++;

}

// Get the Equity Return of both portfolios.

var totalValue = new List<double>{1.0};

var dailySum = 0.0;

for(int i=0; i < portRet.GetLength(0); i++)

{

totalValue.Add(totalValue.Last() * (1 + dailySum));

dailySum = 0.0;

for (int j=0; j < portRet.GetLength(1); j++)

{

if (double.IsFinite(portRet[i, j]))

{

dailySum += portRet[i, j];

}

}

}

var totalValueBench = new List<double>{1.0};

var dailySumBench = 0.0;

for(int i=0; i < benchRet.GetLength(0); i++)

{

totalValueBench.Add(totalValueBench.Last() * (1 + dailySumBench));

dailySumBench = 0.0;

for (int j=0; j < benchRet.GetLength(1); j++)

{

if (double.IsFinite(benchRet[i, j]))

{

dailySumBench += benchRet[i, j];

}

}

}

// Calculate the variance of the 2 portfolios

var returnPort = new List<double>();

var previous = 0.0;

for(int i=0; i < totalValue.Count; i++)

{

var current = totalValue[i];

returnPort.Add((current - previous) / previous);

previous = current;

}

var varPort = Math.Sqrt(returnPort.Skip(1).Average(v=>Math.Pow(v-returnPort.Skip(1).Average(),2)));

var returnBench = new List<double>();

previous = 0.0;

for(int i=0; i < totalValueBench.Count; i++)

{

var current = totalValueBench[i];

returnBench.Add((current - previous) / previous);

previous = current;

}

var varBench = Math.Sqrt(returnBench.Skip(1).Average(v => Math.Pow(v-returnBench.Skip(1).Average(),2)));

// Print the result.

Console.WriteLine("Portfolio Return: {0}, Variance: {1}", (totalValue.Last() - totalValue.First())/totalValue.First(), varPort);

Console.WriteLine("Benchmark Return: {0}, Variance: {1}", (totalValueBench.Last() - totalValueBench.First())/totalValueBench.First(), varBench); # Instantiate a QuantBook.

qb = QuantBook()

# Select the desired tickers for research.

assets = ["SHY", "TLT", "SHV", "TLH", "EDV", "BIL",

"SPTL", "TBT", "TMF", "TMV", "TBF", "VGSH", "VGIT",

"VGLT", "SCHO", "SCHR", "SPTS", "GOVT"]

# Call the add_equity method with the tickers, and its corresponding resolution. Then store their Symbols. Resolution.MINUTE is used by default.

for i in range(len(assets)):

qb.add_equity(assets[i],Resolution.MINUTE)

# Call the history method with qb.securities.keys for all tickers, time argument(s), and resolution to request historical data for the symbol.

history = qb.history(qb.securities.keys(), datetime(2021, 1, 1), datetime(2021, 12, 31), Resolution.DAILY)

# Select the close column and then call the unstack method, then call pct_change to compute the daily return.

returns = history['close'].unstack(level=0).pct_change().iloc[1:]

# Write a function to obtain the least and most correlated 5 assets.

def get_uncorrelated_assets(returns, num_assets):

# Get correlation

correlation = returns.corr()

# Find assets with lowest and highest absolute sum correlation

selected = []

for index, row in correlation.iteritems():

corr_rank = row.abs().sum()

selected.append((index, corr_rank))

# Sort and take the top num_assets

sort_ = sorted(selected, key = lambda x: x[1])

uncorrelated = sort_[:num_assets]

correlated = sort_[-num_assets:]

return uncorrelated, correlated

selected, benchmark = get_uncorrelated_assets(returns, 5)

# Construct a equal weighting portfolio for the 5-uncorrelated-asset-portfolio and the 5-correlated-asset-portfolio (benchmark).

port_ret = returns[[x[0] for x in selected]] / 5

bench_ret = returns[[x[0] for x in benchmark]] / 5

# Call cumprod to get the cumulative return.

total_ret = (np.sum(port_ret, axis=1) + 1).cumprod()

total_ret_bench = (np.sum(bench_ret, axis=1) + 1).cumprod()

# Plot the result.

plt.figure(figsize=(15, 10))

total_ret.plot(label='Proposed')

total_ret_bench.plot(label='Benchmark')

plt.title('Equity Curve')

plt.legend()

plt.show()

The below code snippets concludes the algorithm set up.

using Accord.Statistics;

public class UncorrelatedAssetsDemo : QCAlgorithm

{

private List<string> _asset = new List<string>{"SHY", "TLT", "IEI", "SHV", "TLH", "EDV", "BIL",

"SPTL", "TBT", "TMF", "TMV", "TBF", "VGSH", "VGIT",

"VGLT", "SCHO", "SCHR", "SPTS", "GOVT"};

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

SetCash(1000000);

SetBenchmark("SPY");

SetPortfolioConstruction(new EqualWeightingPortfolioConstructionModel());

SetExecution(new ImmediateExecutionModel());

// Add Equity ------------------------------------------------

foreach(var ticker in _asset)

{

AddEquity(ticker, Resolution.Minute);

}

// Set Scheduled Event Method For Our Model. In this example, we'll rebalance every month.

Schedule.On(DateRules.MonthStart(),

TimeRules.BeforeMarketClose("SHY", 5),

EveryDayBeforeMarketClose);

}

private void EveryDayBeforeMarketClose()

{

// Fetch history on our universe

var history = History(Securities.Keys, 252*2, Resolution.Daily);

if (history.Count() < 0) return;

// Extract daily return of close prices for each Symbol from Slice data

var returns = new Dictionary<string, List<double>>();

var last = new Dictionary<string, double>();

foreach(var slice in history){

foreach(var symbol in slice.Bars.Keys){

if(!returns.ContainsKey(symbol)){

returns.Add(symbol, new List<double>());

last.Add(symbol, (double)slice.Bars[symbol].Close);

}

var change = (double) ((double)slice.Bars[symbol].Close - last[symbol])/last[symbol];

last[symbol] = (double)slice.Bars[symbol].Close;

returns[symbol].Add(change);

}

}

// Convert returns into 2-d array

double[,] ret = new double[returns.Values.ElementAt(0).Count - 1, _asset.Count];

int k = 0;

foreach(var kvp in returns)

{

var symbol = kvp.Key;

for(int i=0; i < returns[symbol].Count - 1; i++)

{

ret[i, k] = returns[symbol][i + 1];

}

k++;

}

// Get correlation matrix

var corrMatrix = Measures.Correlation(ret);

// Find 5 assets with the least absolute sum correlation

var correlations = new Dictionary<string, double>();

for(int i=0; i < corrMatrix.GetLength(0); i++)

{

var symbol = _asset[i];

if(!correlations.ContainsKey(symbol)){

correlations.Add(symbol, 0);

}

for (int j=0; j < corrMatrix.GetLength(1); j++)

{

var value_ = corrMatrix[i, j];

correlations[symbol] += value_ >= 0 ? value_ : -value_;

}

}

var selected = correlations.OrderBy(x => x.Value).Take(5).Select(x => x.Key).ToList();

// Emit insights

foreach(var symbol in selected)

{

var insight = new Insight(symbol, Expiry.EndOfMonth, InsightType.Price, InsightDirection.Up);

EmitInsights(insight);

}

}

} class UncorrelatedAssetsDemo(QCAlgorithm):

def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

self.set_cash(1000000)

self.set_benchmark("SPY")

self.set_portfolio_construction(EqualWeightingPortfolioConstructionModel())

self.set_execution(ImmediateExecutionModel())

self.assets = ["SHY", "TLT", "IEI", "SHV", "TLH", "EDV", "BIL",

"SPTL", "TBT", "TMF", "TMV", "TBF", "VGSH", "VGIT",

"VGLT", "SCHO", "SCHR", "SPTS", "GOVT"]

# Add Equity ------------------------------------------------

for i in range(len(self.assets)):

self.add_equity(self.assets[i], Resolution.MINUTE).symbol

# Set Scheduled Event Method For Our Model. In this example, we'll rebalance every month.

self.schedule.on(self.date_rules.month_start(),

self.time_rules.before_market_close("SHY", 5),

self.every_day_before_market_close)

def every_day_before_market_close(self) -> None:

qb = self

# Fetch history on our universe

history = qb.history(qb.securities.Keys, 252*2, Resolution.DAILY)

if history.empty: return

# Select the close column and then call the unstack method, then call pct_change to compute the daily return.

returns = history['close'].unstack(level=0).pct_change().iloc[1:]

# Get correlation

correlation = returns.corr()

# Find 5 assets with lowest absolute sum correlation

selected = []

for index, row in correlation.iterrows():

corr_rank = row.abs().sum()

selected.append((index, corr_rank))

sort_ = sorted(selected, key = lambda x: x[1])

selected = [x[0] for x in sort_[:5]]

# ==============================

insights = []

for symbol in selected:

insights.append( Insight.price(symbol, Expiry.END_OF_MONTH, InsightDirection.UP) )

self.emit_insights(insights)