Execution

Supported Models

Introduction

This page describes the pre-built Execution models in LEAN. The number of models grows over time. To add a model to LEAN, make a pull request to the GitHub repository. If none of these models perform exactly how you want, create a custom Execution model.

Null Model

The NullExecutionModel doesn't place any trades.

// Set the execution model to NullExecutionModel, which disables execution functionality for debugging or when the execution logic is not needed for the current strategy. SetExecution(new NullExecutionModel());

# Set the execution model to NullExecutionModel, which disables execution functionality for debugging or when the execution logic is not needed for the current strategy. self.set_execution(NullExecutionModel())

For more information about this model, see the class reference and implementation.

For more information about this model, see the class reference and implementation.

Immediate Model

The ImmediateExecutionModel is the default Execution model. It uses market orders to immediately fill portfolio targets. It's similar to placing market orders in line with your algorithm logic.

// Use ImmediateExecutionModel for executing trades instantly at market price to minimize execution delay. This may incur extra slippage. SetExecution(new ImmediateExecutionModel());

# Use ImmediateExecutionModel for executing trades instantly at market price to minimize execution delay. This may incur extra slippage. self.set_execution(ImmediateExecutionModel())

For more information about this model, see the class reference and implementation.

For more information about this model, see the class reference and implementation.

Spread Model

The SpreadExecutionModel executes trades with market orders if the exchange is open and the bid-ask spread is within a threshold percentage. The model only works if the security subscription provides QuoteBar data. The spread percentage is calculated as

where $a$ is the ask price, $b$ is the bid price, and $p$ is the price.

// Use SpreadExecutionModel to manage trade execution based on bid-ask spreads, aiming to optimize trade execution costs and reduce slippage. SetExecution(new SpreadExecutionModel());

# Use SpreadExecutionModel to manage trade execution based on bid-ask spreads, aiming to optimize trade execution costs and reduce slippage. self.set_execution(SpreadExecutionModel())

The following table describes the arguments the model accepts:

| Argument | Data Type | Description | Default Value |

|---|---|---|---|

acceptingSpreadPercentaccepting_spread_percent | decimalfloat | Maximum spread accepted comparing to current price in percentage | 0.005 (0.5%) |

For more information about this model, see the class reference and implementation.

For more information about this model, see the class reference and implementation.

Standard Deviation Model

The StandardDeviationExecutionModel seeks to fill orders when the price is more than 2 standard deviations lower than the average price over a trailing period. The intent is to find dips in the market to place trades. In strongly trending markets, this procedure can result in delayed trade placement since it might be a while before the next price spike or dip.

// Use StandardDeviationExecutionModel to execute trades based on volatility measures, aiming to adapt trade sizes and timing according to market volatility. SetExecution(new StandardDeviationExecutionModel());

# Use StandardDeviationExecutionModel to execute trades based on volatility measures, aiming to adapt trade sizes and timing according to market volatility. self.set_execution(StandardDeviationExecutionModel())

The following table describes the arguments the model accepts:

| Argument | Data Type | Description | Default Value |

|---|---|---|---|

period | decimalfloat | Period of the standard deviation indicator | 60 |

deviations | int | The number of deviations away from the mean before submitting an order | 2 |

resolution | Resolution | The resolution of the STD and SMA indicators | Resolution.MinuteResolution.MINUTE |

For more information about this model, see the class reference and implementation.

For more information about this model, see the class reference and implementation.

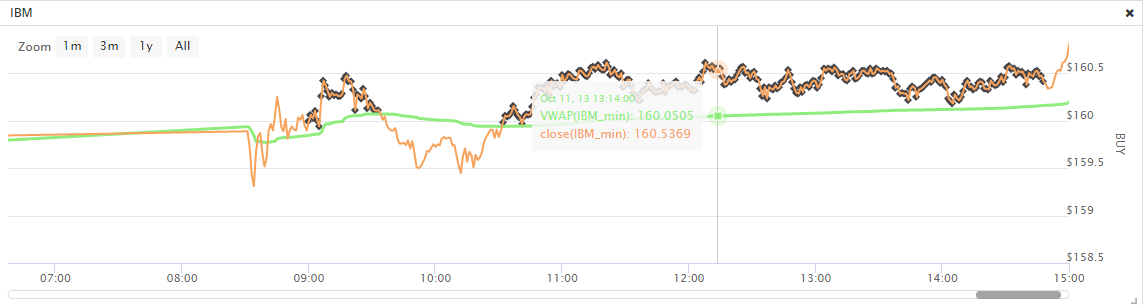

VWAP Model

The VolumeWeightedAveragePriceExecutionModel works to fill your orders at or better than the volume-weighted average price (VWAP) for the trading day. This is a best-effort algorithm, so no guarantee can be made that it will reach the VWAP.

The model uses market orders and it only works if the security subscription provides intraday data. It sets a maximum order size of 1% of the current bar's volume, but you can update the maximum order size through the MaximumOrderQuantityPercentVolumemaximum_order_quantity_percent_volume member.

// Use VolumeWeightedAveragePriceExecutionModel to execute trades based on volume-weighted average price, aiming to minimize market impact and achieve better execution prices. SetExecution(new VolumeWeightedAveragePriceExecutionModel());

# Use VolumeWeightedAveragePriceExecutionModel to execute trades based on volume-weighted average price, aiming to minimize market impact and achieve better execution prices. self.set_execution(VolumeWeightedAveragePriceExecutionModel())

For more information about this model, see the class reference and implementation.

For more information about this model, see the class reference and implementation.