Option Strategies

Short Box Spread

Introduction

A Short Box Spread is the inverse of a box spread, as well as the combination of a bear call spread and a bull put spread. It consists of buying an OTM call at strike $A$, selling an ITM put at strike $A$, buying an OTM put and strike $B < A$, and selling an ITM call at strike $B$, where all of the contracts have the same expiry date. This strategy serves as an delta-neutral arbitration from Option mispricing. Note that it only attains a true profit when the risk-free return is greater than the risk-free interest rate.

Implementation

Follow these steps to implement the short box spread strategy:

- In the

Initializeinitializemethod, set the start date, set the end date, subscribe to the underlying Equity, and create an Option universe. - In the

OnDataon_datamethod, select the strike and expiry of the contracts in the strategy legs. - In the

OnDataon_datamethod, select the contracts and place the orders.

private Symbol _symbol;

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

SetCash(100000);

UniverseSettings.Asynchronous = true;

var option = AddOption("GOOG", Resolution.Minute);

_symbol = option.Symbol;

option.SetFilter(universe => universe.BoxSpread(30, 5));

} def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

self.set_cash(100000)

self.universe_settings.asynchronous = True

option = self.add_option("GOOG", Resolution.MINUTE)

self._symbol = option.symbol

option.set_filter(lambda universe: universe.box_spread(30, 5))

The BoxSpreadbox_spread filter narrows the universe down to just the four contracts you need to form a short box spread.

public override void OnData(Slice slice)

{

if (Portfolio.Invested) return;

// Get the OptionChain

if (!slice.OptionChains.TryGetValue(_symbol, out var chain)) return;

// Select an expiry date and ITM & OTM strike prices

var expiry = chain.Max(x => x.Expiry);

var contracts = chain.Where(x => x.Expiry == expiry).ToList();

var higherStrike = contracts.Max(x => x.Strike);

var lowerStrike = contracts.Min(x => x.Strike); def on_data(self, slice: Slice) -> None:

if self.portfolio.invested:

return

# Get the OptionChain

chain = slice.option_chains.get(self._symbol, None)

if not chain:

return

# Select an expiry date and ITM & OTM strike prices

expiry = max([x.expiry for x in chain])

contracts = [x for x in chain if x.expiry == expiry]

lower_strike = min([x.strike for x in contracts])

higher_strike = max([x.strike for x in contracts])

Approach A: Call the OptionStrategies.ShortBoxSpreadOptionStrategies.short_box_spread method with the details of each leg and then pass the result to the Buybuy method.

var shortBoxSpread = OptionStrategies.ShortBoxSpread(_symbol, higherStrike, lowerStrike, expiry); Buy(shortBoxSpread, 1);

short_box_spread = OptionStrategies.short_box_spread(self._symbol, higher_strike, lower_strike, expiry) self.buy(short_box_spread, 1)

Approach B: Create a list of Leg objects and then call the Combo Market Ordercombo_market_order, Combo Limit Ordercombo_limit_order, or Combo Leg Limit Ordercombo_leg_limit_order method.

// Select the call and put contracts

var itmCall = chain.Single(x => x.Expiry == expiry && x.Strike == lowerStrike && x.Right == OptionRight.Call);

var otmCall = chain.Single(x => x.Expiry == expiry && x.Strike == higherStrike && x.Right == OptionRight.Call);

var itmPut = chain.Single(x => x.Expiry == expiry && x.Strike == higherStrike && x.Right == OptionRight.Put);

var otmPut = chain.Single(x => x.Expiry == expiry && x.Strike == lowerStrike && x.Right == OptionRight.Put);

var legs = new List<Leg>()

{

Leg.Create(itmCall.Symbol, -1),

Leg.Create(itmPut.Symbol, -1),

Leg.Create(otmCall.Symbol, 1),

Leg.Create(otmPut.Symbol, 1),

};

ComboMarketOrder(legs, 1); # Select the call and put contracts

itm_call = [x for x in chain if x.right == OptionRight.CALL and x.expiry == expiry and x.strike == lower_strike][0]

otm_call = [x for x in chain if x.right == OptionRight.CALL and x.expiry == expiry and x.strike == higher_strike][0]

itm_put = [x for x in chain if x.right == OptionRight.PUT and x.expiry == expiry and x.strike == higher_strike][0]

otm_put = [x for x in chain if x.right == OptionRight.PUT and x.expiry == expiry and x.strike == lower_strike][0]

legs = [

Leg.create(itm_call.symbol, -1),

Leg.create(itm_put.symbol, -1),

Leg.create(otm_call.symbol, 1),

Leg.create(otm_put.symbol, 1),

]

self.combo_market_order(legs, 1)

Strategy Payoff

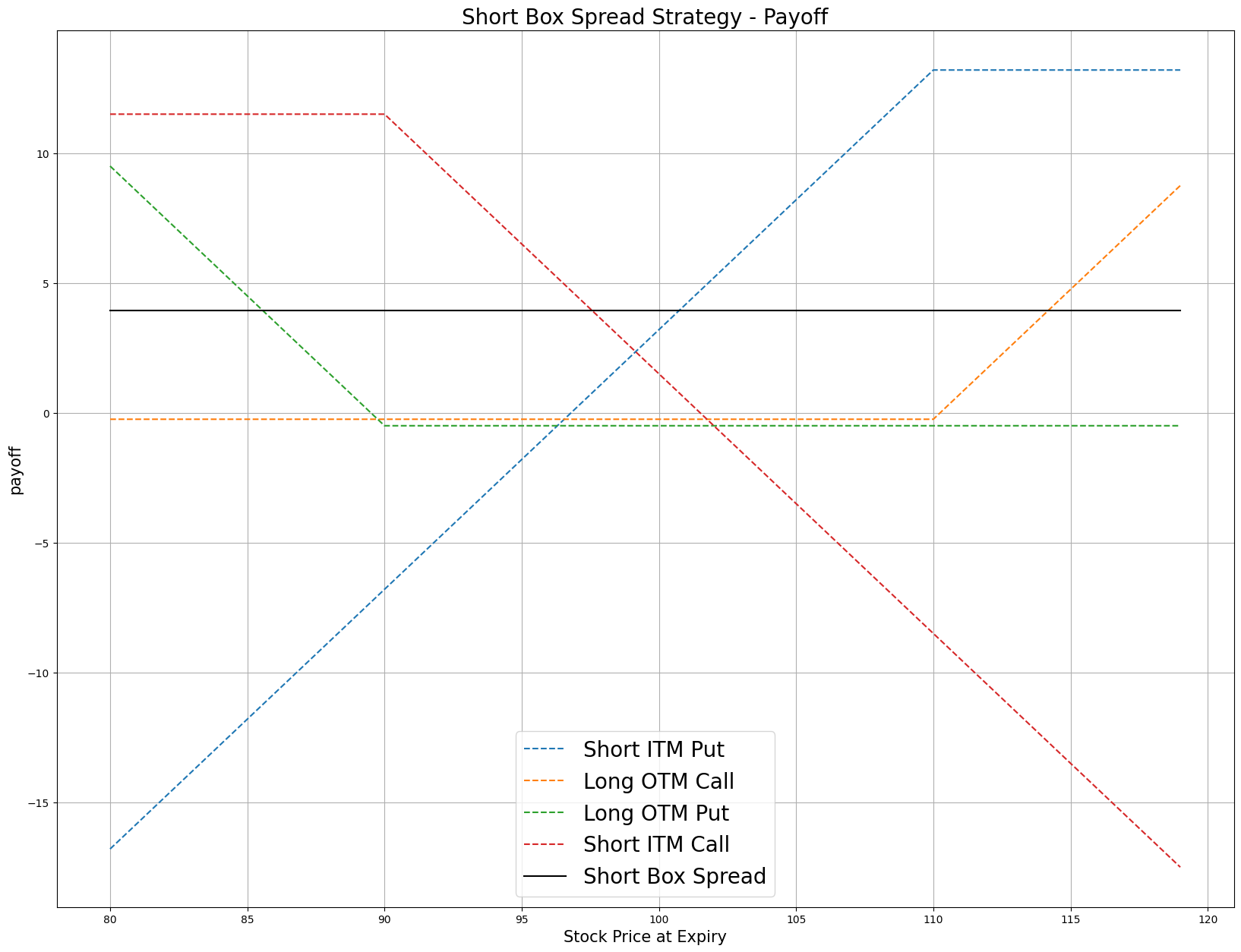

This is a fixed payoff, delta-neutral strategy. The payoff is

$$ \begin{array}{rcll} C_T^{ITM} & = & (S_T - K_{-})^{+}\\ C_T^{OTM} & = & (S_T - K_{+})^{+}\\ P_T^{ITM} & = & (K_{+} - S_T)^{+}\\ P_T^{OTM} & = & (K_{-} - S_T)^{+}\\ Payoff_T & = & (C_{T_0}^{ITM} - C_T^{ITM} + P_{T_0}^{ITM} - P_T^{ITM} - C_{T_0}^{OTM} + C_T^{OTM} - P_{T_0}^{OTM} + P_T^{OTM})\times m - fee\\ & = & (K_{-} - K_{+} + C_{T_0}^{ITM} + P_{T_0}^{ITM} - C_{T_0}^{OTM} - P_{T_0}^{OTM})\times m - fee \end{array} $$ $$ \begin{array}{rcll} \textrm{where} & C_T^{ITM} & = & \textrm{ITM Call value at time T}\\ & C_T^{OTM} & = & \textrm{OTM Call value at time T}\\ & P_T^{ITM} & = & \textrm{ITM Put value at time T}\\ & P_T^{OTM} & = & \textrm{OTM Put value at time T}\\ & S_T & = & \textrm{Underlying asset price at time T}\\ & K_{+} & = & \textrm{Higher strike price}\\ & K_{-} & = & \textrm{Lower strike price}\\ & Payoff_T & = & \textrm{Payout total at time T}\\ & C_{T_0}^{ITM} & = & \textrm{ITM Call price when the trade opened (debit paid)}\\ & C_{T_0}^{OTM} & = & \textrm{OTM Call price when the trade opened (credit received)}\\ & P_{T_0}^{ITM} & = & \textrm{ITM Put price when the trade opened (debit paid)}\\ & P_{T_0}^{OTM} & = & \textrm{OTM Put price when the trade opened (credit received)}\\ & m & = & \textrm{Contract multiplier}\\ & T & = & \textrm{Time of expiration} \end{array} $$The following chart shows the payoff at expiration:

The payoff is only dependent on the strike price and the initial asset prices.

If the Option is American Option, there is a risk of early assignment on the contracts you sell.

Example

The following table shows the price details of the assets in the algorithm:

| Asset | Price ($) | Strike ($) |

|---|---|---|

| ITM Call | 23.00 | 810.00 |

| ITM Put | 23.80 | 857.50 |

| OTM Call | 1.85 | 857.50 |

| OTM Put | 2.75 | 810.00 |

| Underlying Equity at expiration | 843.25 | - |

Therefore, the payoff is

$$ \begin{array}{rcll} Payoff_T & = & (K_{-} - K_{+} + C_0^{ITM} + P_0^{ITM} - C_0^{OTM} - P_0^{OTM})\times m - fee\\ & = & (810.00 - 857.50 + 23.00 + 23.80 - 1.85 - 2.75)\times100 - 1.00\times4\\ & = & -534.00\\ \end{array} $$So, the strategy loses $534.

The following algorithm implements a short box spread Option strategy:

public class ProtectiveCollarStrategy : QCAlgorithm

{

private Symbol _equitySymbol;

private Symbol _optionSymbol;

private bool _investEver = false;

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

SetCash(100000);

UniverseSettings.Asynchronous = true;

_equitySymbol = AddEquity("GOOG").Symbol;

var option = AddOption("GOOG", Resolution.Minute);

_optionSymbol = option.Symbol;

option.SetFilter(universe => universe.BoxSpread(30, 5));

}

public override void OnData(Slice slice)

{

if (_investEver) return;

// Get the OptionChain

var chain = slice.OptionChains.get(_optionSymbol, null);

if (chain == null || chain.Count() == 0) return;

// Select an expiry date

var expiry = chain.OrderBy(x => x.Expiry).Last().Expiry;

// Select the strike prices of the contracts

var orderedContracts = chain.OrderBy(x => x.Strike);

var higherStrike = orderedContracts.Last().Strike;

var lowerStrike = orderedContracts.First().Strike;

var boxSpread = OptionStrategies.ShortBoxSpread(_optionSymbol, higherStrike, lowerStrike, expiry);

Buy(boxSpread, 1);

_investEver = true;

}

public override void OnEndOfDay(Symbol symbol)

{

if (symbol == _equitySymbol)

{

Log($"{Time}::{symbol}::{Securities[symbol].Price}");

}

}

} class ProtectiveCollarOptionStrategy(QCAlgorithm):

def initialize(self) -> None:

self.set_start_date(2024, 9, 1);

self.set_end_date(2024, 12, 31);

self.set_cash(100000)

self.universe_settings.asynchronous = True

self.equity_symbol = self.add_equity("GOOG").symbol

option = self.add_option("GOOG", Resolution.Minute)

self.option_symbol = option.symbol

option.set_filter(lambda universe: universe.box_spread(30, 5))

self.invest_ever = False

def on_data(self, slice: Slice) -> None:

if self.invest_ever: return

# Get the OptionChain

chain = slice.option_chains.get(self.option_symbol, None)

if not chain: return

# Select an expiry date

expiry = sorted(chain, key = lambda x: x.expiry)[-1].expiry

# Select the strike prices of the contracts

ordered_contracts = sorted(chain, key = lambda x: x.strike)

higher_strike = ordered_contracts[-1].strike

lower_strike = ordered_contracts[0].strike

box_spread = OptionStrategies.short_box_spread(self.option_symbol, higher_strike, lower_strike, expiry)

self.buy(box_spread, 1)

self.invest_ever = True

def on_end_of_day(self, symbol: Symbol) -> None:

if symbol == self.equity_symbol:

self.log(f"{self.time}::{symbol}::{self.securities[symbol].price}")