Option Strategies

Short Call Butterfly

Introduction

The short call butterfly strategy is the combination of a bull call spread and a bear call spread. In the call butterfly, all of the calls should have the same underlying Equity, the same expiration date, and the same strike price distance between the ITM-ATM and OTM-ATM call pairs. The short call butterfly consists of a short ITM call, a short OTM call, and 2 long ATM calls. This strategy profits from high volatility in the underlying Equity price.

Implementation

Follow these steps to implement the short call butterfly strategy:

- In the

Initializeinitializemethod, set the start date, end date, cash, and Option universe. - In the

OnDataon_datamethod, select the contracts of the strategy legs. - In the

OnDataon_datamethod, place the orders.

private Symbol _symbol;

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

SetCash(500000);

UniverseSettings.Asynchronous = true;

var option = AddOption("GOOG", Resolution.Minute);

_symbol = option.Symbol;

option.SetFilter(universe => universe.CallButterfly(30, 5));

} def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

self.set_cash(500000)

self.universe_settings.asynchronous = True

option = self.add_option("GOOG", Resolution.MINUTE)

self._symbol = option.symbol

option.set_filter(lambda universe: universe.call_butterfly(30, 5))

The CallButterflycall_butterfly filter narrows the universe down to just the three contracts you need to form a short call butterfly.

public override void OnData(Slice slice)

{

if (Portfolio.Invested ||

!slice.OptionChains.TryGetValue(_symbol, out var chain))

{

return;

}

// Select the call Option contracts with the furthest expiry

var expiry = chain.Max(x =x> x.Expiry);

var calls = chain.Where(x => x.Expiry == expiry && x.Right == OptionRight.Call);

if (calls.Count() == 0) return;

// Select the ATM, ITM and OTM contracts from the remaining contracts

var atmCall = calls.OrderBy(x => Math.Abs(x.Strike - chain.Underlying.Price)).First();

var itmCall = calls.OrderBy(x => x.Strike).Skip(1).First();

var otmCall = calls.Single(x => x.Strike == atmCall.Strike * 2 - itmCall.Strike); def on_data(self, slice: Slice) -> None:

if self.portfolio.invested:

return

# Get the OptionChain

chain = slice.option_chains.get(self._symbol, None)

if not chain:

return

# Get the furthest expiry date of the contracts

expiry = max([x.expiry for x in chain])

# Select the call Option contracts with the furthest expiry

calls = [i for i in chain if i.expiry == expiry and i.right == OptionRight.CALL]

if len(calls) == 0:

return

# Select the ATM, ITM and OTM contracts from the remaining contracts

atm_call = sorted(calls, key=lambda x: abs(x.strike - chain.underlying.price))[0]

itm_call = sorted(calls, key=lambda x: x.strike)[1]

otm_call = [x for x in calls if x.strike == atm_call.strike * 2 - itm_call.strike][0]

Approach A: Call the OptionStrategies.ShortButterflyCallOptionStrategies.short_butterfly_call method with the details of each leg and then pass the result to the Buybuy method.

var optionStrategy = OptionStrategies.ShortButterflyCall(_symbol, otmCall.Strike, atmCall.Strike, itmCall.Strike, expiry); Buy(optionStrategy, 1);

option_strategy = OptionStrategies.short_butterfly_call(self._symbol, otm_call.strike, atm_call.strike, itm_call.strike, expiry) self.buy(option_strategy, 1)

Approach B: Create a list of Leg objects and then call the Combo Market Ordercombo_market_order, Combo Limit Ordercombo_limit_order, or Combo Leg Limit Ordercombo_leg_limit_order method.

var legs = new List<Leg>()

{

Leg.Create(atmCall.Symbol, 2),

Leg.Create(itmCall.Symbol, -1),

Leg.Create(otmCall.Symbol, -1)

};

ComboMarketOrder(legs, 1); legs = [

Leg.create(atm_call.symbol, 2),

Leg.create(itm_call.symbol, -1),

Leg.create(otm_call.symbol, -1)

]

self.combo_market_order(legs, 1)

If the Option is American Option, there is a risk of early assignment on the contracts you sell.

Strategy Payoff

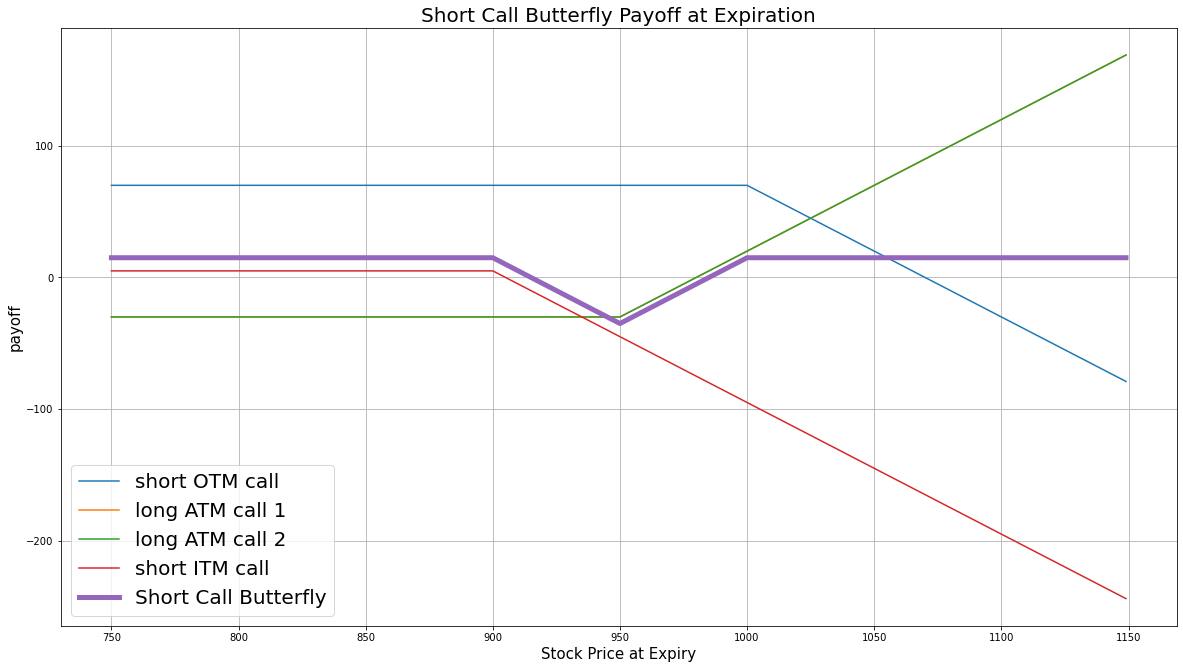

The short call butterfly is a limited-reward-limited-risk strategy. The payoff is

$$ \begin{array}{rcll} C^{OTM}_T & = & (S_T - K^{OTM})^{+}\\ C^{ITM}_T & = & (S_T - K^{ITM})^{+}\\ C^{ATM}_T & = & (S_T - K^{ATM})^{+}\\ P_T & = & (2\times C^{ATM}_T - C^{OTM}_T - C^{ITM}_T - 2\times C^{ATM}_0 + C^{ITM}_0 + C^{OTM}_0)\times m - fee \end{array} $$ $$ \begin{array}{rcll} \textrm{where} & C^{OTM}_T & = & \textrm{OTM call value at time T}\\ & C^{ITM}_T & = & \textrm{ITM call value at time T}\\ & C^{ATM}_T & = & \textrm{ATM call value at time T}\\ & S_T & = & \textrm{Underlying asset price at time T}\\ & K^{OTM} & = & \textrm{OTM call strike price}\\ & K^{ITM} & = & \textrm{ITM call strike price}\\ & K^{ATM} & = & \textrm{ATM call strike price}\\ & P_T & = & \textrm{Payout total at time T}\\ & C^{ITM}_0 & = & \textrm{ITM call value at position opening (credit received)}\\ & C^{OTM}_0 & = & \textrm{OTM call value at position opening (credit received)}\\ & C^{ATM}_0 & = & \textrm{ATM call value at position opening (debit paid)}\\ & m & = & \textrm{Contract multiplier}\\ & T & = & \textrm{Time of expiration} \end{array} $$The following chart shows the payoff at expiration:

The maximum profit is the net credit received: $C^{ITM}_0 + C^{OTM}_0 - 2\times C^{ATM}_0$. It occurs when the underlying price is less than ITM strike or greater than OTM strike at expiration.

The maximum loss is $K^{ATM} - K^{ITM} + C^{ITM}_0 + C^{OTM}_0 - 2\times C^{ATM}_0$. It occurs when the underlying price is at the same level as when you opened the trade.

If the Option is American Option, there is a risk of early assignment on the contracts you sell.

Example

The following table shows the price details of the assets in the short call butterfly:

| Asset | Price ($) | Strike ($) |

|---|---|---|

| OTM call | 4.90 | 767.50 |

| ATM call | 15.00 | 800.00 |

| ITM call | 41.00 | 832.50 |

| Underlying Equity at expiration | 829.08 | - |

Therefore, the payoff is

$$ \begin{array}{rcll} C^{OTM}_T & = & (S_T - K^{OTM})^{+}\\ & = & (767.50-829.08)^{+}\\ & = & 0\\ C^{ITM}_T & = & (S_T - K^{ITM})^{+}\\ & = & (832.50-829.08)^{+}\\ & = & 3.42\\ C^{ATM}_T & = & (S_T - K^{ATM})^{+}\\ & = & (800.00-829.08)^{+}\\ & = & 0\\ P_T & = & (-C^{OTM}_T - C^{ITM}_T + 2\times C^{ATM}_T - 2\times C^{ATM}_0 + C^{ITM}_0 + C^{OTM}_0)\times m - fee\\ & = & (-0-3.42+0\times2+4.90+41.00-15.00\times2)\times100-1.00\times4\\ & = & -1252 \end{array} $$So, the strategy gains $1,244.

The following algorithm implements a short call butterfly Option strategy:

public class BearPutSpreadStrategy : QCAlgorithm

{

private Symbol _symbol;

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

SetCash(500000);

var option = AddOption("GOOG", Resolution.Minute);

_symbol = option.Symbol;

option.SetFilter(universe => universe.CallButterfly(30, 5));

}

public override void OnData(Slice slice)

{

if (Portfolio.Invested) return;

// Get the OptionChain of the symbol

var chain = slice.OptionChains.get(_symbol, null);

if (chain == null || chain.Count() == 0) return;

// sorted the optionchain by expiration date and choose the furthest date

var expiry = chain.OrderByDescending(x => x.Expiry).First().Expiry;

// filter the call options from the contracts which expire on the furthest expiration date in the option chain.

var calls = chain.Where(x => x.Expiry == expiry && x.Right == OptionRight.Call);

if (calls.Count() == 0) return;

// sort the call options with the same expiration date according to their strike price.

var callStrikes = calls.Select(x => x.Strike).OrderBy(x => x);

// get at-the-money strike

var atmStrike = calls.OrderBy(x => Math.Abs(x.Strike - chain.Underlying.Price)).First().Strike;

// Get the distance between lowest strike price and ATM strike, and highest strike price and ATM strike.

// Get the lower value as the spread distance as equidistance is needed for both side.

var spread = Math.Min(Math.Abs(callStrikes.First() - atmStrike), Math.Abs(callStrikes.Last() - atmStrike));

// select the strike prices for forming the option legs

var itmStrike = atmStrike - spread;

var otmStrike = atmStrike + spread;

var optionStrategy = OptionStrategies.ShortButterflyCall(_symbol, otmStrike, atmStrike, itmStrike, expiry);

// We open a position with 1 unit of the option strategy

Buy(optionStrategy, 1);

}

} class LongCallButterflyStrategy(QCAlgorithm):

def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

self.set_cash(500000)

option = self.add_option("GOOG", Resolution.MINUTE)

self.symbol = option.symbol

option.set_filter(self.universe_func)

def universe_func(self, universe: OptionFilterUniverse) -> OptionFilterUniverse:

return universe.call_butterfly(30, 5)

def on_data(self, data: Slice) -> None:

# avoid extra orders

if self.portfolio.invested: return

# Get the OptionChain of the self.symbol

chain = data.option_chains.get(self.symbol, None)

if not chain: return

# sorted the optionchain by expiration date and choose the furthest date

expiry = sorted(chain, key = lambda x: x.expiry, reverse=True)[0].expiry

# filter the call options from the contracts which expire on the furthest expiration date in the option chain.

calls = [i for i in chain if i.expiry == expiry and i.right == OptionRight.CALL]

if len(calls) == 0: return

# sort the call options with the same expiration date according to their strike price.

call_strikes = sorted([x.strike for x in calls])

# get at-the-money strike

atm_strike = sorted(calls, key=lambda x: abs(x.strike - chain.underlying.price))[0].strike

# Get the distance between lowest strike price and ATM strike, and highest strike price and ATM strike.

# Get the lower value as the spread distance as equidistance is needed for both side.

spread = min(abs(call_strikes[0] - atm_strike), abs(call_strikes[-1] - atm_strike))

# select the strike prices for forming the option legs

itm_strike = atm_strike - spread

otm_strike = atm_strike + spread

option_strategy = OptionStrategies.short_butterfly_call(self.symbol, otm_strike, atm_strike, itm_strike, expiry)

# We open a position with 1 unit of the option strategy

self.buy(option_strategy, 1)

Other Examples

For more examples, see the following algorithms: