Equity

Legacy Fundamental Universes

Introduction

Warning: This API for Universe Selection was deprecated on November 2023. Please refer to the new Fundamental Universe API.

There are several ways to create an Equities universe. You can select a universe based on CoarseFundamental data

or the constituents of an ETF, and then you can further filter your universe down with corporate fundamentals.

The following sections explain each of these techniques in detail.

Coarse Universe Selection

A coarse universe enables you pick a set of stocks based on their trading volume, price, or whether they have fundamental data. To add a coarse universe, in the Initializeinitialize method, pass a filter function to the AddUniverseadd_universe method. The coarse filter function receives a list of CoarseFundamental objects and must return a list of Symbol objects. The Symbol objects you return from the function are the constituents of the universe and LEAN automatically creates subscriptions for them. Don't call AddEquityadd_equity in the filter function.

public class MyCoarseUniverseAlgorithm : QCAlgorithm

{

public override void Initialize()

{

UniverseSettings.Asynchronous = true;

AddUniverse(CoarseFilterFunction);

}

private IEnumerable<Symbol> CoarseFilterFunction(IEnumerable<CoarseFundamental> coarse)

{

return (from c in coarse

orderby c.DollarVolume descending

select c.Symbol).Take(100);

}

} class MyCoarseUniverseAlgorithm(QCAlgorithm):

def initialize(self) -> None:

self.universe_settings.asynchronous = True

self.add_universe(self._coarse_filter_function)

def _coarse_filter_function(self, coarse: List[CoarseFundamental]) -> List[Symbol]:

sorted_by_dollar_volume = sorted(coarse, key=lambda x: x.dollar_volume, reverse=True)

return [c.symbol for c in sorted_by_dollar_volume[:100]]

CoarseFundamental objects have the following attributes:

The total number of stocks in the US Equity Security Master dataset is 30,000 but your coarse filter function won't receive all of these at one time because the US Equity Security Master dataset is free of survivorship bias and some of the securities have delisted over time. The number of securities that are passed into your coarse filter function depends on the date of your algorithm. Currently, there are about 10,000 securities that LEAN passes into your coarse filter function.

Fundamentals Selection

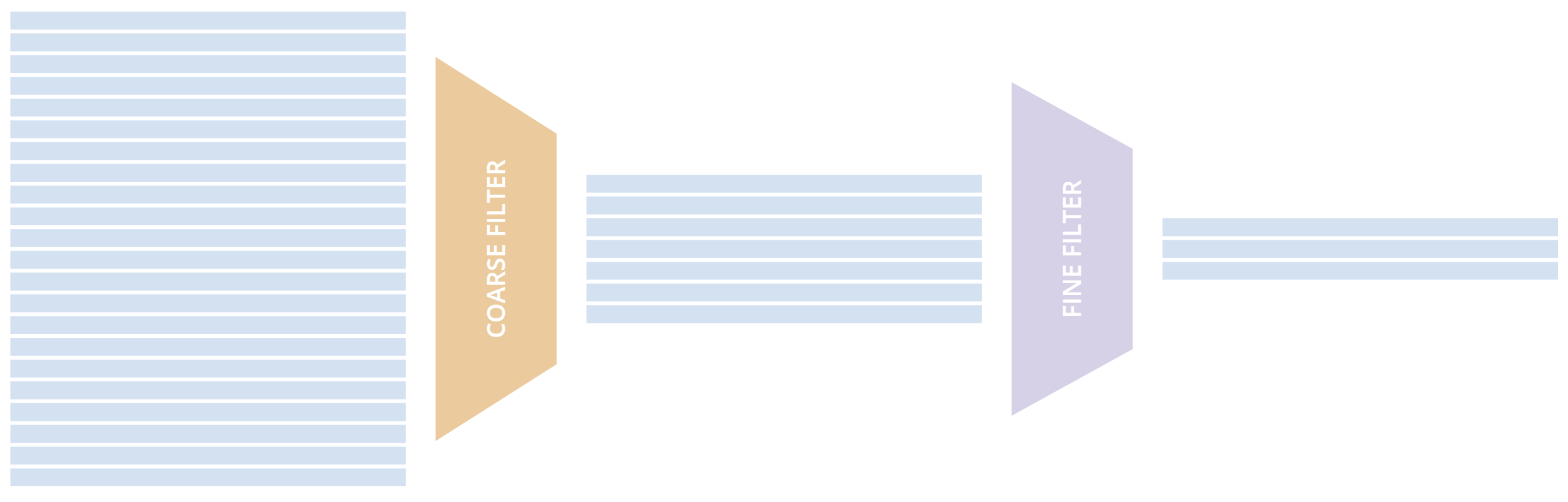

A fundamental universe lets you select stocks based on corporate fundamental data. This data is powered by Morningstar® and includes approximately 8,100 tickers with 900 properties each. This universe doesn't include ETFs, ADRs, or OTC equities. Due to the sheer volume of information, fundamental selection is performed on the output of another universe filter. Think of this process as a 2-stage filter. An initial filter function selects a set of stocks and then a fine fundamental filter function selects a subset of those stocks.

To add a fundamental universe, in the Initializeinitialize method, pass two filter functions to the AddUniverseadd_universe method. The first filter function can be a coarse universe filter, dollar volume filter, or an ETF constituents filter. The second filter function receives a list of FineFundamental objects and must return a list of Symbol objects. The list of FineFundamental objects contains a subset of the Symbol objects that the first filter function returned. The Symbol objects you return from the second function are the constituents of the fundamental universe and LEAN automatically creates subscriptions for them. Don't call AddEquityadd_equity in the filter function.

Only 8,100 assets have fundamental data. If your first filter function receives CoarseFundamental data, you should only select assets that have a true value for their HasFundamentalDatahas_fundamental_data property.

public class MyUniverseAlgorithm : QCAlgorithm {

public override void Initialize()

{

UniverseSettings.Asynchronous = true;

AddUniverse(CoarseFilterFunction, FineFundamentalFilterFunction);

}

// filter based on CoarseFundamental

IEnumerable<Symbol> CoarseFilterFunction(IEnumerable<CoarseFundamental> coarse)

{

// In addition to further coarse universe selection, ensure the security has fundamental data

return (from c in coarse

where c.HasFundamentalData

select c.Symbol);

}

// filter based on FineFundamental

public IEnumerable<Symbol> FineFundamentalFilterFunction(IEnumerable<FineFundamental> fine)

{

// Return a list of Symbols

return Enumerable.Empty<Symbol>();

}

}

class MyUniverseAlgorithm(QCAlgorithm):

def initialize(self) -> None:

self.universe_settings.asynchronous = True

self.add_universe(self._coarse_filter_function, self._fine_fundamental_function)

def _coarse_filter_function(self, coarse: List[CoarseFundamental]) -> List[Symbol]:

# In addition to further coarse universe selection, ensure the security has fundamental data

return [c.symbol for c in coarse if c.has_fundamental_data]

def _fine_fundamental_function(self, fine: List[FineFundamental]) -> List[Symbol]:

# Return a list of Symbols

return []

FineFundamental objects have the following attributes:

Example

The simplest example of accessing the fundamental object would be harnessing the iconic PE ratio for a stock. This is a ratio of the price it commands to the earnings of a stock. The lower the PE ratio for a stock, the more affordable it appears.

// Take the top 50 by dollar volume using coarse

// Then the top 10 by PERatio using fine

UniverseSettings.Asynchronous = true;

AddUniverse(

coarse => {

return (from c in coarse

where c.Price > 10 && c.HasFundamentalData

orderby c.DollarVolume descending

select c.Symbol).Take(50);

},

fine => {

return (from f in fine

orderby f.ValuationRatios.PERatio ascending

select f.Symbol).Take(10);

});

# In Initialize:

self.universe_settings.asynchronous = True

self.add_universe(self._coarse_selection_function, self._fine_selection_function)

def _coarse_selection_function(self, coarse: List[CoarseFundamental]) -> List[Symbol]:

sorted_by_dollar_volume = sorted(coarse, key=lambda x: x.dollar_volume, reverse=True)

filtered = [x.symbol for x in sorted_by_dollar_volume if x.has_fundamental_data]

return filtered[:50]

def _fine_selection_function(self, fine: List[FineFundamental]) -> List[Symbol]:

sorted_by_pe_ratio = sorted(fine, key=lambda x: x.valuation_ratios.pe_ratio, reverse=False)

return [x.symbol for x in sorted_by_pe_ratio[:10]]

Asset Categories

In addition to valuation ratios, the US Fundamental Data from Morningstar has many other data point attributes, including over 200 different categorization fields for each US stock. Morningstar groups these fields into sectors, industry groups, and industries.

Sectors are large super categories of data. To get the sector of a stock, use the MorningstarSectorCode property.

var tech = fine.Where(x => x.AssetClassification.MorningstarSectorCode == MorningstarSectorCode.Technology);

tech = [x for x in fine if x.asset_classification.morningstar_sector_code == MorningstarSectorCode.TECHNOLOGY]

Industry groups are clusters of related industries that tie together. To get the industry group of a stock, use the MorningstarIndustryGroupCode property.

var ag = fine.Where(x => x.AssetClassification.MorningstarIndustryGroupCode == MorningstarIndustryGroupCode.Agriculture);

ag = [x for x in fine if x.asset_classification.morningstar_industry_group_code == MorningstarIndustryGroupCode.AGRICULTURE]

Industries are the finest level of classification available. They are the individual industries according to the Morningstar classification system. To get the industry of a stock, use the MorningstarIndustryCode.

var coal = fine.Where(x => x.AssetClassification.MorningstarIndustryCode == MorningstarSectorCode.Coal);

coal = [x for x in fine if x.asset_classification.morningstar_industry_code == MorningstarSectorCode.COAL]

Practical Limitations

Like coarse universes, fine universes allow you to select an unlimited universe of assets to analyze. Each asset in the universe consumes approximately 5MB of RAM, so you may quickly run out of memory if your universe filter selects many assets. If you backtest your algorithms in the Algorithm Lab, familiarize yourself with the RAM capacity of your backtesting and live trading nodes. To keep your algorithm fast and efficient, only subscribe to the assets you need.

Live Trading Considerations

The live data for fundamental universe selection arrives at 6/7 AM Eastern Time (ET), so fundamental universe selection runs for live algorithms between 7 and 8 AM ET. This timing allows you to place trades before the market opens. Don't schedule anything for midnight because the universe selection data isn't ready yet.

Examples

The legacy fundamental universe is deprecated. For examples of the new fundamental universe API, see Examples.