Option Strategies

Covered Call

Introduction

A Covered Call consists of a long position in a stock and a short position in call Options for the same amount of stock. Covered calls aim to profit from the Option premium by selling calls written on the stock you already own. At any time for American Options or at expiration for European Options, if the stock moves below the strike price, you keep the premium and still maintain the underlying Equity position. If the underlying price moves above the strike, the Option buyer can exercise the Options contract, which means you sell your stock at the strike price and keep the premium. Another risk of a covered call comes from the long stock position, which can drop in value.

Implementation

Follow these steps to implement the covered call strategy:

- In the

Initializeinitializemethod, set the start date, end date, starting cash, and Options universe. - In the

OnDataon_datamethod, select the Option contract. - In the

OnDataon_datamethod, place the orders.

private Symbol _symbol;

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

SetCash(100000);

UniverseSettings.Asynchronous = true;

var option = AddOption("IBM");

_symbol = option.Symbol;

option.SetFilter(universe => universe.NakedCall(30, 0));

} def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

self.set_cash(100000)

self.universe_settings.asynchronous = True

option = self.add_option("IBM")

self._symbol = option.symbol

option.set_filter(lambda universe: universe.naked_call(30, 0))

The NakedCallnaked_call filter narrows the universe down to just the one contract you need to form a covered call.

public override void OnData(Slice slice)

{

if (Portfolio.Invested ||

!slice.OptionChains.TryGetValue(_symbol, out var chain))

{

return;

}

// Find ATM call with the farthest expiry

var expiry = chain.Max(x => x.Expiry);

var atmCall = chain

.Where(x => x.Right == OptionRight.Call && x.Expiry == expiry)

.OrderBy(x => Math.Abs(x.Strike - chain.Underlying.Price))

.FirstOrDefault(); def on_data(self, slice: Slice) -> None:

if self.portfolio.invested:

return

chain = slice.option_chains.get(self._symbol)

if not chain:

return

# Find ATM call with the farthest expiry

expiry = max([x.expiry for x in chain])

call_contracts = sorted([x for x in chain

if x.right == OptionRight.CALL and x.expiry == expiry],

key=lambda x: abs(chain.underlying.price - x.strike))

if not call_contracts:

return

atm_call = call_contracts[0]

Approach A: Call the OptionStrategies.CoveredCallOptionStrategies.covered_call method with the details of each leg and then pass the result to the Buybuy method.

var coveredCall = OptionStrategies.CoveredCall(_symbol, atmCall.Strike, expiry); Buy(coveredCall, 1);

covered_call = OptionStrategies.covered_call(self._symbol, atm_call.strike, expiry) self.buy(covered_call, 1)

Approach B: Create a list of Leg objects and then call the Combo Market Ordercombo_market_order, Combo Limit Ordercombo_limit_order, or Combo Leg Limit Ordercombo_leg_limit_order method.

var legs = new List<Leg>()

{

Leg.Create(atmCall.Symbol, -1),

Leg.Create(chain.Underlying.Symbol, chain.Underlying.SymbolProperties.ContractMultiplier)

};

ComboMarketOrder(legs, 1); legs = [

Leg.create(atm_call.symbol, -1),

Leg.create(chain.underlying.symbol, chain.underlying.symbol_properties.contract_multiplier)

]

self.combo_market_order(legs, 1)

Strategy Payoff

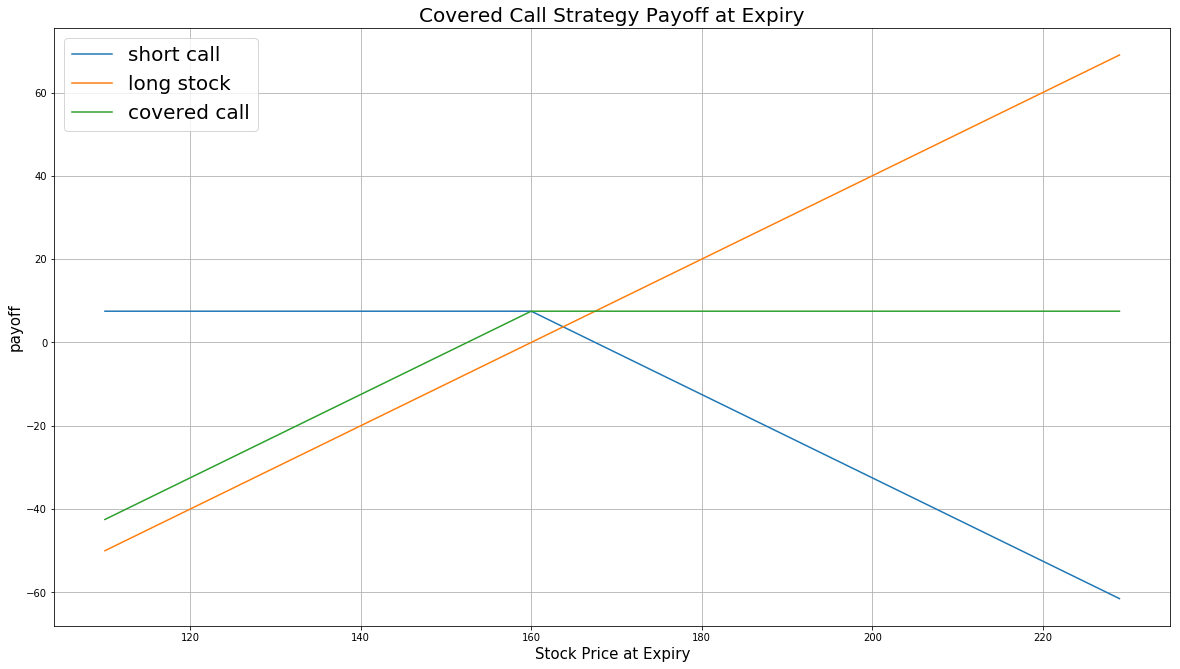

The payoff of the strategy is

$$ \begin{array}{rcll} C^{K}_T & = & (S_T - K)^{+}\\ P_T & = & (S_T - S_0 + C^{K}_0 - C^{K}_T)\times m - fee \end{array} $$ $$ \begin{array}{rcll} \textrm{where} & C^{K}_T & = & \textrm{Call value at time T}\\ & S_T & = & \textrm{Underlying asset price at time T}\\ & K & = & \textrm{Call strike price}\\ & P_T & = & \textrm{Payout total at time T}\\ & S_0 & = & \textrm{Underlying asset price when the trade opened}\\ & C^{K}_0 & = & \textrm{Call price when the trade opened (credit received)}\\ & m & = & \textrm{Contract multiplier}\\ & T & = & \textrm{Time of expiration} \end{array} $$The following chart shows the payoff at expiration:

The maximum profit is $K - S_T + C^{K}_0$, which occurs when the underlying price is at or above the strike price of the call at expiration.

The maximum loss is $S_0 - C^{K}_0$, which ocurrs when the underlying price drops.

If the Option is American Option, there is a risk of early assignment on the contract you sell.

Example

The following table shows the price details of the assets in the algorithm:

| Asset | Price ($) | Strike ($) |

|---|---|---|

| Call | 3.35 | 185.00 |

| Underlying Equity at start of the trade | 187.07 | - |

| Underlying Equity at expiration | 190.01 | - |

Therefore, the payoff is

$$ \begin{array}{rcll} C^{K}_T & = & (S_T - K)^{+}\\ & = & (190.01 - 185)^{+}\\ & = & 5.01\\ P_T & = & (S_T - S_0 + C^{K}_0 - C^{K}_T)\times m - fee\\ & = & (190.01 - 187.07 + 3.35 - 5.01)\times m - fee\\ & = & 1.28 \times 100 - 2\\ & = & 126 \end{array} $$So, the strategy gains $126.

The following algorithm implements a covered call strategy:

public class CoveredCallAlgorithm : QCAlgorithm

{

private Symbol _call, _symbol;

public override void Initialize()

{

SetStartDate(2024, 9, 1);

SetEndDate(2024, 12, 31);

SetCash(100000);

var option = AddOption("IBM");

_symbol = option.Symbol;

option.SetFilter(universe => universe.NakedCall(30, 0));

// use the underlying equity as the benchmark

SetBenchmark(_symbol.Underlying);

}

public override void OnData(Slice slice)

{

if (_call != null && Portfolio[_call].Invested) return;

if (!slice.OptionChains.TryGetValue(_symbol, out var chain)) return;

// Find ATM call with the farthest expiry

var expiry = chain.Max(x => x.Expiry);

var atmCall = chain

.Where(x=> x.Right == OptionRight.Call && x.Expiry == expiry)

.OrderBy(x => Math.Abs(x.Strike - chain.Underlying.Price))

.FirstOrDefault();

if (atmCall == null) return;

var coveredCall = OptionStrategies.CoveredCall(_symbol, atmCall.Strike, expiry);

Buy(coveredCall, 1);

_call = atmCall.Symbol;

}

} class CoveredCallAlgorithm(QCAlgorithm):

def initialize(self) -> None:

self.set_start_date(2024, 9, 1)

self.set_end_date(2024, 12, 31)

self.set_cash(100000)

option = self.add_option("IBM")

self.symbol = option.symbol

option.set_filter(lambda universe: universe.naked_call(30, 0))

self.call = None

# use the underlying equity as the benchmark

self.set_benchmark(self.symbol.underlying)

def on_data(self, slice: Slice) -> None:

if self.call and self.portfolio[self.call].invested:

return

chain = slice.option_chains.get(self.symbol)

if not chain:

return

# Find ATM call with the farthest expiry

expiry = max([x.expiry for x in chain])

call_contracts = sorted([x for x in chain

if x.right == OptionRight.CALL and x.expiry == expiry],

key=lambda x: abs(chain.underlying.price - x.strike))

if not call_contracts:

return

atm_call = call_contracts[0]

covered_call = OptionStrategies.covered_call(self.symbol, atm_call.strike, expiry)

self.buy(covered_call, 1)

self.call = atm_call.symbol